Ethereum price expected to bounce as ETH transaction fees fall to multi-month lows

- Ethereum transaction fees have dropped to multi-month lows, indicating that the token could see a reversal in its price.

- The figure represents a decline of over 75% of the average fee price since November 2021.

- Ethereum could be preparing for a 25% climb if a key support level holds.

While Ethereum price slid lower below $3,000, the network’s median fees have dropped below $3, suggesting that demand for ETH transactions have been low. Increased scalability and lower transaction costs could improve investors’ outlook on the asset, boosting the token’s price.

Ethereum fees drop to July 2021 lows

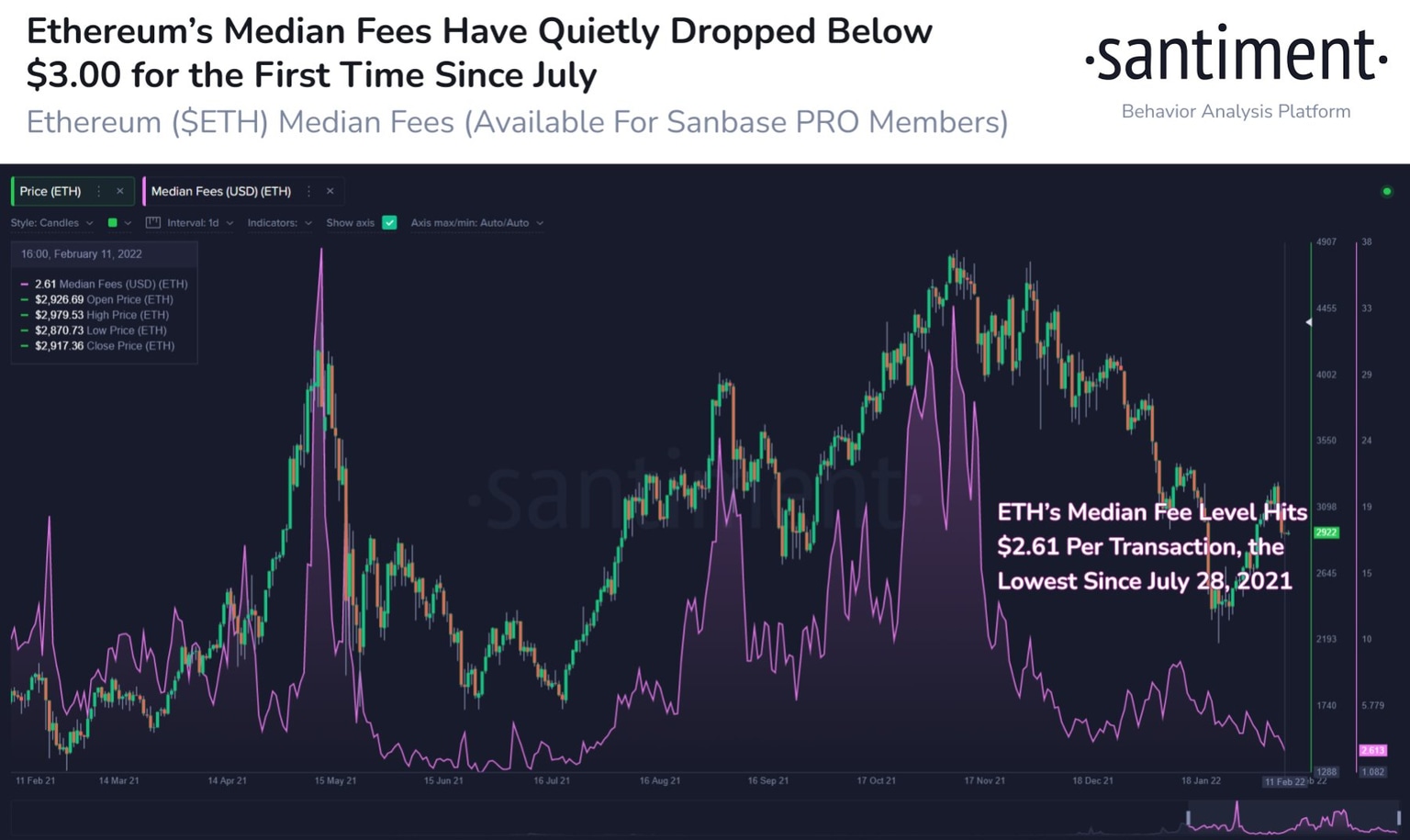

Ethereum transaction fees have reached its lowest level since July 28, 2021, as ETH price dropped below $3,000. According to on-chain analytics platform Santiment, low fees usually correlate with a bounce in the asset’s price.

The figure represents a decrease of over 75% of the average fee price since November 2021, when fees reached over $60 on average.

Ethereum median fees

Ethereum fees have been critical to the sustainability of the blockchain network, as users who create transactions must be involved in a bidding process to have their operations processed more quickly. The higher fees paid to miners, the faster the confirmation process is for the transaction.

To ease the burden of paying high transaction fees is the Ethereum Consensus Layer, formerly known as ETH 2.0, which aims to introduce proof-of-stake and scalability solutions such as sharding which could increase the transaction processing capacity to nearly 100,000 transactions per second.

Vitalik Buterin, co-founder of Ethereum recently introduced the concept of a “near-future hard fork” that would include “blob-carrying transactions” which could temporarily relieve scalability concerns before sharding begins. The proposed solution is expected to be adopted in the Shanghai hard fork.

Ethereum price gears up for 25% ascent

Ethereum price could be headed for a 25% rise to tag the upper boundary of the ascending parallel channel at $3,584 on the 12-hour chart.

The first line of resistance will emerge at the 21 twelve-hour Simple Moving Average (SMA) at $3,039, coinciding with the 78.6% Fibonacci retracement level. ETH may also encounter a hurdle at the 100 twelve-hour SMA at $3,131, intersecting with the middle boundary of the governing technical pattern.

ETH/USDT 12-hour chart

In order for the bullish outlook to be validated, Ethereum price must sustain above the lower boundary of the prevailing chart pattern at $2,851 which acts as a reliable support. An increase in selling pressure may push ETH lower toward the 50 twelve-hour SMA at $2,761.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.