Fantom price takes a breather while FTM remains on track for $3

- Fantom price action takes a breather after rejection on the monthly pivot.

- FTM price takes a step back as bulls start booking profit for now.

- Once the price pops back above $2.40, expect a rally to $2.96, holding 25% gains.

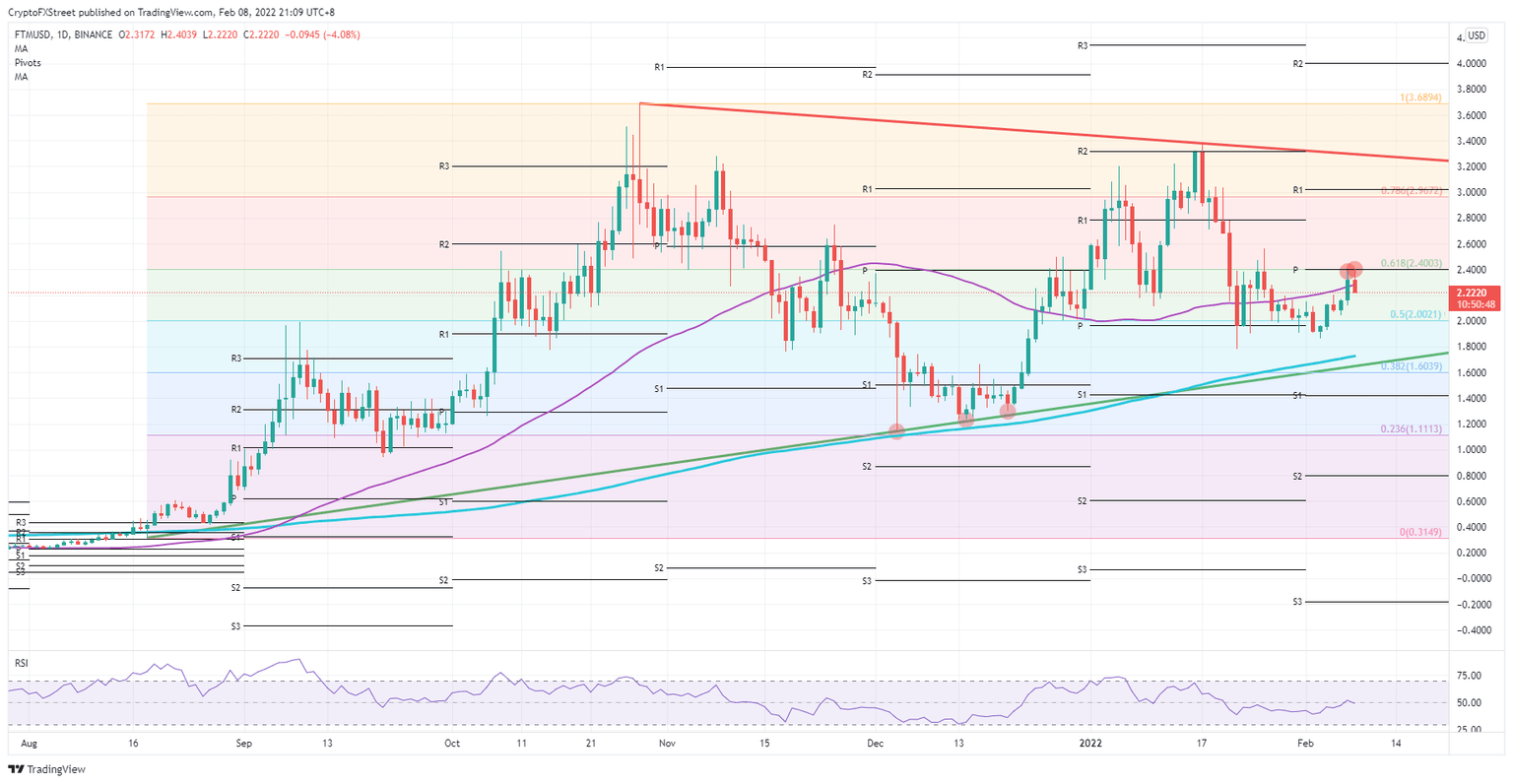

Fantom (FTM) price takes a step back as bulls are for the moment unable to break above $2.40, which proves to be a level too big to breach with the monthly pivot and the 61.8% Fibonacci level perfectly falling in line with each other. Although this has sparked some profit-taking, the uptrend is still very much intact, and the support of the 50% Fibonacci level at $2.00 has not yet been tested. Expect either a bounce off $2.00 or a simple U-turn once positive sentiment kicks in and breaks through the monthly pivot, attracting more buyers and in the process taking out $2.96.

Fantom takes a breather with $3.00 set insight

Fantom price was on an excellent path to recovery after some short-term price action below $2.00. Bulls seized the moment to buy into the price action, scooped up the dip and set their minds on $3.00. But for the moment, price is hitting a curb with a firm rejection at $2.40, which is the monthly pivot level and the 61.8% Fibonacci level, making it an adamant level to break.

FTM price will still see some profit-taking and could undergo a short downfall to $2.00, at the 50% Fibonacci level. A bounce off that level would indeed generate enough interest from bulls who missed the first entry a few days ago and is likely to see an even stronger uptick that will breach the dam at $2.40. With that, the uptrend will be confirmed and see more inflows, pushing price towards $2.96, and a possible test of $3.00, and the monthly R1 and the 78.6% Fibonacci resistances located there.

FTM/USD daily chart

The rejection could be the start of a downtrend, as bears used the monthly pivot as an entry point and have no intention of letting the FTM price break above. A further push towards $2.00 would create a false bounce with bulls getting trapped and bears going in for the squeeze with a break below $2.00, washing out bulls and going for a test on the green ascending trend line and the 200-day Simple Moving Average (SMA), that are both moving very close to one another. That could be the start of a downtrend but would need a severe deterioration of global market sentiment to create the headwinds bears need.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.