Ethereum price slacks off but Layer 2 tokens might be the next category of tokens to pump

- Ethereum price shows a breakdown from a bullish pennant formation on the four-hour chart.

- On-chain metrics suggest that ETH whales are slowing down their accumulation and could have hit a glass ceiling.

- The bullish thesis will make a comeback if the $2,000 psychological level is flipped into a support floor.

Ethereum (ETH) price lacked the initiative to break out of a bullish pennant formation that was birthed between February 13 and 21 and now risks a reversal and the start of a new bearish phase.

Ethereum price fails to follow through

Ethereum price formed a continuation pattern known as a bullish pennant in the last week and a half. When the time for breakout arrived, however, ETH lacked the necessary fuel.

Influenced by the downturn in Bitcoin price and the selling pressure for the smart contract token, ETH invalidated the aforementioned pennant setup.

The ongoing order flow is largely bearish, but the outlook remains ambiguous for ETH, since it shadows BTC’s moves.

Investors should be careful shorting Ethereum without due diligence, but should the selling pressure persist - with the inefficiencies to the downside - investors are likely to be tagged.

Market participants should expect Ethereum price to fall to the immediate support level at $1,554, a breach of which could see ETH revisit the 200-day Simple Moving Average at $1,440.

ETH/USD 4-hour chart

Adding credence to the potential bearish outlook is the activity of whales - investors that hold between 10,000 and 100,000 ETH tokens - who have stopped accumulating and started offloading their holdings.

Roughly two whales have stopped accumulating, indicating the potential for selling activity. If such a trend should catch on, a steep correction as envisioned from a technical standpoint is likely.

ETH whale distribution

ETH fundamentals show improvement

Ethereum futures volume on Chicago Mercantile Exchange(CME) has hit a whopping 10,545 ETH as of February 21, denoting a high interest for the smart contract token among investors. Furthermore, the on-chain volume seen for the asset has also sustained around the 9 billion mark, adding credence to the strong fundamentals. Therefore, this short-term bearish outlook could flip on its head with the right catalyst. So, investors need to be cautious in shorting Ether.

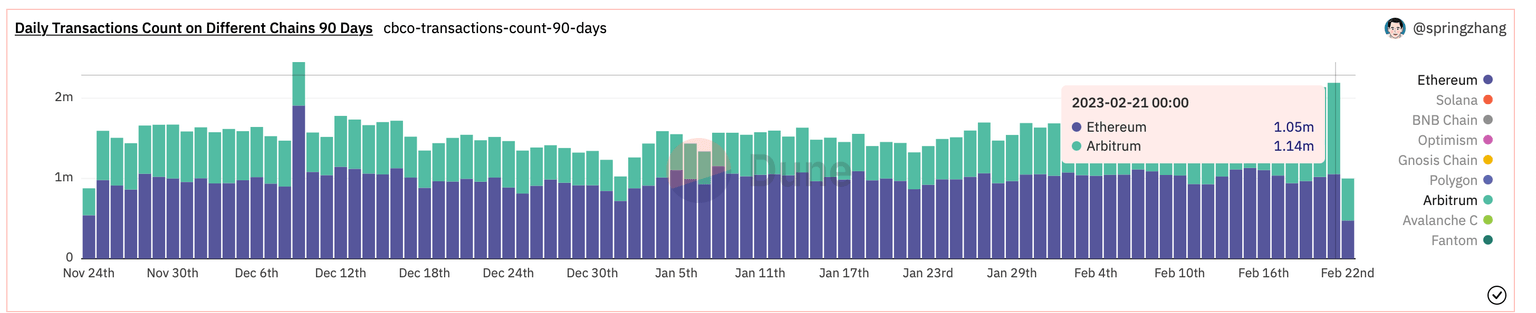

Arbitrum is a layer 2 solution for Ethereum, which is a technology that helps reduce the load on the main blockchain. These sidechains are often referred to as L2, aka Layer 2. Of late Arbitrum has taken the Ethereum ecosystem by surprise as the total transactions on the Layer 2 solution exceeded that of Ethereum's. As seen on February 21, the total transactions on Arbitrum hit 1.14 million while ETH clocked in 1.05 million.

Ethereum vs. Arbitrum

While the bearish outlook for Ethereum price makes sense, a sudden spike in Bitcoin's buying pressure could influence the path for ETH. If this move produces a higher high above $1,750 on a daily timeframe , it would invalidate the bearish thesis.

In such a case, Ethereum price could restart its uptrend and tag the $2,000 psychological level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B12.42.15%2C%252022%2520Feb%2C%25202023%5D-638126480267808828.png&w=1536&q=95)