Fantom transactions surpass Ethereum as users look to farm yields

Transactions on Fantom exceeded those of Ethereum for the first time ever on Monday, as investors seek newer avenues to farm yields and accrue value.

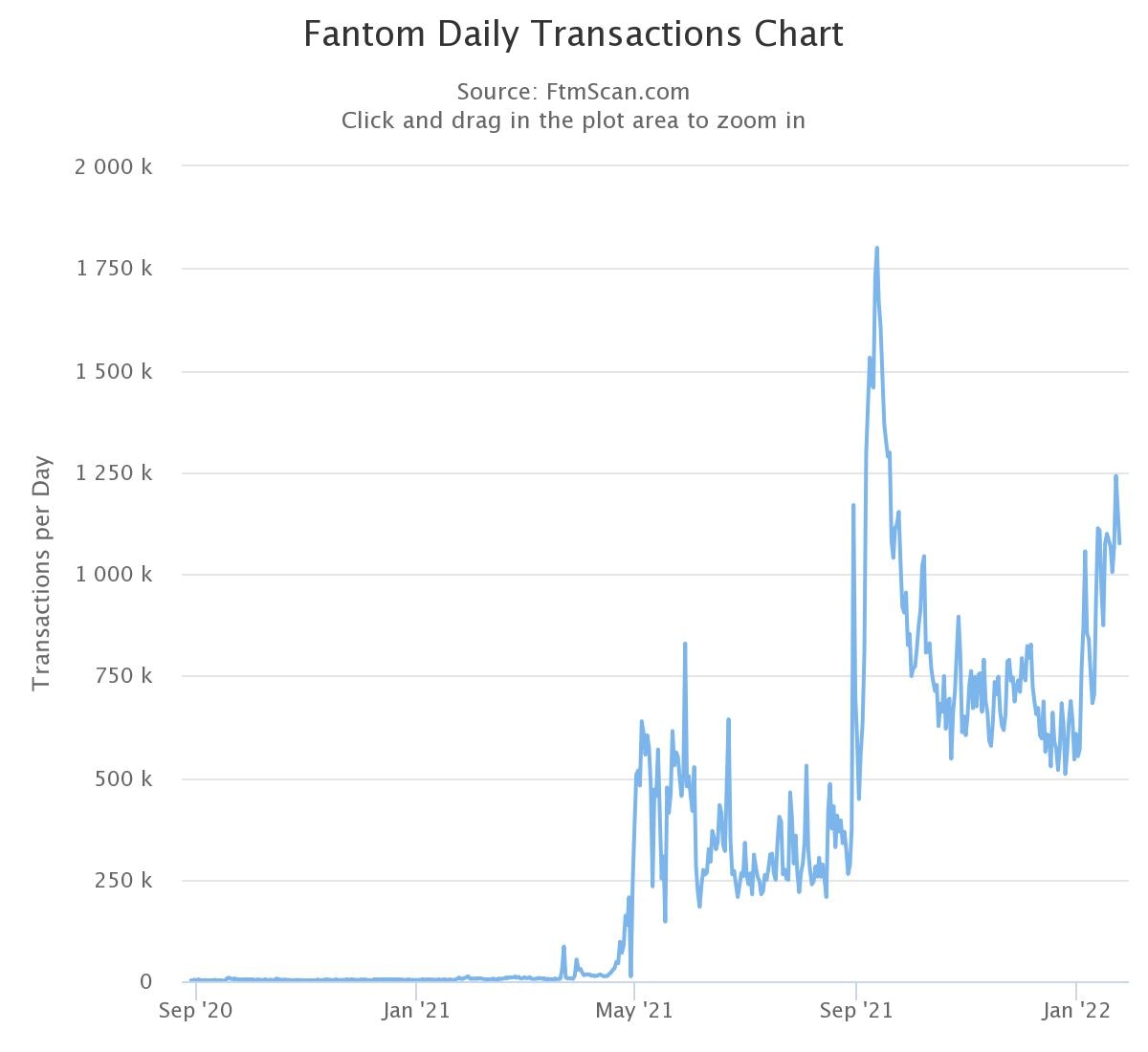

In the past 24 hours, over 1.2 million transactions were processed on the Fantom network, data from blockchain tracker Fantomscan showed. This was slightly higher than Ethereum’s 1.1 million transactions, as per data from Ethereum tracker Etherscan.

With fifty-five validators maintaining the network, Fantom processed upward of eight transactions per second (tps) on Monday compared to Ethereum’s current rates of under 2 tps, data showed. Ethereum transactions are now at August 2021 levels, far below the May 2021 peak of 1.7 million daily transactions.

Fantom has now recorded a total of over 170 million transactions since its launch in December 2019, a fraction of Ethereum’s 1.4 billion transactions since its inception in 2015.

However, Monday’s figures on Fantom were still lower than all-time high transaction counts of 1.8 million in September 2021, a month before FTM tokens reached a price peak of $3.46.

Tokens of Fantom have emerged as the top performers in recent months as investors bet on the tokens of layer 1 projects – protocols with their native blockchains, such as Fantom or Solana – as an alternate to Ethereum.

Fantom became the third-largest decentralized finance (DeFi) ecosystem by locked value over the weekend, as reported. It started 2022 at the eighth spot in rankings but has since climbed to the third spot amid increasing developer activity and user interest for products built over Fantom.

DeFi refers to financial services, such as trading, lending, and borrowing, that rely on smart contracts instead of third parties. Over $12.2 billion worth of value is locked on 129 Fantom-based DeFi applications as of Monday.

Why are transactions increasing?

Analysts say newer products and high yield rewards are fuelling growth on the Fantom network. “Many projects like Radial, veDAO, and 0xDAO came up with liquidity mining launches that vampire attacked other protocols to gain TVL. These projects share a lot of resemblance to defi summer projects in 2020,” wrote crypto research firm Delphi Digital in a note on Tuesday. Liquidity mining refers to users supplying liquidity to DeFi applications and receiving rewards for doing so.

“Mercenary capital came over to Fantom to farm these projects as they were providing incredible yields on single-sided staking,” the analysts cautioned, suggesting current activity could be short-lived as yields fall and investors exit to wherever more yields are on offer.

For now, FTM traders are rejoicing. Prices of the token were among top gainers in Asian hours on Tuesday, rising 8% to $2.30 in the past 24 hours. However, there was some profit-taking with prices falling seven cents at the time of writing.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.