Four crucial on-chain metrics suggest that Ethereum price rally has just begun as bulls target $3,000 first

- Ethereum’s technical indicators and on-chain metrics align in support of the expected bull run to $3,000.

- Institutional investors and whales are yet to join the Ethereum rally, suggesting that the rally just started.

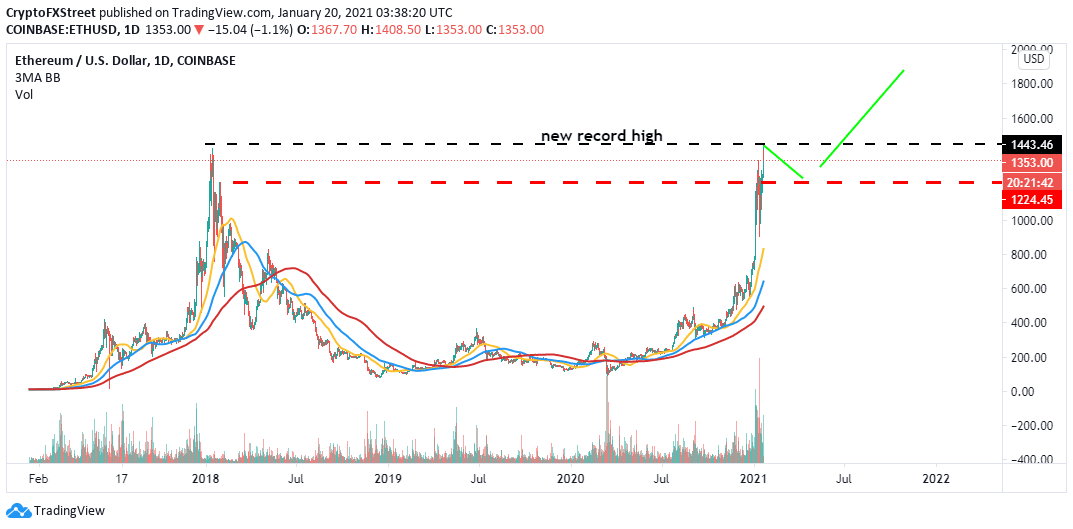

Attention has shifted to Ethereum, the largest altcoin in the market after breaking out to a new record high of $1,446 (on Coinbase). Speculators, traders, and analysts agree that this is just the beginning of the rally, and Ether may have jumpstarted the altcoin season. As both On-chain metrics and technical levels align for the ultimate upswing, Ethereum aims for $3,000 at first.

