Ethereum price unlikely to be moved by SEC ETF decision as approval odds diminish, analysts say

- Ethereum’s recent technical updates have reduced the probability of a Spot Ether ETF approval, according to analysts at Blofin.

- SEC’s decision on Spot Ethereum ETF may not influence the breakthrough of Ether price, experts say.

- ETF experts and crypto analysts have gradually lowered their expectations for Spot Ethereum ETF approval in the past weeks.

The possibility of an approval of a Spot Ethereum ETF has divided the Ether holder community. While there was an expectation of approval by the Securities and Exchange Commission (SEC) immediately after the Bitcoin ETF announcement, the enthusiasm has recently faded after Bloomberg ETF analysts significantly reduced the probability of a Spot Ether exchange-traded fund approval in May, down to 30% from as high as 70%.

Analysts at crypto trading platform Blofin state that a rejection may not have a significant impact on Ethereum price. An ETF approval or rejection may turn out to be a non-event for the altcoin’s price and its holders.

Also read: Ethereum price trades above $4,000 while anti-Ether political campaigns downplay spot ETH ETF

Ethereum ETF approval odds shrink to 30%

Eric Balchunas, Senior ETF analyst at Bloomberg, said that the odds of a Spot Ethereum ETF approval by the SEC are down to 30%, according to his recent tweets. In January, the analyst believed there was a 70% chance of ETF approval by May. Balchunas’ colleague James Seyffart’s prediction was at 60%-65% at that time.

In the absence of meaningful engagement from SEC officials with the ETF applicants, the initial optimism has waned. Experts continue to compare the Bitcoin Spot ETF and its preparation to the regulator’s decision on the Ethereum ETF.

The regulator has held meetings with Coinbase and Grayscale, but there are no public comments. This has added to the uncertainty.

Analysts at crypto trading firm Blofin state that there are three factors that could result in the SEC’s rejection of a Spot Ethereum ETF:

- The Merge, a shift of the altcoin’s consensus mechanism from Proof-of-Work to Proof-of-Stake.

- Price manipulation risk that accompanies PoS consensus.

- Securitization risk.

Spot Ethereum ETF approval may have no bearing on ETH price

Analysts highlight that there was a surge in whale activity and supply distribution of Bitcoin in the weeks leading up to the regulator’s decision on the ETF. However, an on-chain analysis of Ethereum paints a different picture. Instead of consistent accumulation, large wallet addresses have taken profits and likely capitalized on ETH holders’ enthusiasm and optimism of an ETF approval.

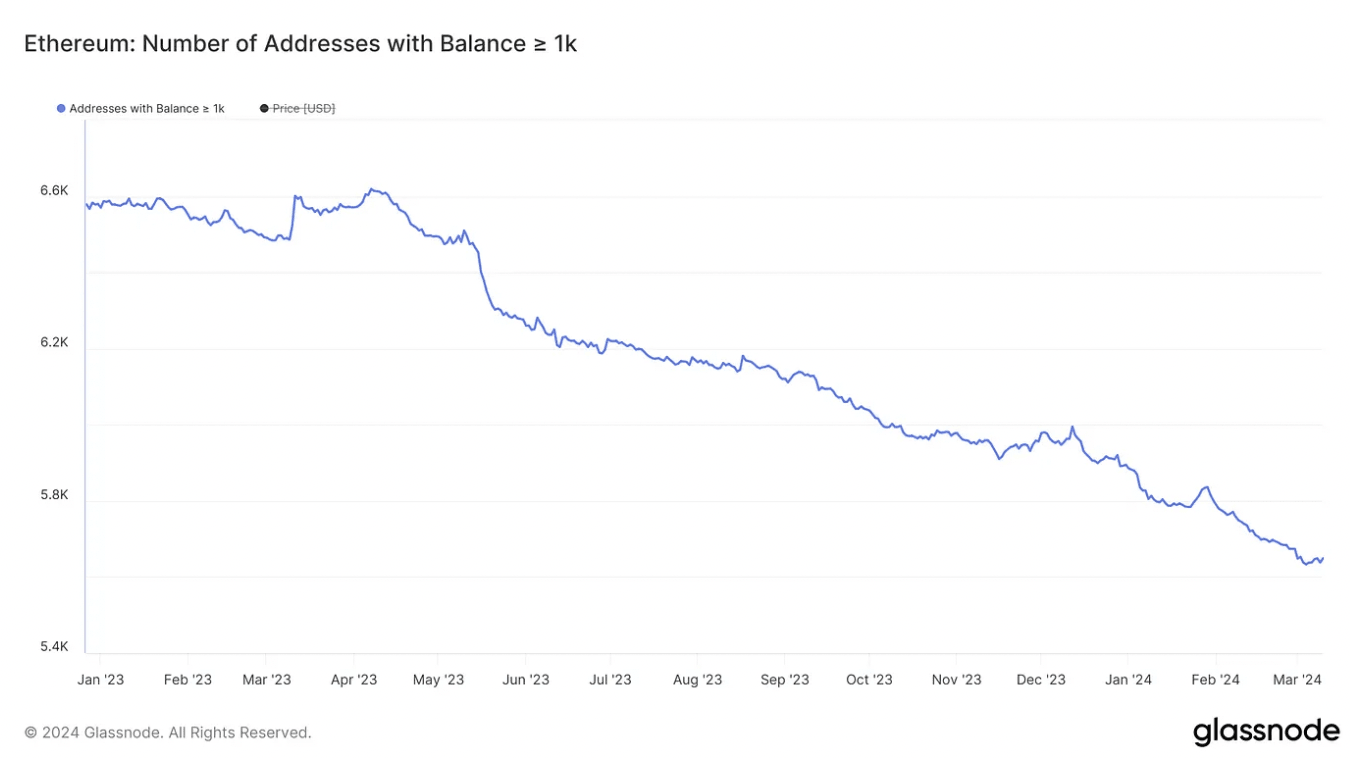

Whale action is lacking in the sense that there is no race among large wallet holders to increase their holdings of the altcoin’s supply. Glassnode data shows a gradual decline in the number of ETH wallets with a holding more than 1,000 Ether.

