Lido DAO token crashes by 9% in 24 hours, but here is why investors do not need to worry much

- Lido DAO token declined during the intra-day trading on May 18 following a 40% rally in the last three days.

- The anticipation surrounding V2 triggered a rise in participation, effectively increasing the rate of new address formation by over 200% week-on-week.

- This also marked an uptick in the velocity, suggesting tokens are changing addresses which is generally a strong network growth indicator.

Bullishness from investors will likely counter any bearishness in price, preventing a steep drop.

Lido DAO price has been observing immense growth in the last few days owing to network development which spurred demand among investors. But even as the altcoin begins suggesting a potential drawdown, investors do not have much to worry about as they hold the key to preventing a decline.

Lido DAO price notes a dip

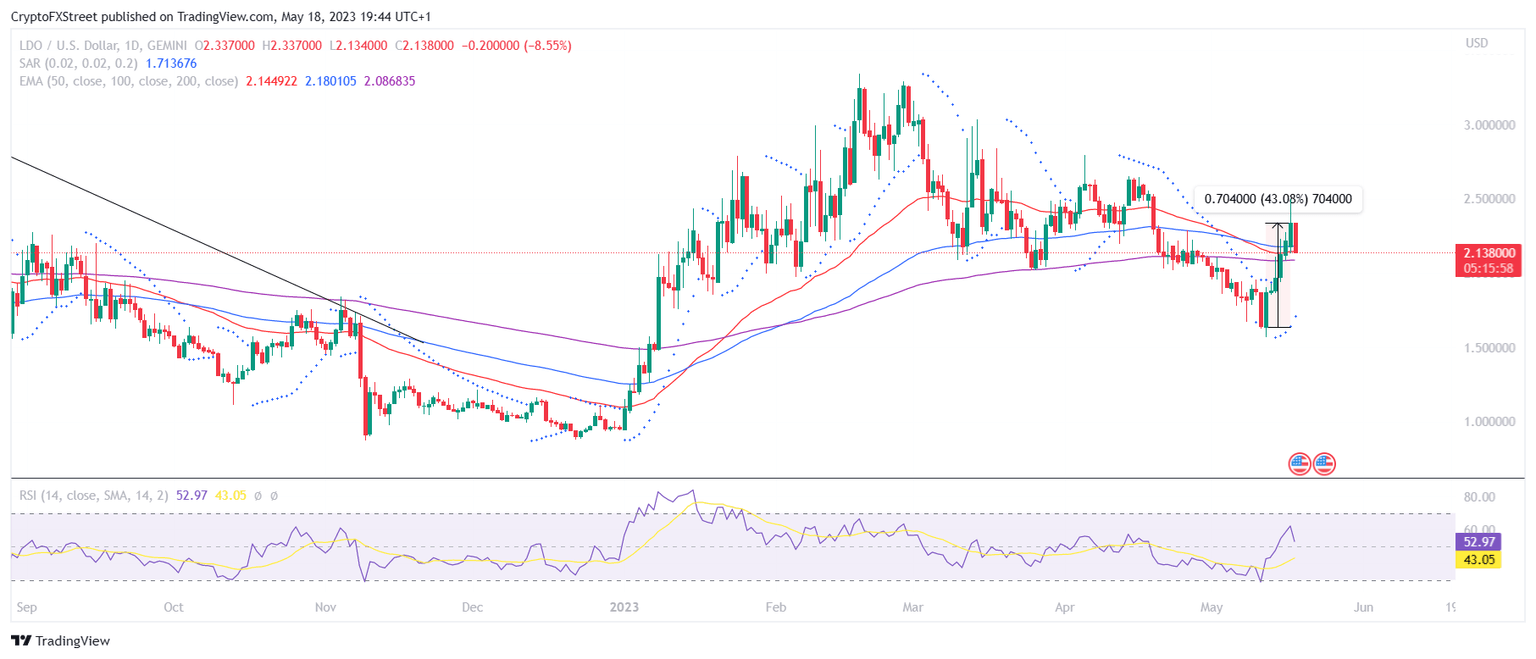

Lido DAO price, trading at $2.13 at the time of writing, fell by nearly 9% in the last few hours. The sudden red candlestick came after the altcoin registered a more than 43% rally over the last four days. Corrections were anticipated as the market would need to cool down at some point.

Usually, such a decline occurs after the token has been oversold and the market has been overheated, but in the case of LDO, the fall came earlier.

LDO/USD 1-day chart

Anyhow, investors who are planning on dumping their supply for profits before the cryptocurrency declines further would be better off not doing that. HODLing is the right choice for now since the V2 bullishness has not dissipated yet.