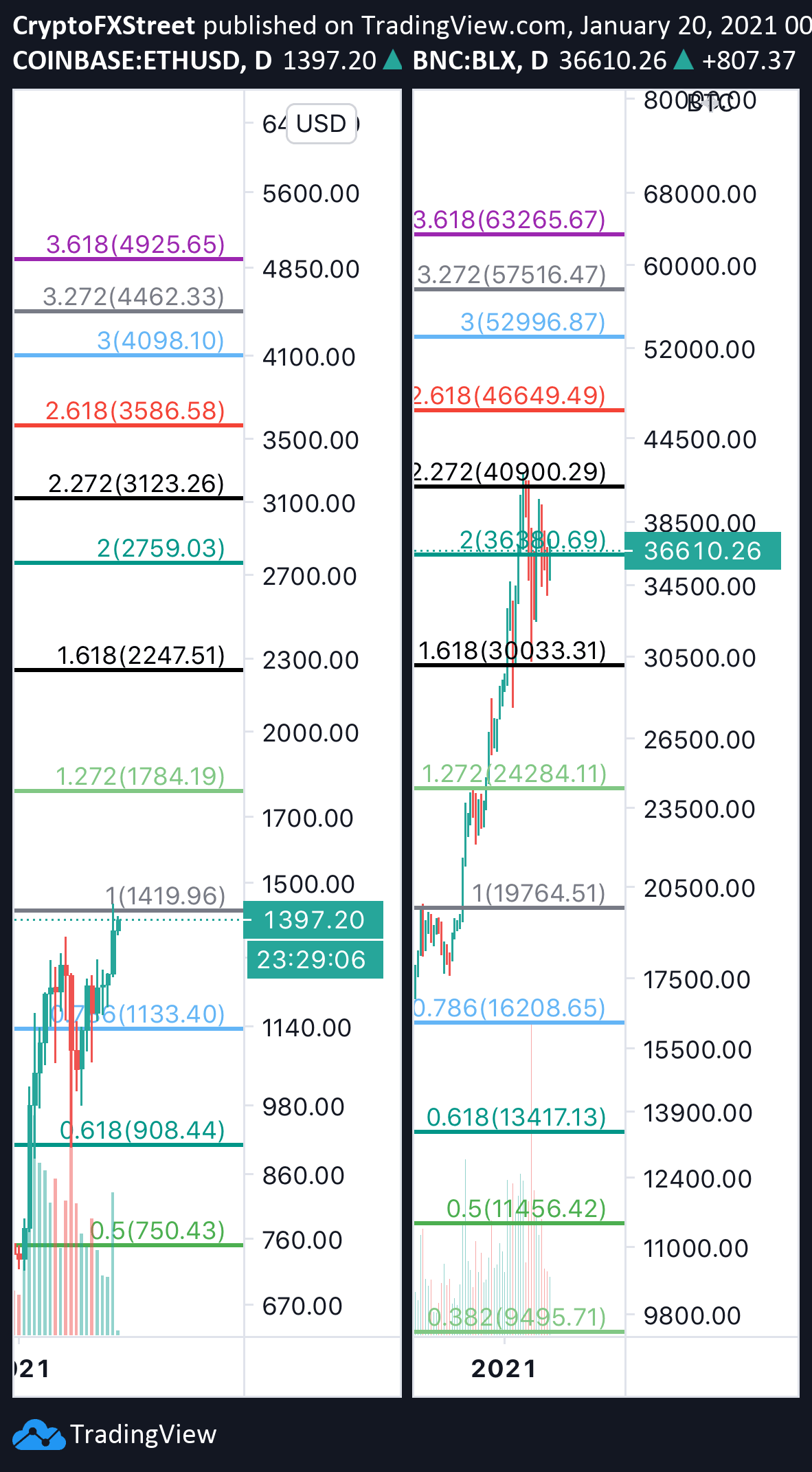

Can Ethereum mimic Bitcoin’s price action after breaking the former all-time high?

Ethereum is likely to replicate Bitcoin’s price action after it broke above its 2017/2018 all-time. According to the daily chart, BTC/USD rose to the 272.2% Fibonacci level following the former record high near $20,000. If ETH/USD follows in the footsteps of Bitcoin, its uptrend will target $3,123, and this level will serve as the starting point of another spike toward $10,000 by the end of 2021.

ETH/USD and BTC/USD charts

On-chain metrics suggests that Ethereum is far from its local top

The number of large transactions has considerably increased from late 2020 to the current 9,800. However, according to the data provided by IntoTheBlock (ITB), in the previous bull run, the large transaction on Ethereum hit 48,000. This means institutional investors and whales (large volume investors) are yet to come to the market. An influx of funds from these unique investors is likely to add weight and credibility to the uptrend.

Ethereum number of large transactions

Santiment, a renowned platform providing up to date on-chain metrics, shows that Ethereum daily active addresses have spiked to an all-time high of nearly 577,000. The metric has doubled year-to-date, bringing to light the massive attention Ethereum is receiving. The chart below displays the tendency of the price surging in tandem with the increase of the daily active addresses.

Ethereum daily active addresses

Ethereum currently supports most of the decentralized finance (DeFi) projects. Although some projects allow Bitcoin (BTC) to be locked, Ethereum still leads in the amount of value already sunk into the platforms. Santiment shows that DeFi total value locked stands at nearly $25 billion worth of Ethereum. As DeFi continues to hit new milestones, the price of Ethereum appears to be rallying with it, as observed on the chart.

DeFi total value locked USD (ETH)

Consequently, Ethereum’s miners’ balance has gone down significantly, as highlighted by Santiment’s 90-day trailing average metric. As the combined ETH balance in addresses belonging to Ethereum mining pools fall, the price of Ethereum tends to rally. Thus, the decline is one of the most prominent bullish signals behind the altcoin’s expected rally.

Ethereum miners’ balance

Despite analysts across the board using different on-chain metrics and technical indicators, they all agree that Ethereum aims for new and significant all-time highs. Moreover, while Bitcoin settles above $34,000, unable to break the critical $40,000 zone, attention is shifting to Ethereum, showing impressive signs of growth.

ETH/USD daily chart

Meanwhile, Ethereum must hold above the broken red line to sustain the uptrend in the short-term. Note that failure to do so may see the price revisit lower levels at $1,000 and $900. On the upside, breaking above $1,600 will leave the air open for gains eyeing $2,000 and later $3,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637467124755336066.png&w=1536&q=95)

%2520%5B06.11.51%2C%252020%2520Jan%2C%25202021%5D-637467123943884988.png&w=1536&q=95)

%2520%5B06.21.09%2C%252020%2520Jan%2C%25202021%5D-637467124029208556.png&w=1536&q=95)

%2520%5B06.28.32%2C%252020%2520Jan%2C%25202021%5D-637467124634438739.png&w=1536&q=95)