Top 3 Price Prediction Bitcoin, Ethereum, Ripple: The levels bulls eye on Biden's inauguration day

- Cryptocurrencies have suffered a setback, including Altcoins which had shined.

- All top digital coins have clear hurdles they need to surpass to unleash the rally.

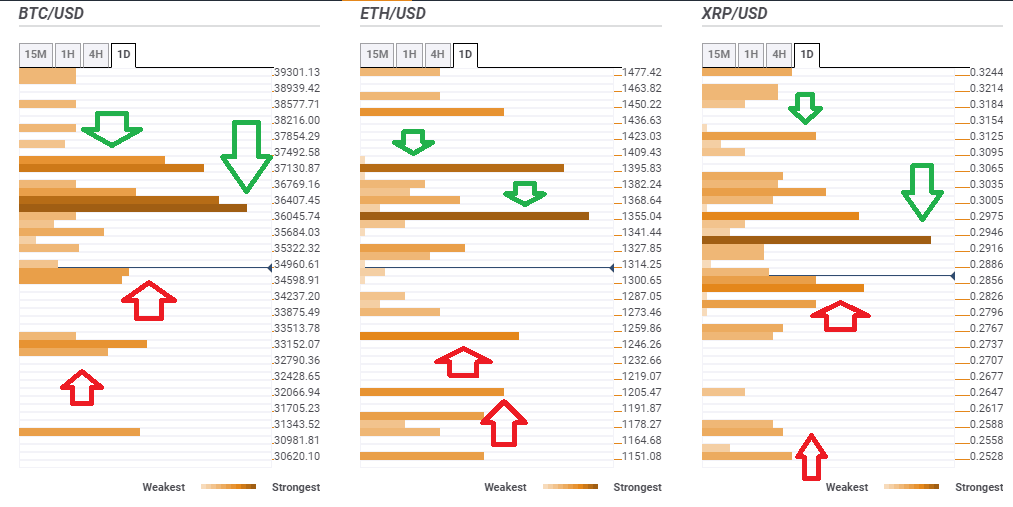

- Here are the next levels to watch according to the Confluence Detector.

Is it Altcoin season or not? Ethereum hit all-time highs earlier this week but has retreated from the highs. Bitcoin has been holding onto high ground –unimaginable several months ago – but below the peak.

Broader markets are eyeing the inauguration of Joe Biden as the 46th PResident of the United States. Will the new administration succeed in unleashing funds that would partially flow to cryptos? The $1,9 trillion plan seems like a significant start, yet its passage is not assured.

How are the top three cryptos technically positioned?

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD eyes $36,400

Bitcoin has been changing hands on lower ground and has support at around $34,500, which is the convergence of the Bollinger Band 4h-Lower, the BB 1h-Lower, the Pivot Point one-day Support 2, and the Fibonacci 38.2% one-week.

Lower, the next cushion for the granddaddy of cryptocurrencies is at $33,150, which is the meeting point of the PP one-month R1 and the Fibonacci 23.6% one-week.

BTC/USD has critical resistance at $36,400, which is the confluence of the Simple Moving Average 5-4h, the BB 4h-Middle, the BB 15min-Upper, and the SMA 5-one-day.

Further above, the next hurdle is $37,200, which is a juncture including the PP one-month R2 and the Fibonacci 61.8% one-day.

ETH/USD needs to surpass $1,350

Ethereum is capped at $1,350, which is a dense cluster including the SMA 5-1h, the BB 15min-Middle, and the previous weekly high.

It is followed by $1,400, which is where the PP one-week R1 and the Fibonacci 23.6% one-day converge.

Support for Vitalik Buterin's brainchild awaits at $1,250, which is the confluence of the SMA 5-one-day and the previous daily high.

ETH/USD has another cushion at $1,200 which is the convergence of the several SMAs: the 10-one-day, the SAM 200-1h, and the SMA 50-4h.

XRP/USD must take 0.2930

Ripple's XRP token had also benefitted from the run into Altcoins, despite its legal woes. Critical resistance awaits at $0.2930, which is the convergence of the SMA 5-1h, the SMA 10-1h, the Fibonacci 23.6% one-month, and the SMA 10-15m.

The upside target is $0.3125, which is the meeting point of the previous 4h-high and the Fibonacci 38.2% one-day.

XRP/USD has close support at $0.2840, which is a dense cluster including the SMA 5-one-day, the previous 1h-low, and the BB 1h-Lower.

Bears eye $0.2570, which is the meeting point of the Fibonacci 161.8% one-day and the PP one-day S2.

See all the cryptocurrency technical levels.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.