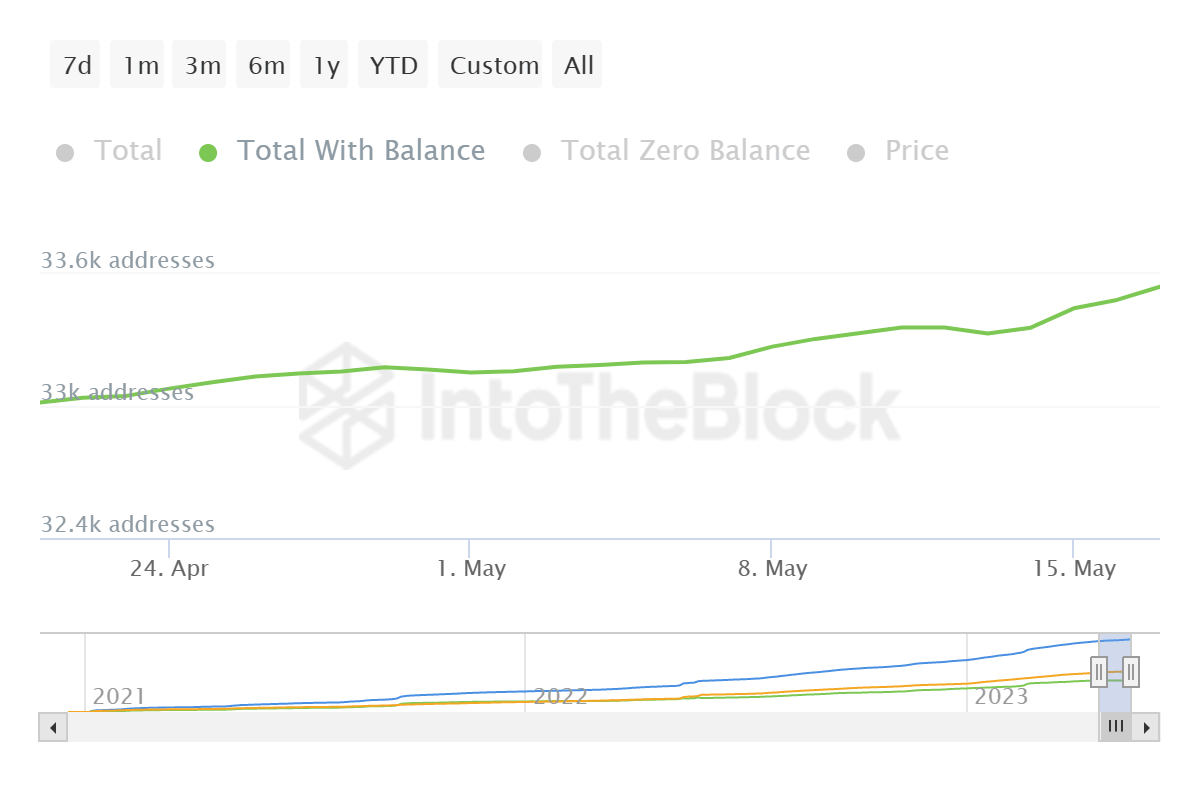

The anticipation surrounding the launch of V2 was the reason behind the rally, and it also triggered interest from investors. As a result, following the launch, the network began observing higher participation and also attracted investors in a much larger quantity.

On average Lido DAO network has been observed to add about 60 new addresses, whereas, in just the last four days, over 200 new addresses have been formed. This is a 230% week-on-week increase, bringing the total addresses to 33,540.

Lido DAO total addresses

But it's not just the addition of LDO holders but also their increased participation that suggests that investors are not done with the Lido DAO token yet. The active addresses, which have been rising since the beginning of the month, are still at a monthly high of 510.

Furthermore, at the time of writing, the velocity also stands at a 30-day high. The indicator depicts the rate at which a token changes addresses, and a high velocity suggests the network growth is rather strong.

Lido DAO velocity

This means that LDO holders are active in conducting transactions on the network which will keep Lido DAO price from noting a steep drop-off anytime soon. The observed slowdown would serve as a momentary break to keep the market from overheating before the altcoin begins climbing back up. The next target for the cryptocurrency is $2.31, which is the average price at which nearly 141 million LDO tokens were purchased by 4,800 investors.

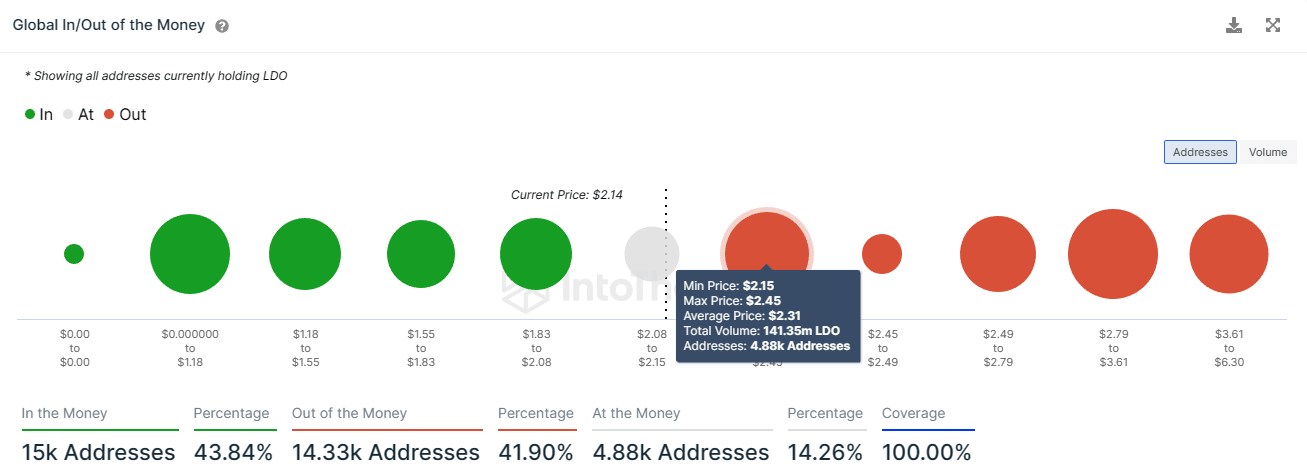

Lido DAO GIOM

Once this demand wall is breached and this supply worth over $280 million becomes profitable, some profit-taking could be observed; until then, investors will refrain from selling to support Lido DAO price to rise to $2.31.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B00.21.25%2C%252019%2520May%2C%25202023%5D-638200379131033162.png&w=1536&q=95)