Ethereum Shapella upgrade gets new date, making way for un-staking ETH

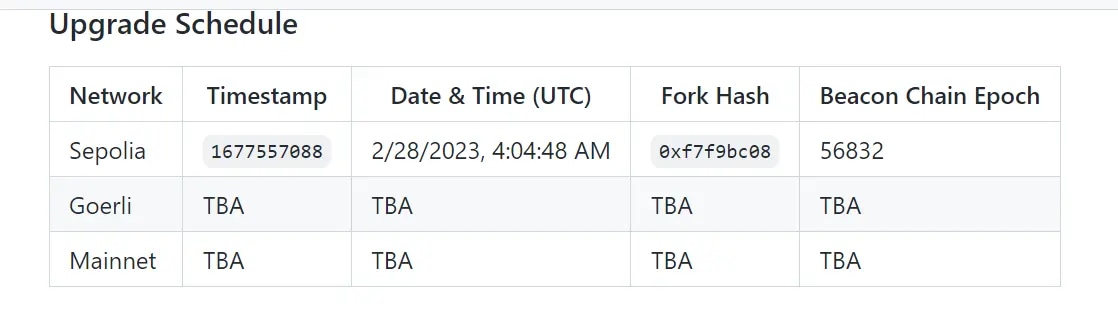

Ethereum core developer Tim Beiko announced the Shapella (Shanghai/Capella) upgrade is scheduled for Feb. 28. The Shapella network upgrade will activate on the Sepolia network at epoch 56832.

Shanghai and Capella are the names of the upcoming Ethereum hard fork. Shanghai is the name of the fork on the execution client side, and Capella is the upgrade name on the consensus layer client side.

Some of the key Ethereum improvement proposals (EIP) changes on the execution layer include Warm Coinbase and Beacon chain push withdrawals. The push withdrawals will make way for validator withdrawals from the beacon chain to the EVM via a new "system-level" operation type. On the other hand, WARM Coinbase could be a game changer that could reduce network fees for some of the key network participants called builders.

Coinbase here is the name of the software that builders use to receive new tokens on the network. Every new transaction on the platform needs to interact with the Coinbase software multiple times, The first interaction costs more as the software needs to “warm” up, and then the fees decline as the interactions increase. However, with the introduction of EIP-3651, the Coinbase software will remain warm to begin with, thus requiring a lower gas fee to access it.

Major changes to the consensus layer include full and partial withdrawals for validators and independent state and block historical accumulators, replacing the original singular historical roots.

Partial withdrawal means validators can withdraw Ether ETH $1,642 rewards in excess of 32 Ether and keep validating. In case they want a full withdrawal, validators can fully exit and take all 32 Ether and rewards and stop doing the work.

The upcoming upgrade would enable validators to withdraw their staked Ether (ETH) from the Beacon Chain to the execution layer. Moreover, the upgrade would bring changes to the execution layer and consensus layer adding new features, making it a key upgrade following The Merge.

Stakers and non-stakers who operate nodes must, however, upgrade their nodes to the most recent Ethereum client versions in order to take advantage of the Sepolia upgrade. After the deployment of the Sepolia upgrade, the next step would be the release of the Shanghai upgrade on the Ethereum Goerli test network, expected to commence in March.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.