Watch this element which could spell the end of the summer rally in Ethereum

- Ethereum price is flirting with a break of support in the summer rally.

- ETH price could probe lower in search of a floor, which could mean a 22% discount.

- In a worst-case scenario, ETH price could fully collapse and give back its summer gains, with a 20% decline.

Ethereum (ETH) price is taking a step back this morning during the ASIA PAC and European session as a third consecutive day of negative prints is set to materialise. In concert with global markets, the mighty dollar looks to be setting the record straight and weighing on cryptocurrencies overall. There is a slim chance that this is a mere bear trap, but some elements point to a correction unfolding as the summer rally runs on its last legs.

ETH price says goodbye to the summer rally

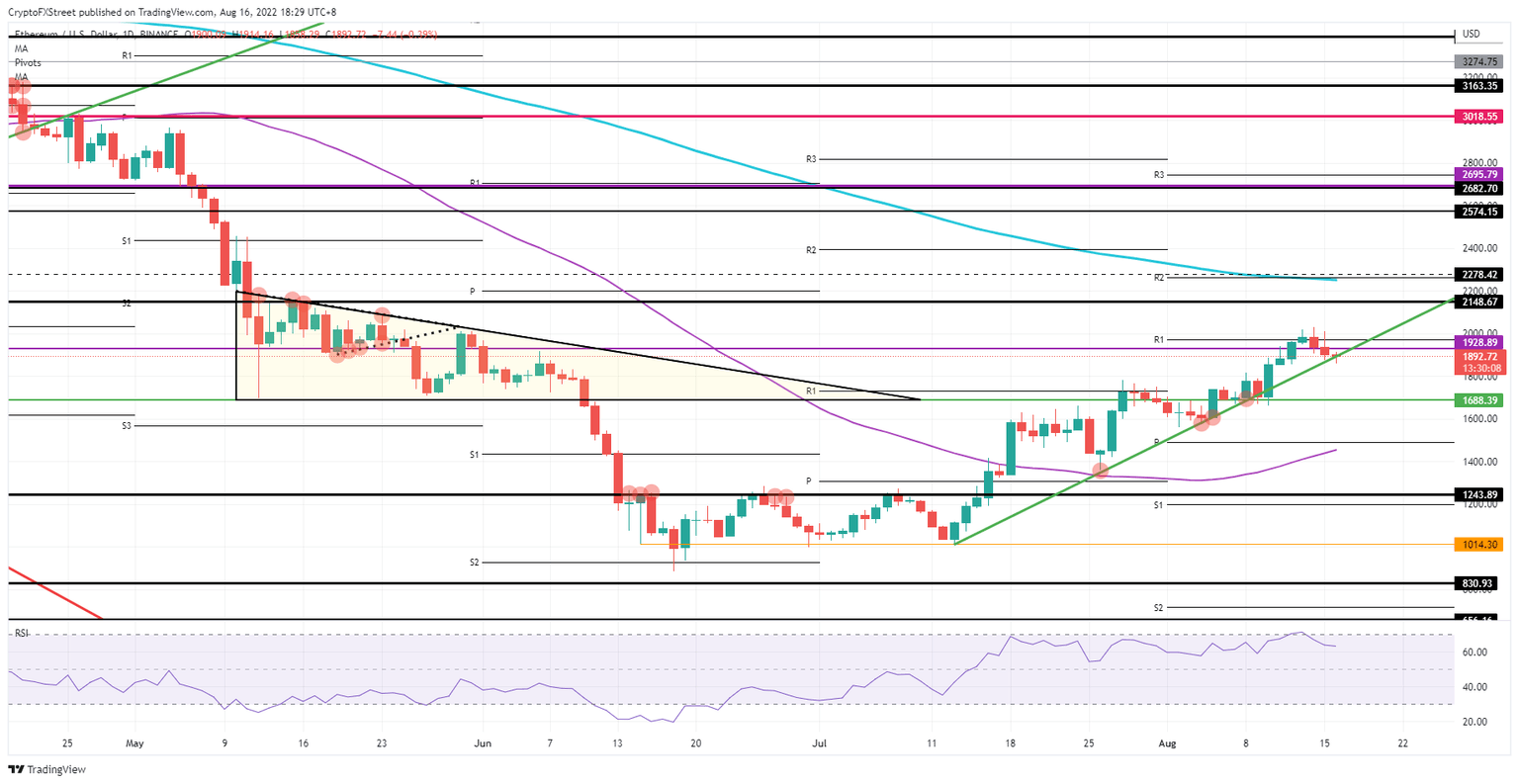

Ethereum price takes a step back after briefly sticking its nose above $2,000, which quickly got followed by a fade that is now starting to deepen out. Investors are currently reflecting on whether to hold, buy or sell as ETH price is around the green ascending trend line, which has acted as the backbone of this summer rally. All in all, seeing the overheated Relative Strength Index, the dollar strength and the global market reaction – with Fed Futures grinding higher in line with 75 bp rate hike expectations for September – these look to be enough to trigger a correction.

ETH price will tank towards its nearest level of support once it backs away a few dollars from the green ascending trend line. The first support level is the green horizontal line at $1,688 which was the base for the bearish triangle from May and June. That is roughly a 10% decline from where price action is trading now, with the monthly pivot at $1,500 additionally underpinned by the 55-day Simple Moving Average (SMA) as a failsafe area catching any falling knives and refraining from making more than 20% of losses.

ETH/USD Daily chart

This short excursion below the summer rally support could be an easy bear trap, with price action quickly pulling back up towards $2,000 again. Once that level breaks firmly and price action moves substantially higher, expect a big squeeze on the short-sellers and a rally up to $2,278, with 19% of gains on the docket. At that level, the 200-day SMA is on the cusp of being broken to the upside and pointing to massive gains for the last quarter of 2022.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.