Ethereum price could drop to $1,500 if bulls do not defend this level

- Ethereum price could break down the recently formed range low at $1,852, triggering a correction.

- The lack of bullish momentum could knock ETH down to $1,730 and, in a dire case, $1,543.

- A daily candlestick close above $2,022 will invalidate the short-term bearish outlook.

Ethereum price shows a lack of buying pressure, which has led to a range formation. This development could tilt in bears’ favor if a certain support level is breached. Investors will likely stay on the sidelines until one side takes out the other and the market starts moving in a clear direction again.

Ethereum price remains weak

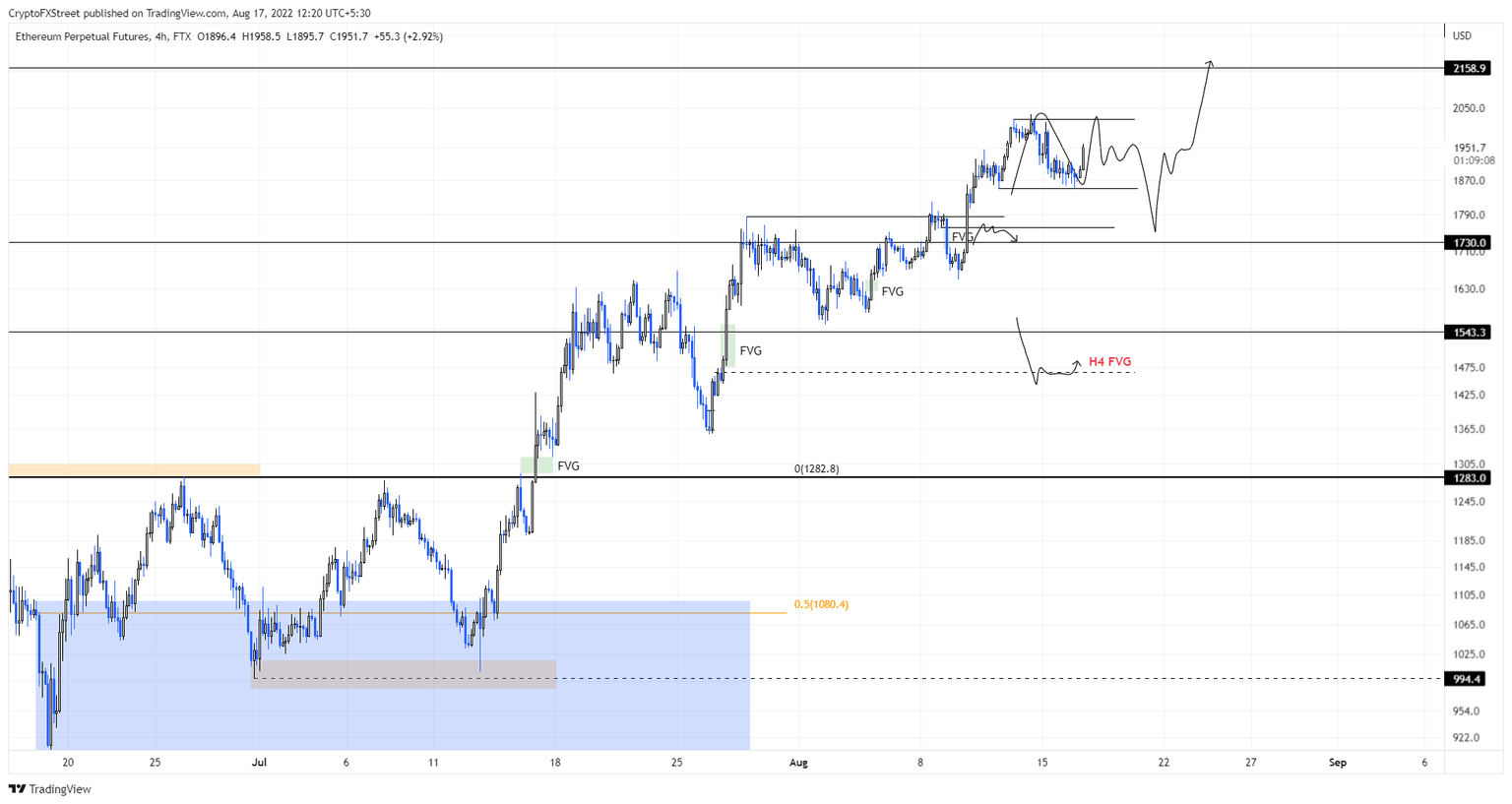

Ethereum price is consolidating in the $1,852 to $2,022 range and shows weakness after the recent spike in buying pressure failed to sustain. A breakdown of this range will signify the start of a downtrend.

However, investors need to be aware that a quick recovery at any time could catch short-sellers off guard, strangling them in a squeeze as prices rise. To avoid this bears should await a breakdown of the $1,852 support level followed by a rejection. Then market participants can expect a 6.7% down move to the $1,730 barrier.

Once reached, bears are likely to face the pressure at the aforementioned level. If they successfully overwhelm buyers, then a breakdown followed by a crash to $1,543 will be on the cards. This movement will likely induce the market makers or smart money to extend the downswing a little lower so that the price inefficiency at $1,446, aka fair value gap (FVG), is filled.

Although unlikely, investors should keep in mind that a revisit of the $1,280 level is possible too, if Bitcoin price suffers a sell-off.

ETH/USD 4-hour chart

Regardless of the bearish signs, the Merge is an extremely significant event on the horizon for ETH. The narrative around the event has caused a massive explosion in altcoins while Ethereum price is playing catch up. Therefore, a breakdown of the $1,852 level, if followed by a quick recovery, could indicate a short squeeze is in play, with higher prices to come.

In such a case, market participants need to wait for a flip of the range high at $2,022 into a support floor. Such a move will be a signal to position long and await a retest of the $2,158 and $2,266 resistance levels.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.