Ethereum could become internet’s money layer as PayPal issues PYUSD stablecoin as an ERC-20 token

- PayPal is rolling out a so-called stablecoin as the payments giant makes a foray into cryptocurrency.

- PYUSD stablecoin will run on Ethereum blockchain as an ERC-20 token.

- With 70% of eBay transactions going through PayPal, the venture could make Ethereum the internet’s preferred money layer.

Ethereum (ETH) price is suffering in the wake of Bitcoin’s falling dominance, recording lower highs and lower lows as overhead pressure continues to abound. Nevertheless, this gloomy outlook has not prevented the Ethereum blockchain from contending as a potential money layer for the internet.

Ethereum blockchain to support PayPal’s PYUSD stablecoin

Ethereum could become the money layer of the internet, a position that comes as payments giant PayPal makes a foray into the cryptocurrency realm. As reported, PayPal has launched a stablecoin, which means it will henceforth track the price of a fiat currency.

PayPal’s PYUSD is not only pegged to the dollar, but also backed by short-term treasuries, dollar deposits, and cash equivalents, and christened PayPal USD with the PYUSD ticker. For the layperson, pegged means it is backed by cash equivalents, but then there is the added bonus of short-term treasuries backing.

PayPal CEO Dan Schulman in a statement to Bloomberg, talked about the PYUSD, which is Paxos Trust Company-issued, saying that the stablecoin is poised to become “a part of the overall payments infrastructure.”

Noteworthy, the PYUSD stablecoin will run on the Ethereum blockchain as an ERC-20 token, working in jointly with the rest of the payment giant’s cryptocurrency offerings, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). This means that users will be able to swap the dollar-denominated tokens for cash or other crypto assets on its platform.

Cryptocurrency offerings on PayPal

Ethereum as a possible money layer

Ethereum could become the internet’s money layer as PayPal, a reputed payments giant, leverages the blockchain protocol’s “speed, cost and programmability.” Being an ERC-20 token means PYUSD is a fungible token, meaning it is interchangeable with different tokens. More specifically, the announcement notes:

The stablecoin will be accessible to an already large and growing community of external developers, wallets and web3 applications, can be easily adopted by exchanges, and will be deployed to power experiences within the PayPal ecosystem.

With PYUSD structured to curb friction for in-experience payments in virtual spaces, the fact that it runs on the Ethereum blockchain facilitates expedited transactions and enables seamless developer-to-creator flow, while promoting digital asset growth.

This is the Ethereum contract address for PayPal's stablecoin.

— RYAN SΞAN ADAMS - rsa.eth (@RyanSAdams) August 7, 2023

I can't believe i get to tweet that.

We've come so far. pic.twitter.com/S6kSqcV4ut

Further supporting the money layer thesis is that PayPal facilitates approximately 70% of the transactions on eBay, and with Ethereum now playing in, the integration could increase the transaction volume on the American e-commerce company as customers and vendors now have more options to execute their transactions.

PayPal just launched its own stablecoin.

— S4mmy.eth (@S4mmyEth) August 7, 2023

70% of eBay transactions go through PayPal.

The global crypto onramp has landed.(1/6) pic.twitter.com/9Jjq0dGtSP

Citing the industry sleuth and digital asset consultant in a Crypto X post:

$51.8 billion (70% of $74b) could flow through PayPal Stablecoins from eBay alone.

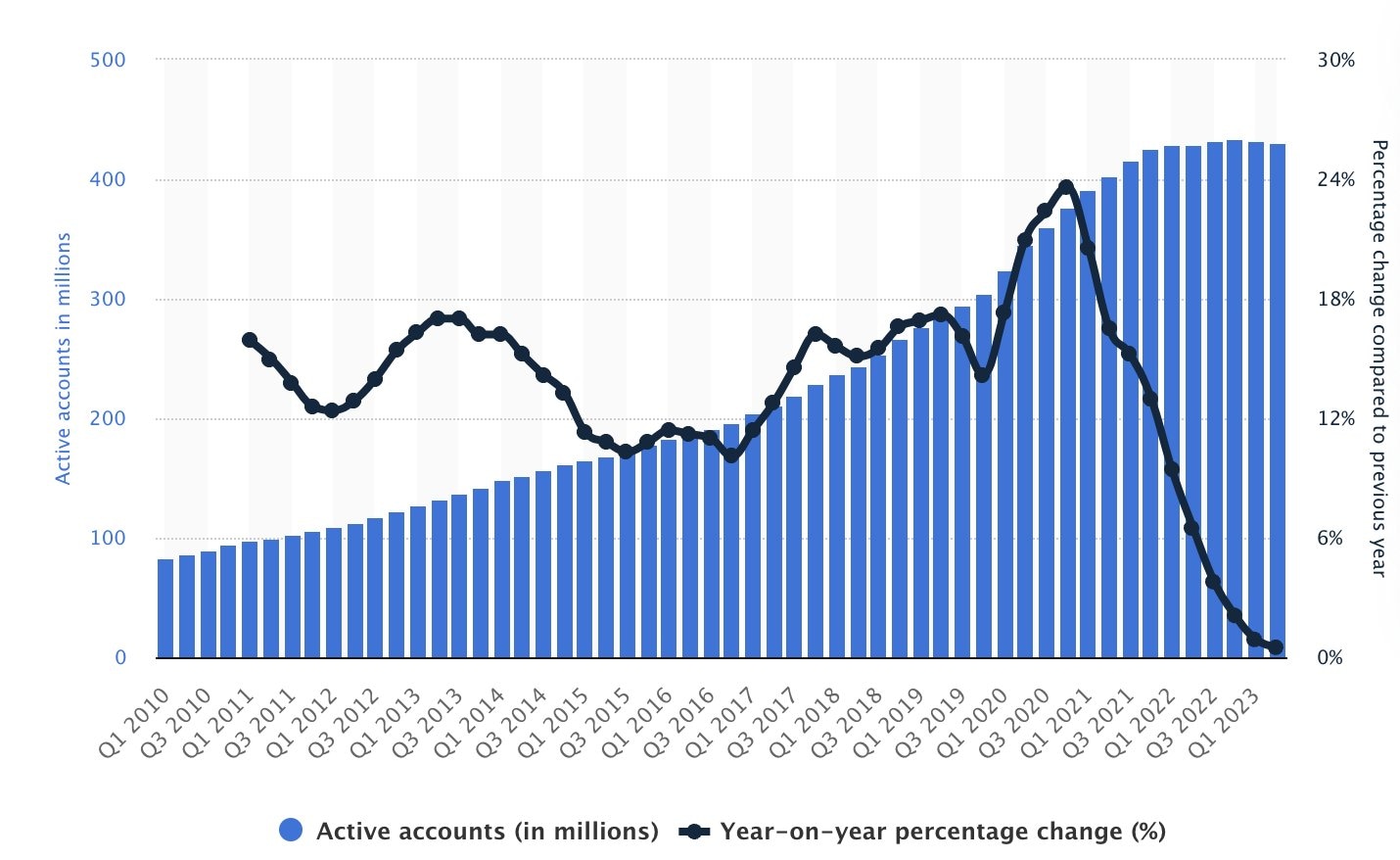

eBay is poised to benefit from the 426 million active accounts on PayPal’s registry, with almost $1.2 trillion in volume across 19 billion annual transactions.

eBay PayPal annual transactions

With the year-on-year percentage change slumping, the integration of stablecoins could serve as a catalyst to steer further growth. With these statistics, experts say the move could serve as a catalyst for retail investor interest in blockchain-related technology, with a potential for digital assets being traded on established traditional marketplaces.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.