Base and Optimism become cheaper than Solana as Ethereum Dencun upgrade empowers L2 chains

- Ethereum Dencun upgrade introduced proto danksharding, reducing transaction costs for Layer 2 chains like Base and Optimism.

- Critics argue that Layer 2 fees could increase in upcoming weeks and months as chains compete for blob space.

- Ethereum Layer 2 tokens see price nosedive on Thursday, while ETH price trades sideways below $4,000.

Ethereum Layer 2 chains are competing with Solana for scalability after transaction costs were significantly lowered by Ether’s Dencun upgrade. While the successful rollout of the hard fork on the Ethereum mainnet has reduced fees for chains like Optimism and Base relative to Solana, critics argue that this may change with competition among Layer 2 chains.

Layer 2 tokens noted a correction in their prices on Thursday.

Also read: Ethereum Layer 2 locks nearly $40 billion in assets as Dencun upgrade looms

Ethereum Layer 2 versus Solana, the scaling war rages on

Ethereum’s Layer 2 scaling solutions like Polygon, Base, Optimism, Arbitrum, among others, are competing with Solana for “scalability.” There is no clear winner since the altcoin’s Dencun upgrade has slashed transaction costs for Layer 2 chain users.

Data from Dune analytics shows the average transaction cost in USD for the top Layer 2 chains. The cost is down to $0.057 for Optimism, $0.054 for Base and $0.005 for Zora, among others.

Layer 2- Average Transaction Fee in USD. Source: Dune Analytics

The implementation of proto danksharding, or EIP 4844, has introduced blobs to reduce the cost for Layer 2 chains, at least by one order of magnitude. At the time of writing, Optimism (OP) and Base are cheaper than Solana. However, critics argue that Layer 2 fees could climb in the coming weeks and months.

