Ethereum Layer 2 locks nearly $40 billion in assets as Dencun upgrade looms

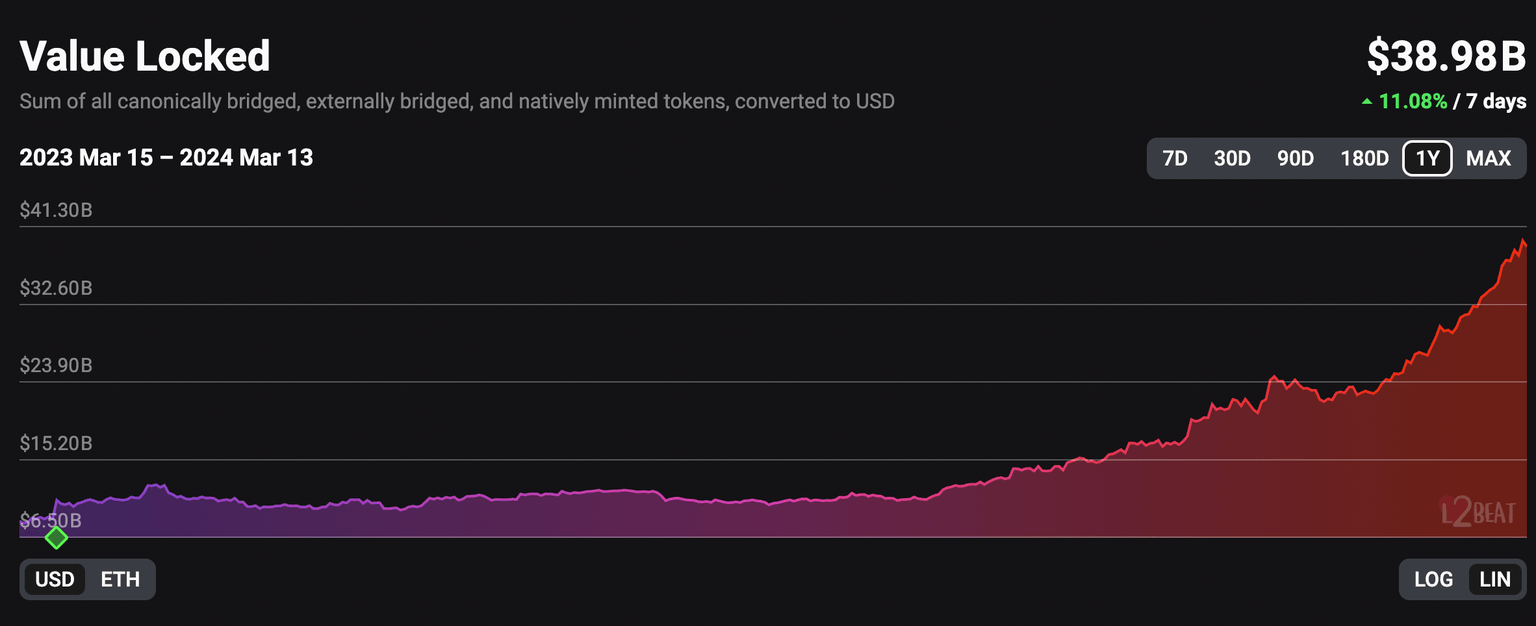

- Ethereum Layer 2 network’s total value of assets locked climbed to $38.98 billion on Wednesday.

- Ethereum Dencun upgrade is less than six hours away and the TVL in most Layer 2 projects has climbed by double digits overnight.

- ETH price sustained above the psychologically important $4,000 level, up 14% on the week.

Ethereum Layer 2 projects, those that scale the underlying blockchain and are built on top of Ether, locked in $38.98 billion in cryptocurrencies ahead of a key technical upgrade. The Dencun upgrade, scheduled to occur on Wednesday, is the most significant upgrade in the Ethereum ecosystem since the Merge.

Layer 2 tokens see massive spike in TVL

Ethereum Layer 2 tokens see a resurgence in the narrative’s popularity as the Dencun upgrade draws close. Of all the technical improvements that the Hard Fork proposes to bring to the Ethereum mainnet, the reduction in transaction cost for L2 tokens is the most significant one for the Ether and L2 community.

L2 TVL rose to $38.98 billion on Wednesday, hitting a key milestone, while the mainnet prepares for the Dencun rollout. The countdown for the Dencun upgrade can be seen here.

TVL increase in Ethereum Layer 2 chains. Source: L2Beat

The surge in TVL is important since it represents the increasing relevance of these projects and the rise in participants locking in their cryptocurrencies on L2 chains in the current market cycle.

