Ethereum price falls as BTC takes center stage after US CPI announcement

- Ethereum price shows a clear lack of buying interest after the CPI announcement on January 12.

- This lack of buying pressure combined with declining momentum seen in RSI hints that a reversal is likely.

- Invalidation of the bearish thesis will occur if ETH produces a four-hour candlestick close above $1,679.

Ethereum price shows a stagnation of its move after it slices through a crucial hurdle, indicating that the rally is exhausting. The US Consumer Price Index (CPI) was announced on January 12, which caused Bitcoin price to whipsaw for a while, but eventually the big crypto rallied higher. Since all eyes were on BTC, investors seem to have lost interest in ETH as it took a backseat. Interestingly, ETH was up 2.80% and BTC was at 3.30% after the US CPI numbers were announced.

Therefore, investors need to be prepared for a reversal that could trigger a countertrend rally.

Also Read: Will US CPI release whipsaw Bitcoin price to $16,500?

Ethereum price at the brink of reversal

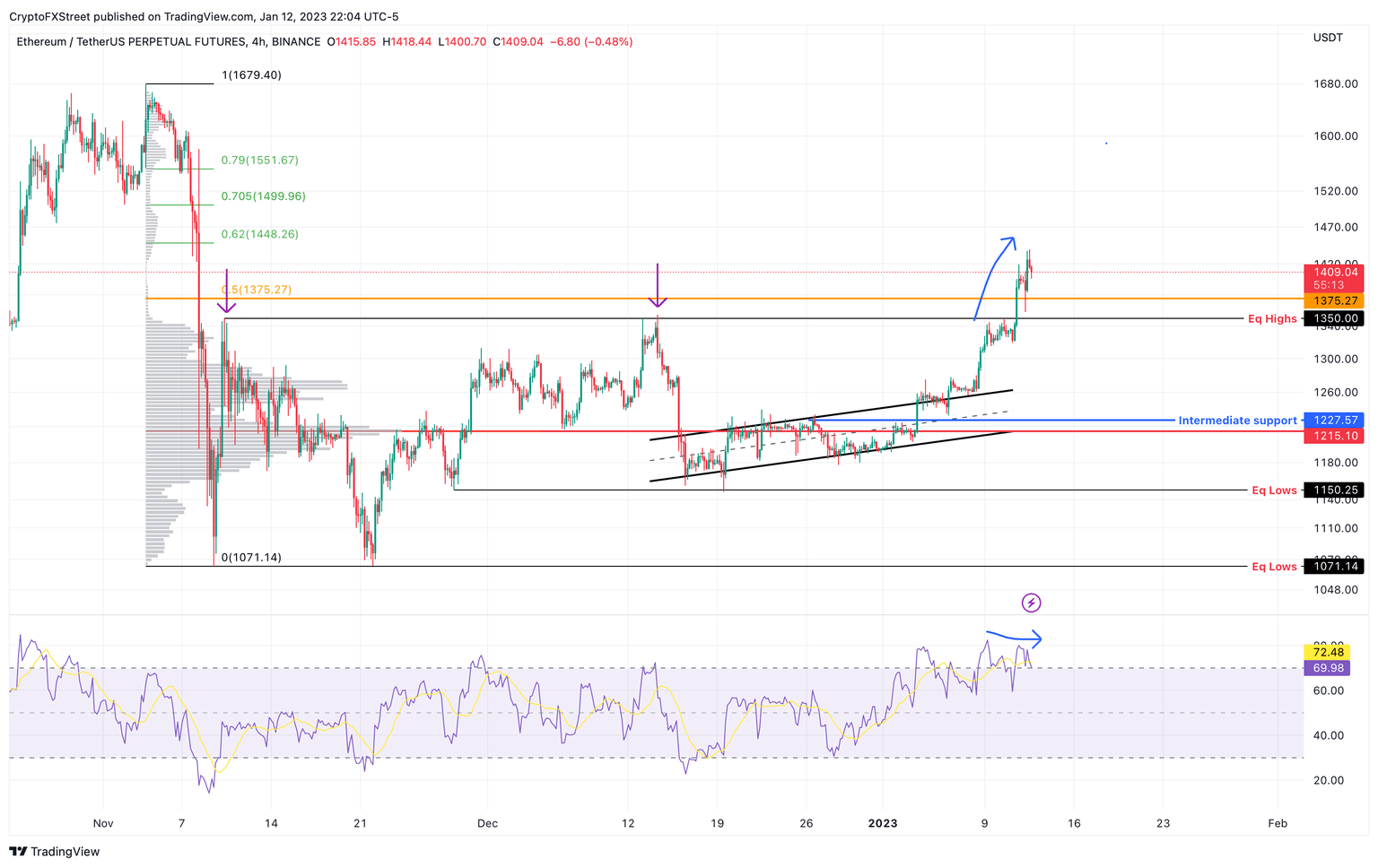

Ethereum price has rallied 14% since it retested the recently breached parallel channel on January 8. As noted in a previous publication, ETH was already lackluster before it shattered through $1,375, a crucial hurdle.

The same can be seen in the Relative Strength Index (RSI), a momentum indicator, which has produced lower highs in the overbought region. Compared to the higher highs on Ethereum price, it clearly shows a non-conformity that is termed as bearish divergence.

This setup often results in a drop in the underlying asset’s market value aka a trend reversal favoring bears. A confirmation of the countertrend rally will occur after ETH produces a four-hour candlestick close below $1,375. Beyond this level, Ethereum price could revisit the $1,215, $1,150 and $1,071 support levels.

ETH/USDT 4-hour chart

While things are looking bearish for Ethereum price, a sustenance of the uptrend that leads to a four-hour candlestick close above $1,679 will create a higher high and invalidate the bearish thesis.

In such a case, Ethereum price will continue its uptrend and retest the $1,700 psychological level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.