Ethereum cools off as miners book profits en masse, prices still look primed to rebound

- Ethereum price was rejected at its all-time high of $1,440 and has significantly cooled off.

- ETH miners have taken some profit in 2021 which could have contributed to the selling pressure.

Ethereum price reached $1,440 on Coinbase, a new all-time high before plummeting to a low of $1,234. It seems that ETH miners have been selling a lot in the past few weeks as their balances have dropped below 1 million ETH for the first time since the price hit $1,000.

Ethereum price faces healthy correction and it's poised for another leg up

Most of the selling pressure comes from ETH miners selling a significant amount of coins from January 3 until now. This can be concerning to the bulls in the short-term as miners could continue to panic sell if Ethereum price falls harder.

ETH Miners Balance

Additionally, the MVRV (30d) chart shows Ethereum is still close to the danger zone although this metric has cooled off with the last dip. The risk of accumulating ETH when the digital asset is close to the danger zone is certainly higher.

ETH MVRV (30d) chart

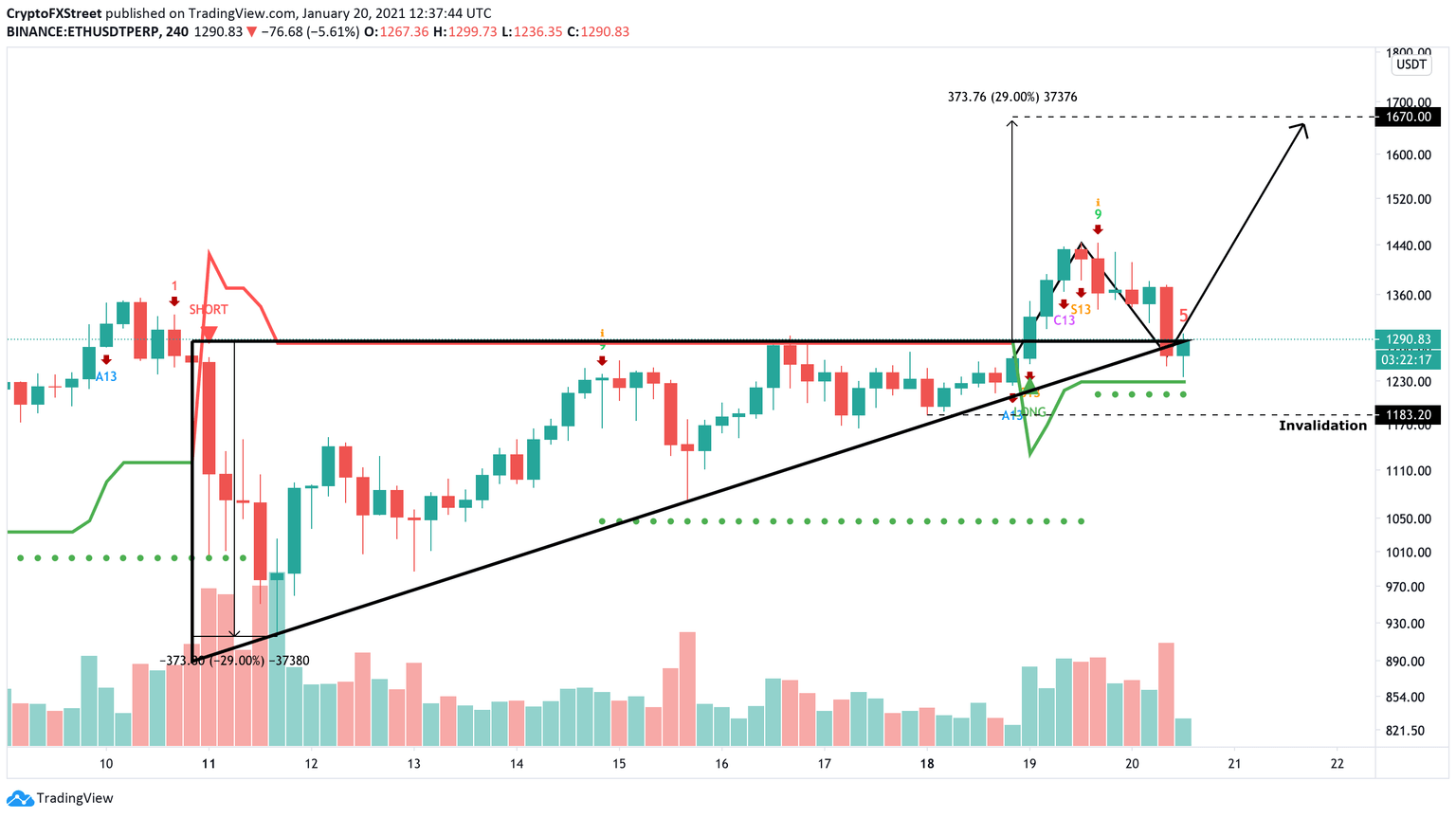

The recent sell-off from Ethereum’s all-time high happened right after the TD Sequential indicator presented a sell signal in the form of a green nine candlestick on the 4-hour chart. So far, ETH bulls have defended a crucial support level at $1,183. However, if this one breaks, bears will take control of the trend.

ETH/USD 4-hour chart

Ethereum has re-tested the previous resistance level of an ascending triangle pattern on the 4-hour chart. Considering that the SuperTrend has remained bullish, the digital asset could be aiming for a high of $1,670 after a rebound.

ETH Holders Distribution

It’s also important to note that despite miners are selling, whales aren’t. The number of large holders with 1,000,000 to 10,000,000 ETH coins hasn’t moved since January 15 and it has increased by two since January 6. Similarly, whales holding between 100,000 and 1,000,000 have accumulated even more ETH since the beginning of 2021.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.36.03%2C%252020%2520Jan%2C%25202021%5D-637467474760261062.png&w=1536&q=95)

%2520%5B14.51.34%2C%252020%2520Jan%2C%25202021%5D-637467474987284272.png&w=1536&q=95)

%2520%5B14.50.31%2C%252020%2520Jan%2C%25202021%5D-637467475055257925.png&w=1536&q=95)