Fantom relief rally set for 70% of the value adjustment

- Fantom breaches the 50% Fibonacci level in a solid relief rally.

- As tailwinds mount, expect to see more uplift in the coming days and possibly weeks.

- The overall rally can result in a test of $3.20, returning around 70% of gains.

Fantom (FTM) price action is no different from other cryptocurrencies today, with bulls storming out of the gates on a wave of positive news out of Moscow as troops are ordered to stand down and end their exercises near the Ukrainian border. As markets breathe a sigh of relief, cryptocurrencies are also being pulled up in the joyous setting. In the process, bulls are gaining ground and traction and look set to start the biggest bull rally for 2022.

This could be the biggest bull rally for 2022 in Fantom

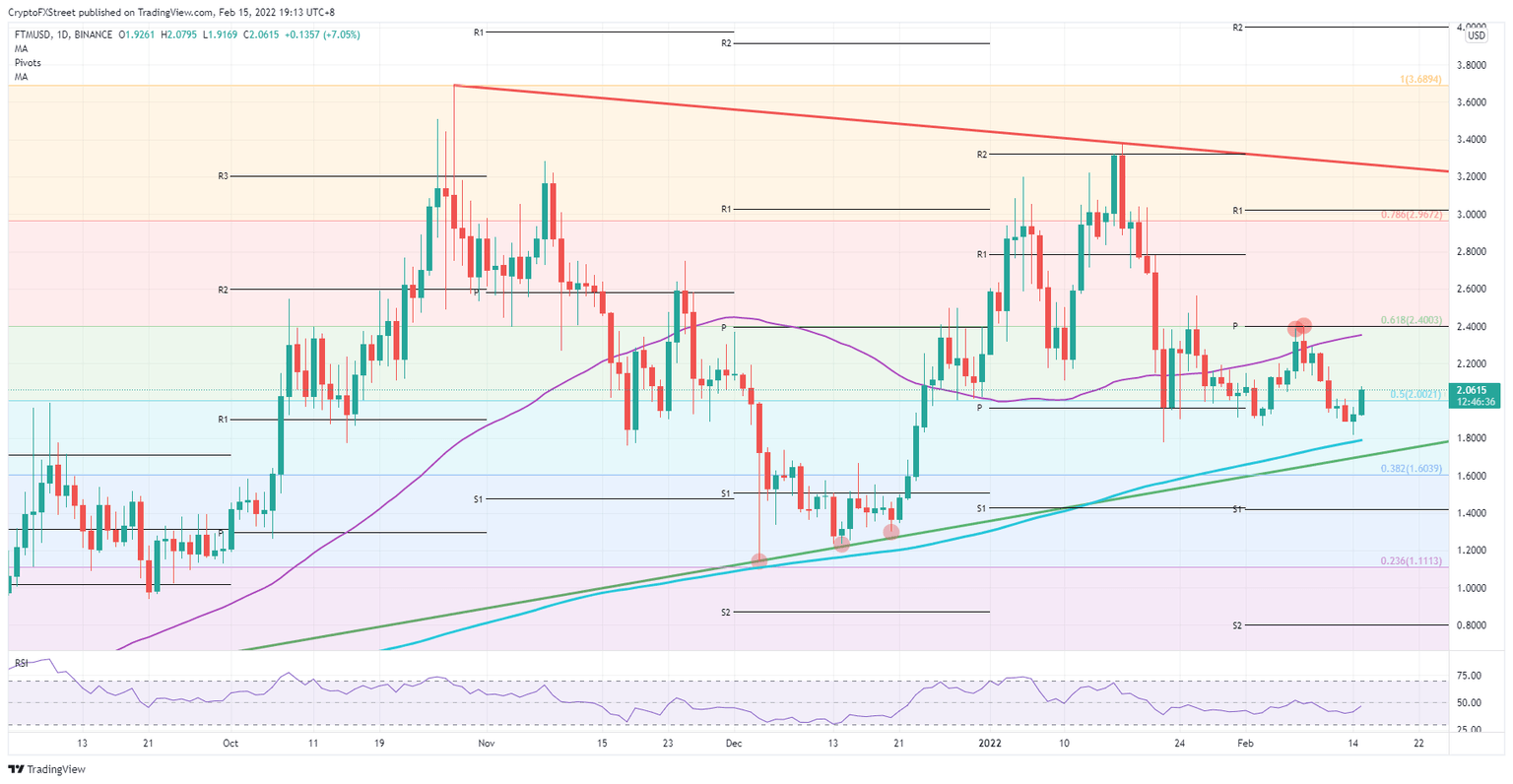

Fantom price action sees a few critical short-term levels broken, such as this week's low and the 50% Fibonacci level at $2.00. With the move, more bulls and investors are joining the broad relief rally and trying to be part of it in the first hour of what looks to be a tailwind that could persist for a few days or even weeks, for that matter. With that said, it is good to have a trading plan and some critical profit levels already marked for potential profit-taking, as the rally could harvest around 70% of solid gains.

FTM bulls' first target is at $2.40, coinciding with the 55-day Simple Moving average, the monthly pivot, and the 61.8% Fibonacci level. Expect to certainly see a short fade with some profit-taking as bulls will seek to book around ⅓ of their profits. As long as the current tailwinds persist, expect a further continuation towards $3.00 with the 78.6% Fibonacci level and the monthly R1 resistance level just a few ticks above there as the level where another part of profit can be booked, whilst keeping the remaining funds in the trade to at least the test of, or possible break of the red descending trendline at around $3.200.

FTM/USD daily chart

The current environment could be proven fragile on any more hawkish comments from the FED – such as if they were to forecast more monetary tightening than already communicated. That would scare investors away and see fund outflows from cryptocurrencies. Expect Fantom price action to return to supportive levels at $1.80 with the 200-day Simple Moving Average on such news, as well as the green ascending trend line – both working in tandem to keep the longer-term uptrend in check with higher lows overall.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.