Ethereum price shows optimism as ETH Beacon Chain continues to defy critics

- Ethereum’s Beacon Chain had recorded massive inflows since April 12, when staking withdrawals were enabled.

- The contract boasts over $7.7 billion worth of Ethereum deposits despite speculation of massive outflows post-Shanghai Upgrade.

- Total amount of deposited ETH exceeds the April 12 balance by 1.25 million Ether, daily deposits sometimes reach 225,000 ETH.

Ethereum (ETH) Beacon Chain had recorded commendable inflows, with the contract registering worth over $7.7 billion in ETH deposits since April 12, when the network-enabled staked Ether (stETH) withdrawals. The turnout comes despite speculation of massive outflows after the Shanghai/Capella (Shapella) upgrade.

Also Read: Vitalik Buterin warns against risks of overloading the Ethereum network

For Clarity: Beacon Chain is a crucial part of the Ethereum blockchain’s next generation, Ethereum 2.0, presenting as a Proof-of-Stake (PoS) blockchain to coordinate validators, validate transactions, and propose and finalize blocks within the Ethereum network.

Ethereum Beacon Chain breaks record with $7.7 billion in deposits

Data from Arkham Intelligence shows that ETH deposits are around 1.25 million ETH more than the balance recorded on April 12 when stETH withdrawals went live. The analysis also shows a daily deposit variation reaching 225,000 ETH in certain instances, translating to more than $400 million daily.

The Beacon Chain has seen over $7.7B in inflows since staking withdrawals were enabled on April 12th.

— Arkham (@ArkhamIntel) May 22, 2023

Despite some commentors expecting a flood of outflows, withdrawals have actually been greatly outpaced by the inflow following the Shanghai Upgrade.

Let's dive into the detail: pic.twitter.com/siI5ILSjNN

Based on the inflows chart below, there is an obvious spike post-Shapella, conducted with the full facilitation of withdrawals from the Beacon Chain. Lido’s stETH address “0xae7” takes front-row seats among deposits, living up to its consistent record as the top depositor with a lifetime inflow surpassing $15 billion. According to Arkham, this accounts for at least 33% of the Ether locked in the deposit contract.

Let's take a look at some of the top depositors over the last month.

— Arkham (@ArkhamIntel) May 22, 2023

Lido's stETH address 0xae7 has been consistently #1, with a lifetime deposit amount of well over $15B, accounting for over a third of the ETH locked in the deposit contract. pic.twitter.com/kyFOiUreu0

After stETH withdrawals were enabled, Lido’s deposit address changed to a new address, “0xfdd,” that now ranks 4th place among deposit addresses since April boasting a total deposit amount of over 214,000 ETH ($386 million), despite being active for just about three days.

Moreover, alongside the growth of Ethereum 2.0 and Beacon Chain contract, there has also been an increase in staking services and Liquid Staking Tokens with Frax stablecoin. This project, marked among the best players of its kind, is committed to offering a more stable and reliable alternative to traditional fiat currencies. Frax provides the frxETH product, allowing users to stake their ETH and receive liquid-staked ETH tokens (sfrxETH) in return.

While Frax is 14th place on the list of depositors, it boasts an aggregate stake of 72,400 ETH beginning April, representing a notable chunk (33.6%) of its total Frax ETH supply of 215,000.

Ethereum price shows bullish outlook

The advent and subsequent development of staking services and liquid staking tokens is a positive step for the Ethereum network, providing users various options to earn rewards on their ETH holdings. The growth attests to the popularity of Ethereum 2.0 and the Beacon Chain, delivering a more efficient and sustainable network for dApps.

Despite the prevailing uncertainty in the crypto market, the long-term outlook for Ethereum price and the broader digital asset industry remains positive.

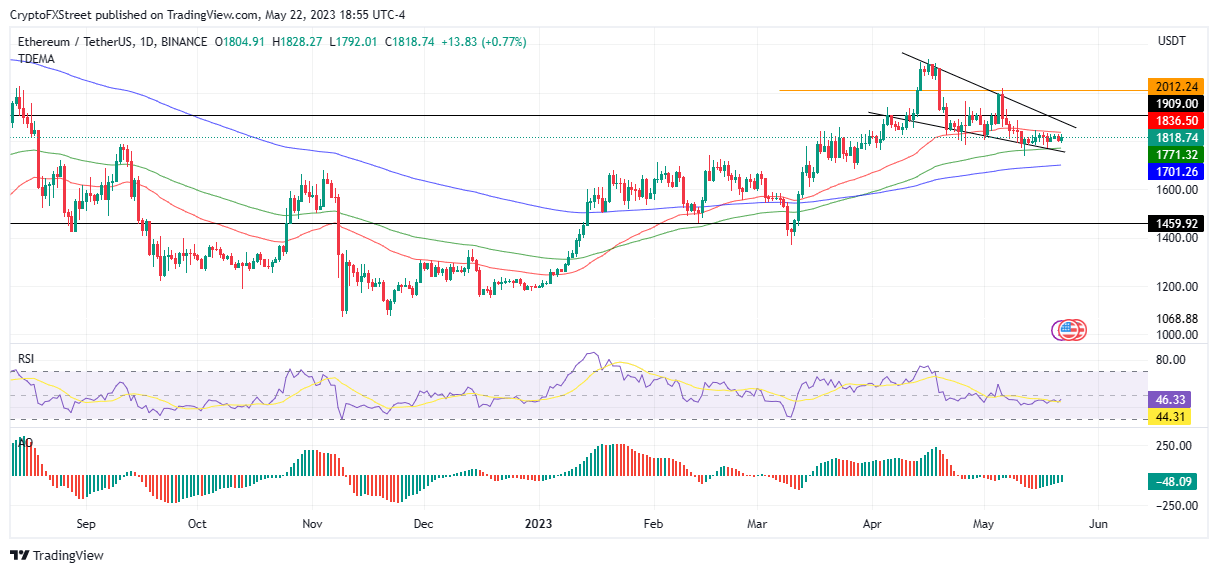

As shown below, Ethereum price action has formed a falling wedge pattern, coiling up for a breakout. Nevertheless, this bullish potential appears limited owing to the PoS token’s correlation to BTC. This means that until Bitcoin price takes charge, investors may not actualize this technical formation with a bullish tendency.

Nevertheless, a surge in BTC could provoke a bullish recovery in Ethereum price to confirm the optimistic outlook of the governing chart pattern. A decisive flip of the $1,909 hurdle could tip the odds in favor of bulls to pursue the $2,012 resistance level next.

ETH/USDT 1-Day Chart

In the meantime, as selling pressure from the 50-day EMA at $1,836 abounds, the Ethereum price could break below the immediate support confluence between the lower boundary of the downtrend line and the 100-day EMA at $1,771. The subsequent price action could be a free fall to the 200-day EMA at $1,701, where buyer momentum may provoke a rebound.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.