Ethereum addresses with balance greater than 1K. Source: Glassnode

Derivatives traders show no excitement for Ethereum ETFs

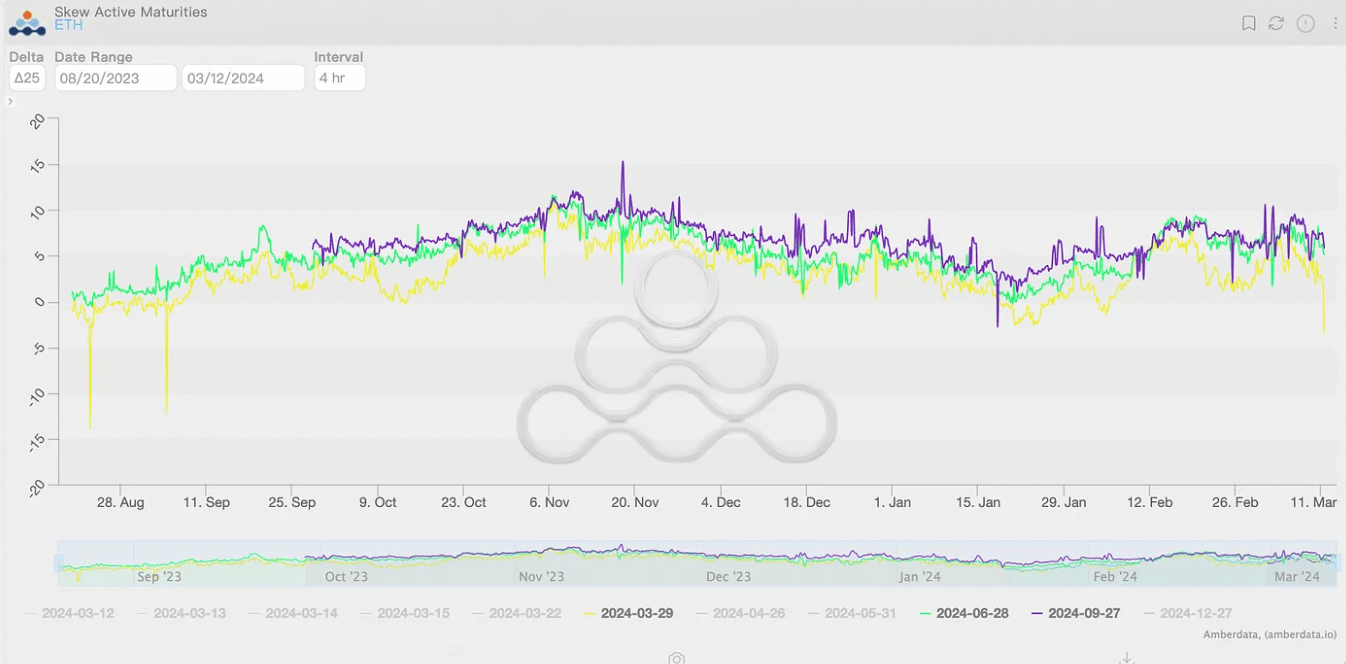

The announcement of the Spot Bitcoin ETF application pushed the far-month option skewness of both Bitcoin and Ethereum to a peak in November 2023.

One would expect a similar effect of Ethereum ETF announcement. However, the applications did not push the bullish sentiment higher. Analysts argue that the increase spotted in the far-month skewness in February likely marks the return of liquidity to the market.

Ethereum Skew Active Maturities. Source: Amberdata

Ethereum price rally depends on multiple factors

Ethereum’s price performance depends on multiple factors. On the one hand, analysts have identified the return of cash liquidity to the crypto market as a factor boosting Ethereum price gains. This has brought volatility back to Ether, adding to the potential for growth.

The gains in Ethereum price are likely a reflection of Bitcoin’s rally to a new all-time high and the optimism among market participants. Ethereum price is inching closer to its peak in the ongoing cycle and analysts argue that a Spot Ethereum ETF approval could fast track the process. However, a rejection of the ETF applications may not result in a significant pullback since the altcoin’s price depends on more variants than the decision by the regulator.

Adriano Feria, a crypto analyst and trader, said that Ethereum price could recover from a rejection after a minor pullback.

What's coming to crypto markets in the next 2-3 months:

— AdrianoFeria.eth ️ (@AdrianoFeria) March 11, 2024

- $ETH continues to gain momentum both in $USD and relative to $BTC. $ETH bulls simply don't care if ETFs are not approved as early as May, and they will use this time to accumulate.

- L2 fundamentals will pop hard after… pic.twitter.com/w2DIP24wbT

DCinvestor also argues Ethereum ETF approval or rejection may have no impact on the altcoin’s price in the near term.

ETH keeps raging on the day when everyone seemingly agrees that ETF may not happen in May

— DCinvestor (@iamDCinvestor) March 12, 2024

seems like the ETF doesn't actually mean much for near-term ETH price

but just imagine what things look like if it finally drops when ETH is already at $10K or $15K in a raging bull...

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.