Ethereum risks correction to $3,600 as $1 billion worth of ETH floods exchanges

- Over $1 billion worth of Ethereum hit exchanges in March 2024, ahead of the Dencun upgrade.

- Whales have consistently taken profits on their Ether holdings, to the tune of $7.36 billion in March.

- ETH price could correct to $3,622 as technical indicators turn bearish and signal decline in Ethereum is likely.

Ethereum (ETH) price is at a risk of decline, according to technical indicators and on-chain metrics. A large volume of Ether hit exchanges in March, and ETH holders realized over $7 billion in profits. The altcoin is trading sideways, with Ethereum price at $3,922 at the time of writing.

Also read: Base and Optimism become cheaper than Solana as Ethereum Dencun upgrade empowers L2 chains

Ethereum price at risk of decline: On-chain perspective

Crypto exchanges have noted Ether token inflows worth $1.02 billion in March 2024. The mass inflow of Ethereum is accompanied by profit-taking activities of large wallet investors. The chart below shows the inflow spikes throughout March.

Supply on exchanges and Ethereum exchange flow. Source: Santiment

Data from crypto intelligence tracker Santiment reveals that there have been spikes in whale transactions valued at $100,000 and more. Whales have likely realized gains consistently in Ethereum’s uptrend, as shown in the Santiment chart below.

Whale transactions valued at $100,000 and higher, Network Realized Profit/Loss. Source: Santiment

On-chain metrics signal there is likely an increase in selling pressure on ETH and Ethereum price could crumble if holders continue realizing gains in the coming weeks and months.

Ethereum price could nosedive to $3,600: Technical analysis

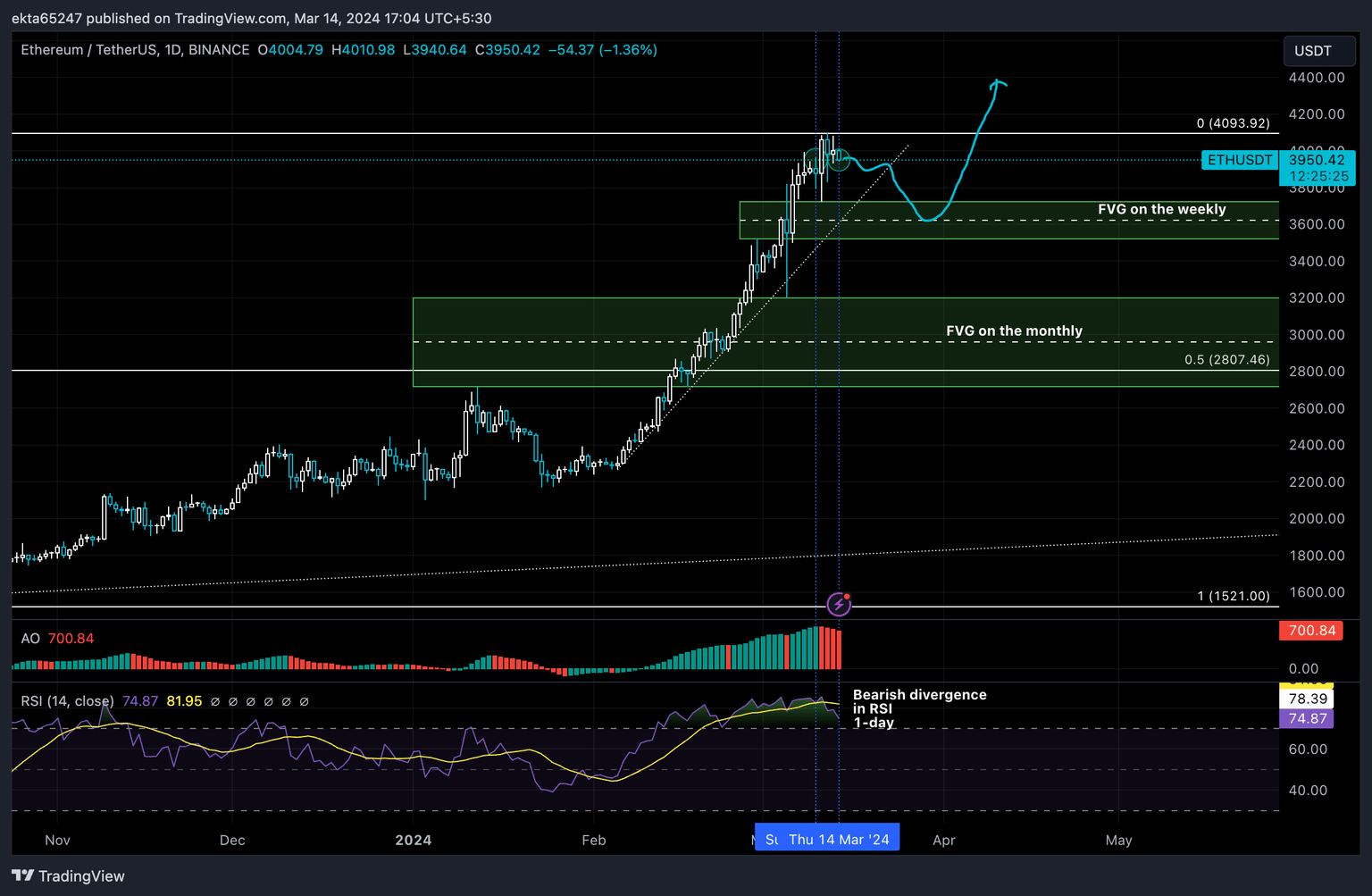

Ethereum price hit its 2024 peak of $4,093.92, on March 13, following the successful rollout of the Dencun upgrade. As Ethereum rallied towards its new year-to-date high, ETH holders kept up their profit-taking. Technical indicators reveal there is a potential for a correction in Ethereum price if demand from traders fails to push ETH price higher.

A nearly 8% correction is likely in Ethereum, ETH price could nosedive to $3,600, the midpoint of the Fair Value Gap (FVG) identified on the ETH/USDT weekly price chart. Once Ethereum sweeps support at $3,600, the altcoin could make its way back to the range high at $4,093.92.

There is a bearish divergence in the Relative Strength Index (RSI) on the 1-day chart, and there are red bars on the Awesome Oscillator (AO). The technical indicators signal Ethereum is likely at the risk of decline, facing a potential correction.

If Ethereum price fails to bounce off the $3,600 level, the altcoin could drop to support at the lower boundary of the Fair Value Gap at $3,522. Such a move would imply over 10% correction in Ethereum.

(This story was corrected on March 14 at 14:37 GMT to say, in the first bullet point, that over $1 billion worth of Ethereum hit the exchanges in March, not over $1 million.)

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B17.08.24%2C%252014%2520Mar%2C%25202024%5D-638460228031958205.png&w=1536&q=95)

%2520%5B17.16.03%2C%252014%2520Mar%2C%25202024%5D-638460228852442417.png&w=1536&q=95)