Ethereum price hints at pullback as centralization risks are likely to emerge after Shanghai upgrade goes live

- Ethereum price struggles with a significant resistance level at $1,677.

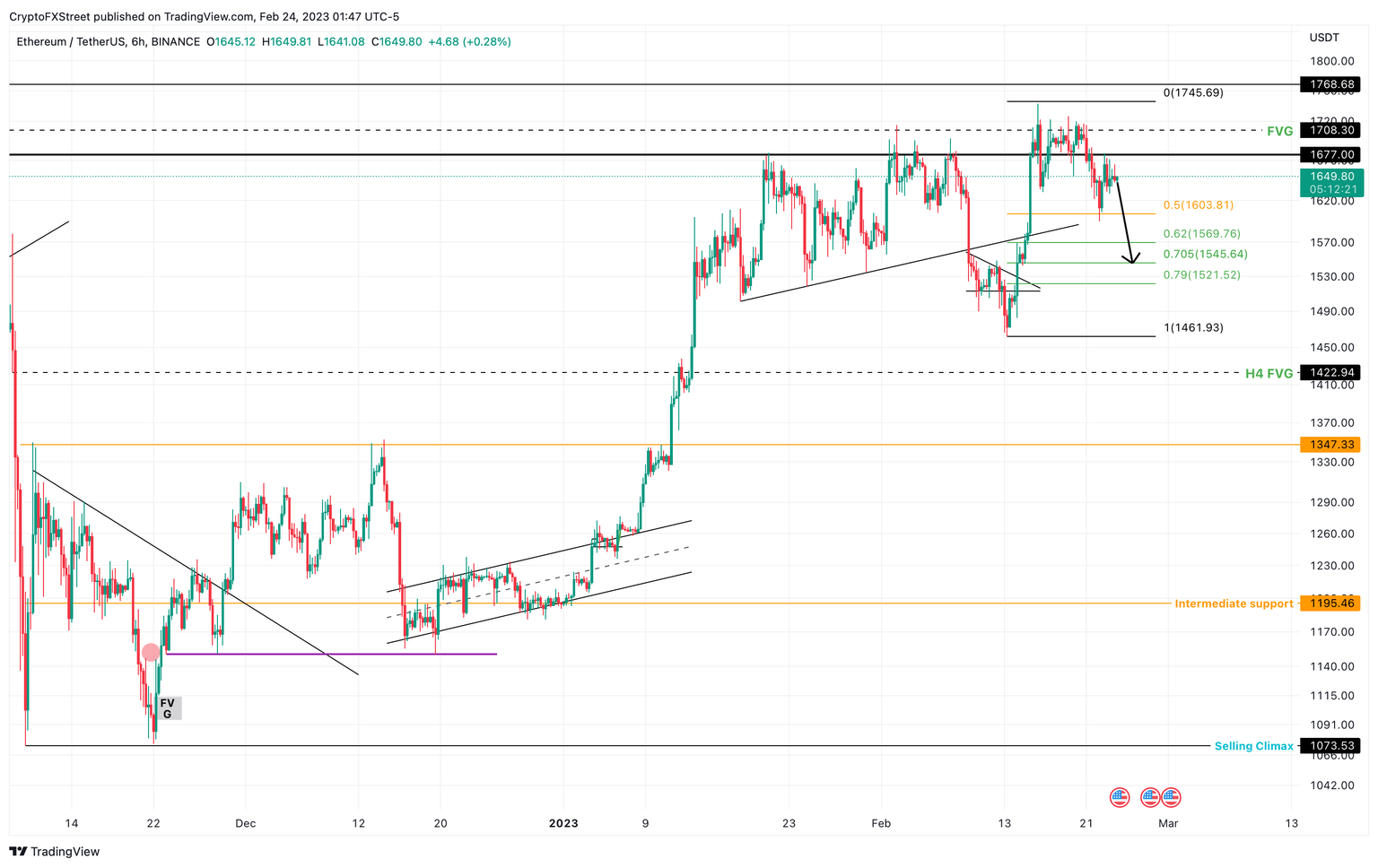

- Rejection could likely result in a pullback to $1,545, but under dire circumstances, ETH could tag $1,422.

- Invalidation of the bearish thesis will occur on the flip of the $1,700 hurdle on a daily timeframe.

Ethereum (ETH) price shows a lack of bullish momentum after its new rally formed a local top. This exhaustion led to a minor retracement that caused ETH to flip a recently formed support level into a resistance barrier. Going forward, investors need to exercise caution to not get caught in the choppy price action.

Ethereum price is directionless

Ethereum price has been struggling to overcome the $1,677 resistance level since January 20, but has failed each time. Although on a lower timeframe, ETH flipped this hurdle, it failed to sustain above it for a long period of time.

Now, Ethereum price is firmly trading below $1,677, but a continuation of this week’s bearish pressure could send the smart contract token to tag the 70.5% retracement level at $1,545. If the sellers fail to take a break, ETH could produce a lower low below the February 13 swing low at $1,434.

Such a move could worsen the situation and knock Ethereum price to clear the inefficiency at $1,422. While this inefficiency might ease the selling pressure, a stable support floor is not present until $1,347.

ETH/USDT 4-hour chart

Regardless of the recent pullback, if Ethereum price produces a decisive flip of the $1,700 hurdle on a daily timeframe, it would invalidate the bearish thesis. Such a move would further attract sidelined buyers and potentially trigger a run-up to $1,800, followed by a retest of the $2,000 psychological level.

Coinbase enters Ethereum L2 race

Coinbase announced its foray into the Ethereum Layer 2 solution race on February 23. The US poster child for crypto exchanges revealed the launch of its L2 solution known as "Base." The said L2 will be built using Optimism's OP stack, another L2 solution for ETH. This new blockchain will be available for Coinbase users, all 100 million of them and their $80 billion in assets, allowing self-custody dream a reality. This move from the exchange is a significant one and is positive for the fundamental aspects of Ethereum.

Staking centralization post-Shanghai upgrade

The Shanghai upgrade will allow stakers to withdraw their holdings. While there is a question about the flood of liquidity, the more important question one needs to address is centralization. With major players in the industry stepping into the staking field, it might become easy for the average Joe to stake their holdings via centralized platforms like Coinbase, Binance, and so on. If this trend continues, there might be a high degree of centralization in the Ethereum network.

Also read: Ethereum Zhejiang testnet for staked ETH withdrawals set to go live ahead of Shanghai hard fork

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.