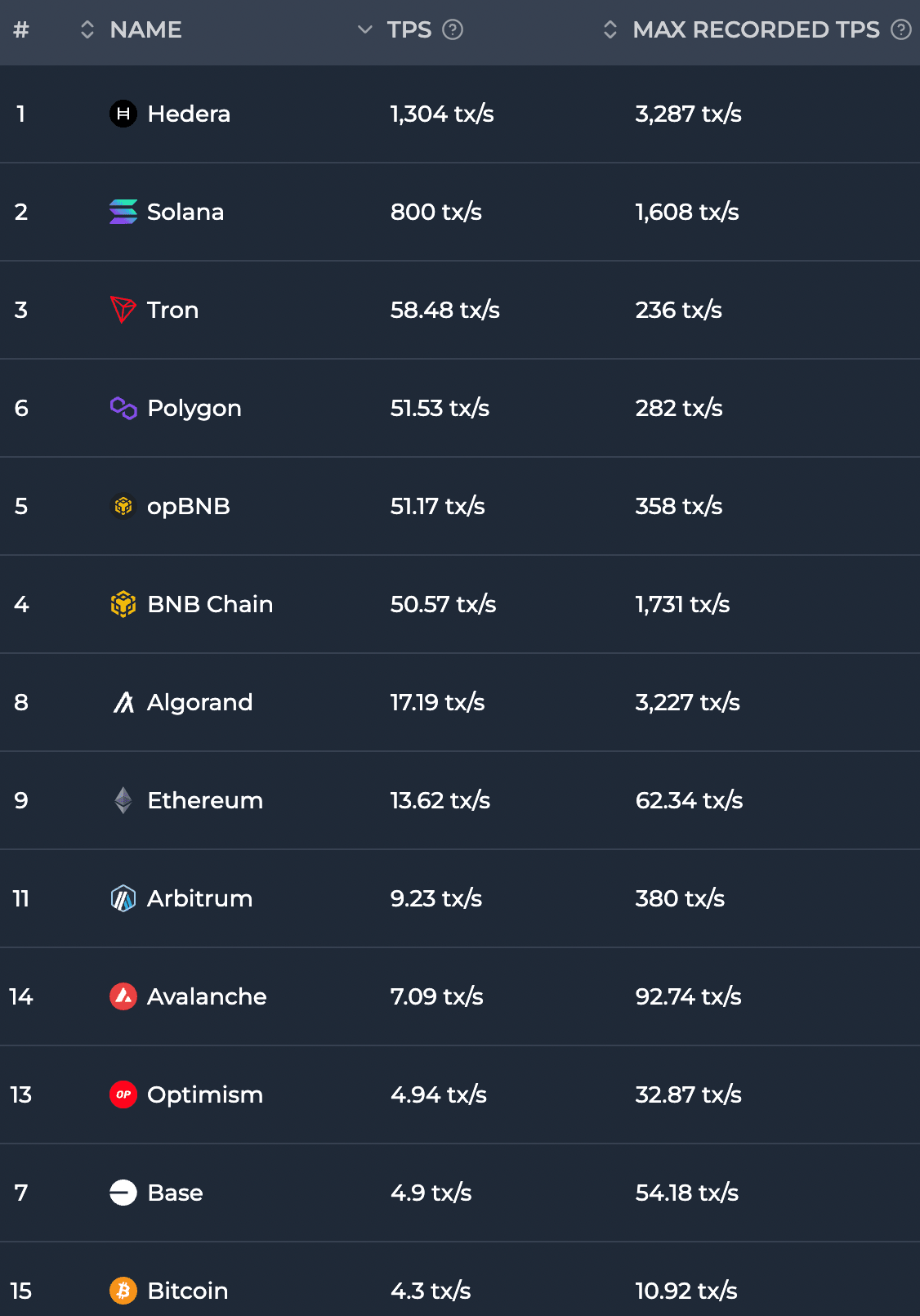

The crypto analyst behind the X handle @QwQiao of AllianceDAO, argues that Layer 2 fees could go up as the chains compete with each other for blob space. Data from Chainspect reveals that Solana ranks high in Transaction Per Second (TPS) compared to Ethereum and its Layer 2 chains. This is an important metric since TPS represents the ability of a blockchain network to handle transactional load. The higher the TPS, the more transactions the network can process in a given time frame, boosting its real-world utility.

TPS for Solana and top Ethereum Layer 2 chains. Source: Chainspect

Solana may still be far ahead of Ethereum and its Layer 2 chains in terms of scaling, since TPS is an important metric to determine the scaling prowess of a chain.

Ethereum trades sideways, L2 token prices nosedive

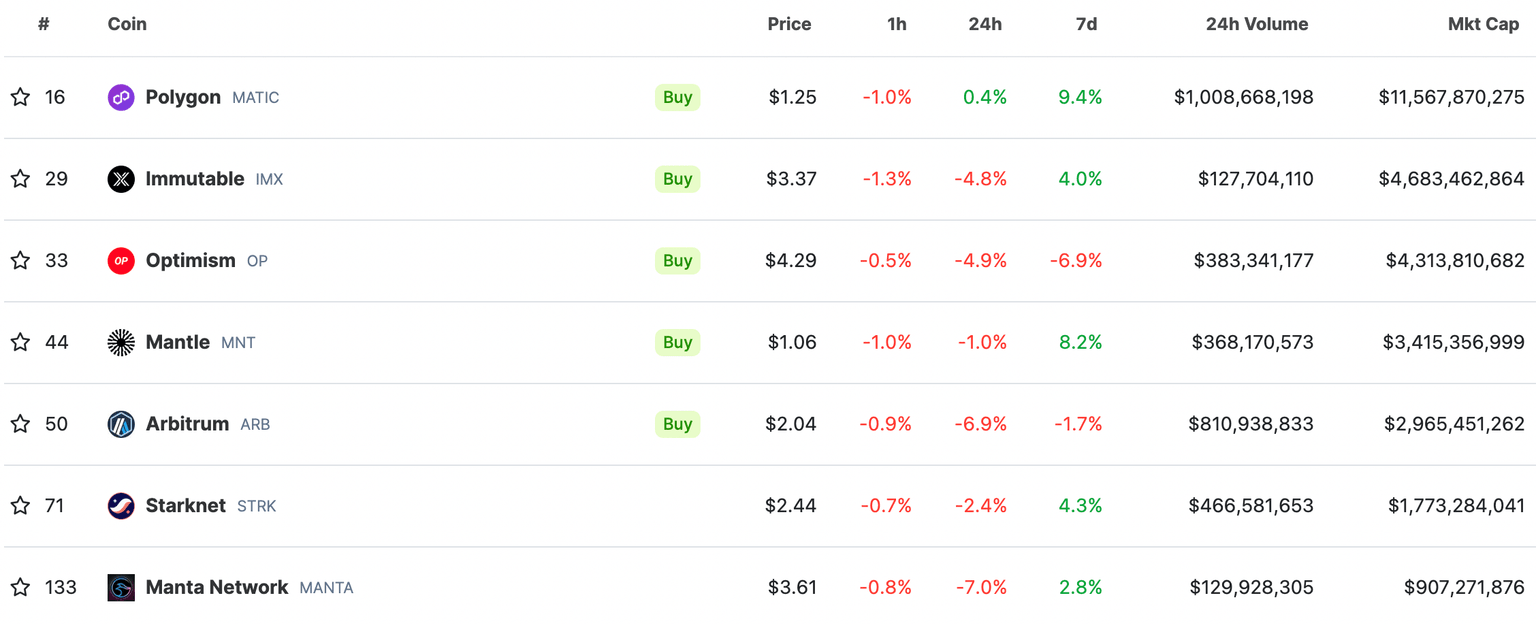

Ethereum is trading sideways below the $4,000 level and Layer 2 tokens Immutable (IMX), Optimism (OP), Mantle (MNT), Arbitrum (ARB), Starknet (STRK), and Manta Network (MANTA) noted up to 7% decline in their prices on the daily timeframe.

Ethereum Layer 2 prices. Source: CoinGecko

Layer 2 token prices have dropped since the successful completion of the Dencun upgrade. This is likely a “sell the news” dip, where anticipation of fee reduction and higher utility of Layer 2 chains drove prices higher prior to the event, traders likely engaged in rapid profit-taking and “sell the news” behavior following the upgrade.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.