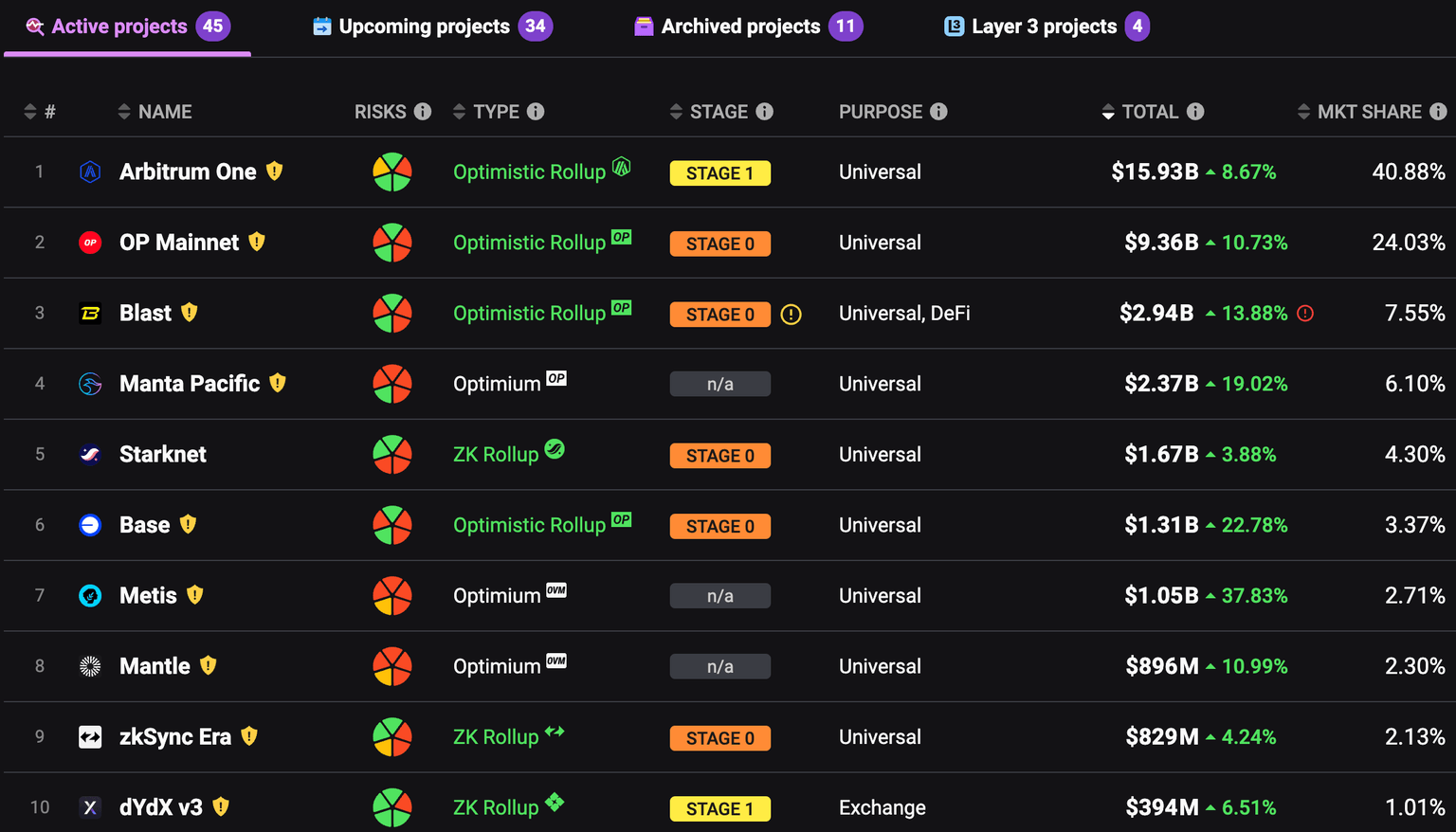

Value locked in Ethereum Layer 2 chains. Source: L2Beat

Crypto expert Eric.eth, behind the X handle @econoar, stresses the importance of L2s to the extent of saying, “L2 is Ethereum.” The crypto analyst wrote that picturing a world in which all transactions are performed on the base chain, or Ethereum’s mainnet, is a false reality. Eric.eth states the community values the fact that anyone can run an Ethereum node, stressing on decentralization in Ethereum. The expert supports the narrative of L2 chains scaling Ethereum while taking advantage of the altcoin’s security infrastructure.

Ethereum's scaling roadmap is rollups.

— eric.eth (@econoar) March 13, 2024

Quit picturing a world where all txs are done on L1. This is a false reality if you have similar values as the Ethereum community.

As a community, we value the ability for anyone to run a node, above all else.

L2 is Ethereum. pic.twitter.com/TNuuRnufVW

The projected transaction cost of a decentralized exchange swap after the Dencun upgrade will decline for various L2 chains, as seen in the image below.

Projected Gas Costs of a DEX Swap. Source: IntoTheBlock

Ethereum price is $4,056 at the time of writing, sustaining above the psychologically important $4,000 level.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.