Ethereum Price Prediction: ETH bears put 15% drop on the radar

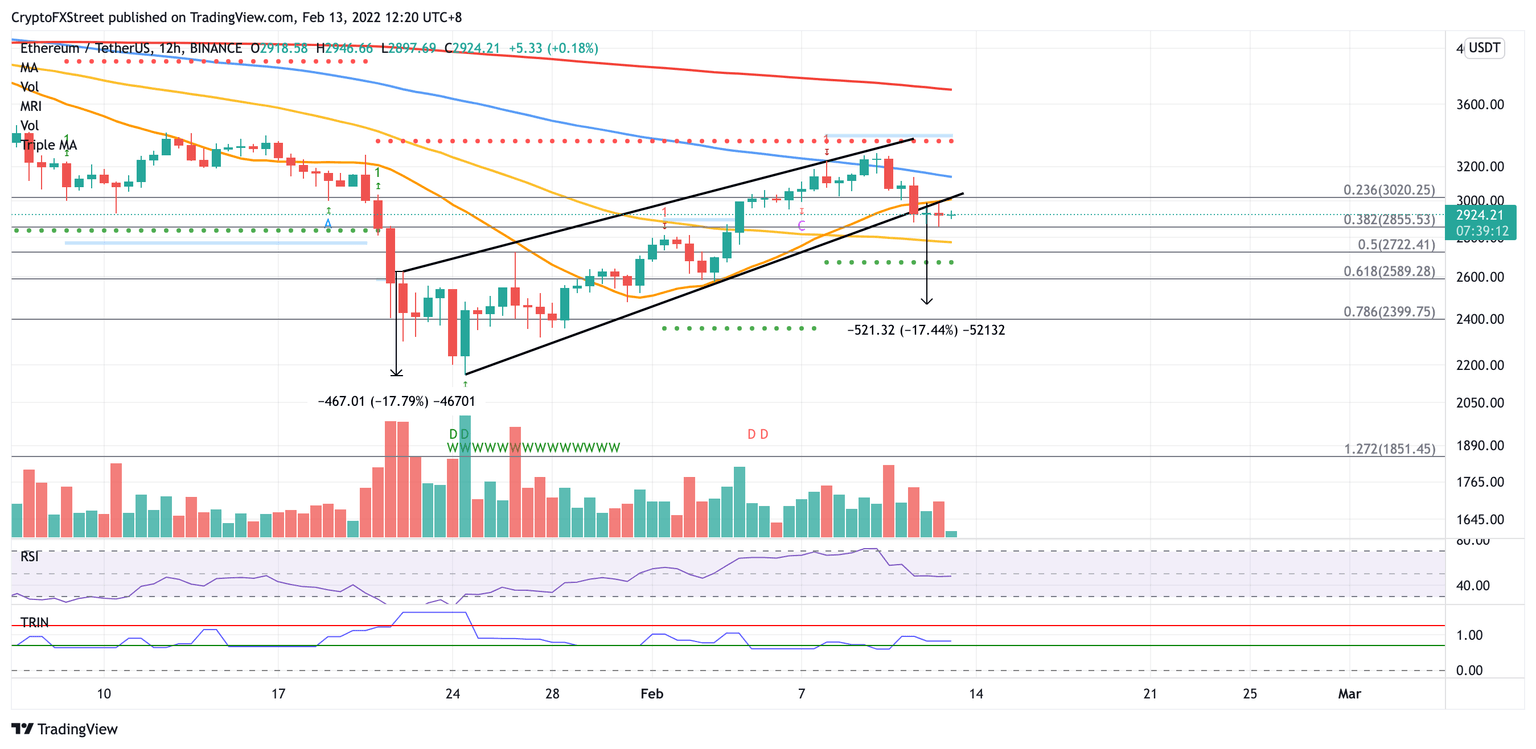

- Ethereum price could be headed for a 15% drop toward $2,472 after a bearish chart pattern emerged.

- The token may be able to discover and test multiple lines of defense before reaching the pessimistic target.

- In order to invalidate the bearish outlook, Ethereum bulls must target levels above $3,020.

Ethereum price is at risk of further decline after the token sliced below a critical line of defense and the lower boundary of the governing technical pattern at $2,944. The prevailing chart pattern suggests a bearish target of a 15% drop toward $2,472.

Ethereum price to test various support levels

Ethereum price has sliced below the lower boundary of the rising wedge pattern, putting the pessimistic target at $2,472 on the radar.

The first line of defense for Ethereum price is at the 38.2% Fibonacci retracement level at $2,855.

Additional footholds may emerge at the 50 twelve-hour Simple Moving Average (SMA) at $2,772, then at the 50% retracement level at $2,722.

If selling pressure continues to increase, Ethereum price could fall toward the support line given by the Momentum Reversal Indicator (MRI) at $2,672.

An increase in bearish sentiment may send Ethereum price lower toward the 61.8% Fibonacci retracement level at $2,589 which acts as the last line of defense before ETH reaches the bearish target at $2,472.

ETH/USDT 12-hour chart

However, if buying pressure increases, Ethereum price may aim to tag $3,020 next, where the 21 twelve-hour SMA and 23.6% Fibonacci retracement level coincide.

An additional spike in buy orders may push Ethereum price higher toward the 100 twelve-hour SMA at $3,134 next, then toward the MRI’s resistance line at $3,357.

Bigger aspirations may target the 200 twelve-hour SMA at $3,698 if sentiment shifts bullish.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.