Base attracts Lion’s share of Ethereum deposits among Layer 2 chains, beats Optimism in TVL

- Base attracts the most capital among Ethereum Layer 2 chains, surpasses deposits to Arbitrum and Optimism.

- Base has recorded an inflow of over 6,500 Ether, worth nearly $20 million this week.

- The volume of daily contracts deployed on Base climbed to 9,000 on Tuesday.

Base, Coinbase’s Ethereum Layer 2 chain, has noted a spike in inflows to its blockchain this week. Nearly $20 million in Ether flowed into Base since Monday, nearly two times that of Arbitrum and five times as much as Optimism, its competitors in the scaling ecosystem.

Base chain has recorded an increase in the volume of daily contracts deployed; this implies the blockchain is gaining relevance and popularity among users.

Base beats competitors in the race to scale Ethereum

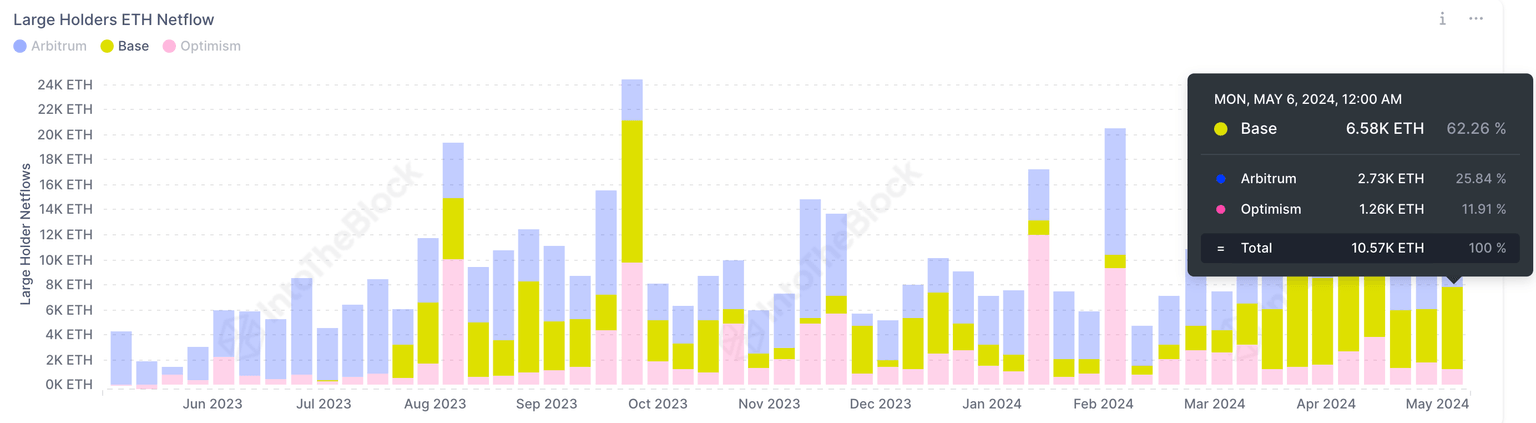

The competition among Ethereum Layer 2 chains has intensified, with Base, Arbitrum and Optimism competing for transactions, volume transferred on-chain and inflow of Ether (Ethereum deposits to the chain). Data from IntoTheBlock shows that Base has seen 6,580 Ether deposits this week, more than twice that of Arbitrum, at 2,730 and nearly five times that of Optimism at 1,260.

Large holders ETH Netflow

The volume of daily contracts on a chain is a metric that helps identify its relevance among developers and market participants. As seen on TokenTerminal, of the 14,700 daily contract developers on Tuesday, 9,000 are deployed on Coinbase’s Ethereum scaling solution, Base.

Base’s meme coin ecosystem’s market capitalization exceeds $900 million, and several categories of crypto tokens are being deployed on Coinbase’s Layer 2 chain.

Daily contract deployers on L2s

— Token Terminal (@tokenterminal) May 8, 2024

14.7k builders launching apps each day, 9k of them on @base. pic.twitter.com/Pgd9umUaTU

Despite leveling activity among top Layer 2 solutions, Base has attracted the highest volume of new capital, while in close competition with Arbitrum and Optimism.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.