Coinbase enters the L2 race: Will this spell disaster for Arbitrum, Polygon and other Layer 2 solutions?

- Coinbase launched its layer two network Base built on Ethereum on Friday.

- Coinbase will be competing directly with the likes of Polygon and Optimism, which dominate the Dapp market.

- The crypto exchange also launched a commemorative NFT that can be minted freely.

Coinbase entered the layer 2 (L2) market on Friday after launching its own L2 network named ‘Base’. The network has been hailed by the cryptocurrency exchange as Coinbase’s contribution to the core infrastructure of the crypto economy. Although built on Ethereum, Base could attract competition from one of its collaborators.

Coinbase L2 on Ethereum

Announcing the testnet launch of Base, Coinbase stated that the network would be aimed at offering a secure, low-cost, developer-friendly way to build Dapps. Coinbase intends to onboard over a billion users to the chain, and in order to do so, it is painting itself as an open ecosystem.

Nevertheless, despite being built in collaboration with Optimism, Base will launch in the same sector that Optimism is a huge part of. The L2 market includes major players like Polygon, Arbitrum as well as Optimism, which host hundreds of Dapps on their network.

Even though these chains have the advantage of being longer in this space, Coinbase has a significant upper hand in the form of resources that it intends to leverage. The company has a plethora of products and over 100 million customers, which would prove essential in scaling the L2. Commenting on the same, Coinbase noted,

“Seamless Coinbase product integrations, easy fiat onramps, and powerful acquisition tools enable developers to serve the 110M+ verified users and to access $80B assets on platform in the Coinbase ecosystem.”

To put this into perspective, Optimism, with all its protocols combined, has about $1.92 billion in total value locked (TVL). Polygon, too, despite having over 372 Dapps on the network, has about $1.18 billion in TVL. The Decentralized Finance (DeFi) market suffering losses over the last year made it worse for these chains and may even present some troubles to Coinbase’s Base.

However, Base, in its introduction, called itself a bridge to other Ethereum L1 and L2 chains as well as other L1 ecosystems like Solana. Base encourages developers to build their Dapp on their L2 but go beyond the restraints of the network and connect to other chains as well. How well this plays out is yet to be seen.

Coinbase joins L2 and NFTs in one go

With the launch of Base, the L2 also marked the launch of its NFT collection titled “Base, Introduced”. The commemorative NFT has been launched to celebrate the L2 and can be minted freely by anyone.

At the time of writing, nearly 42,000 such NFTs had been minted five hours since the launch of Base.

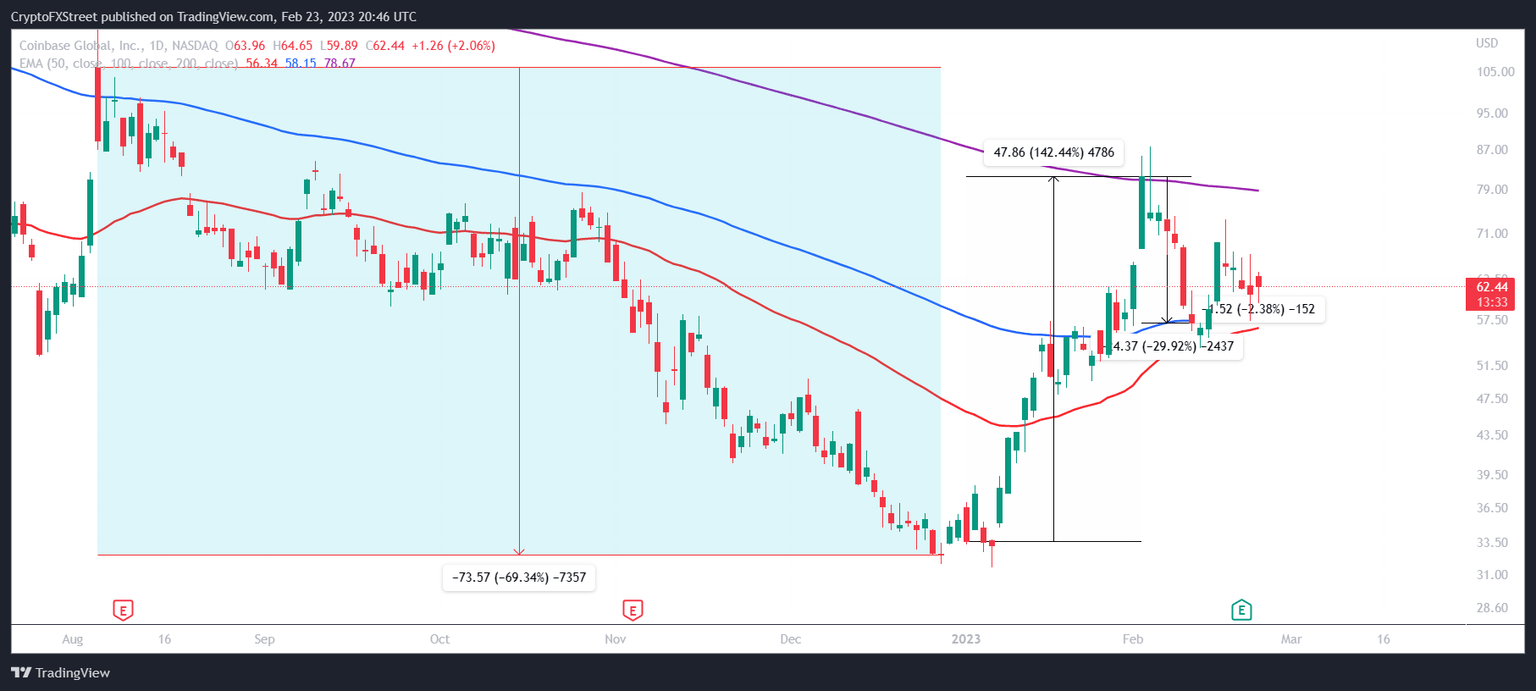

COIN 1-day chart

Coinbase’s COIN stock price, although noted no change even as the market came close to the closing bell. Trading at $62.44, COIN noted a 2.38% decline in value despite being up by 2.06% over the last 24 hours.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.