Compound price rally boosts COMP demand; nearly eclipses Stellar and Bitcoin Cash

- Compound price shot up by almost 14% on Wednesday to breach the $70 mark.

- The increase in demand for COMP is highlighted by its 24-hour volume, which accounted for almost half its market capitalization.

- Even though there has been a decline in the rate of new address forming, participation has grown by 92% in the past five days.

Compound price action over the past couple of days has made its investors a very happy bunch. With every passing day, the demand for the altcoin can be seen rising to an extent where it is just shy of defeating top cryptocurrencies in this regard.

Compound price pushes daily volume to new highs

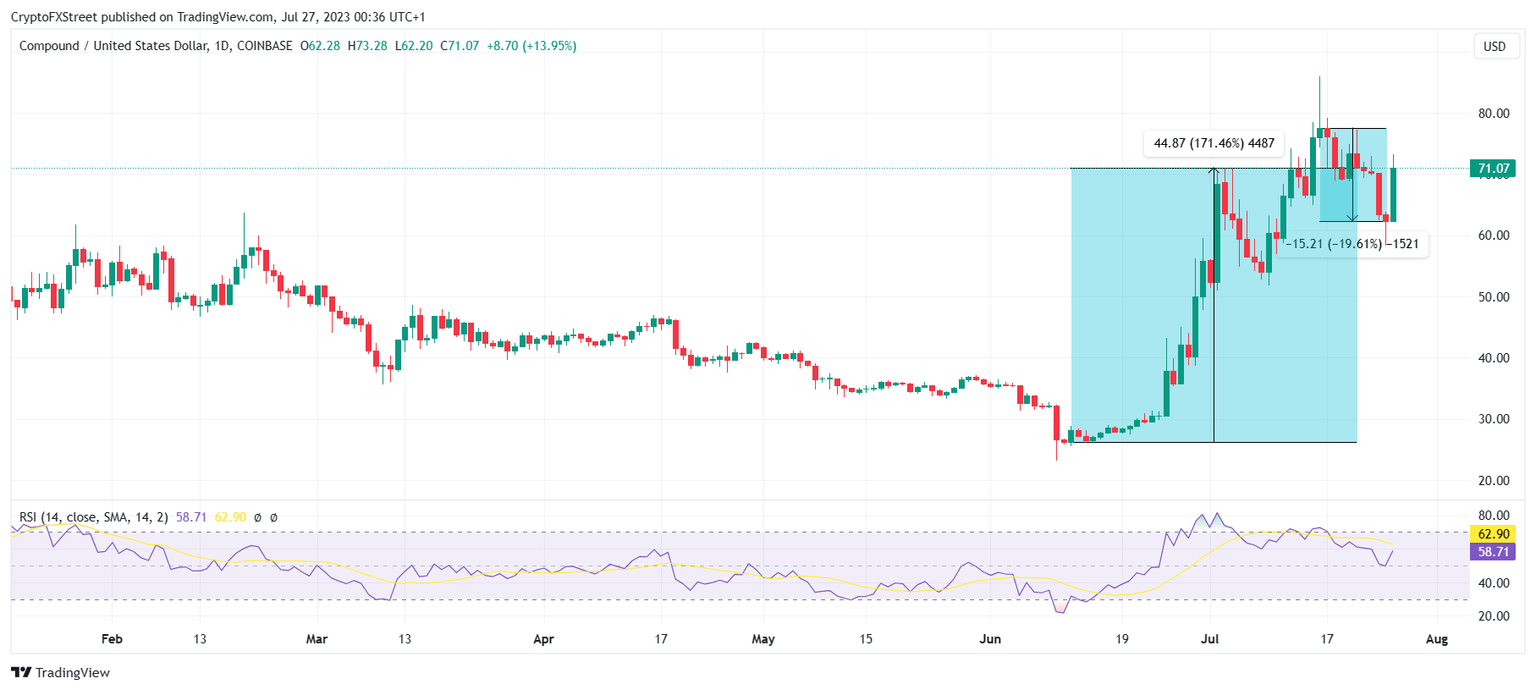

Compound price for a little over a month impressed the market with a solid 171% rally, bringing its value from $26 to $71. Even though in the past couple of days, the cryptocurrency declined by almost 20%, it recovered most of it as the altcoin shot up by nearly 14% in the past 24 hours.

COMP/USD 1-day chart

But the price increase was not the result of broader market bullish cues but the inherent demand for cryptocurrency. This was reflected in the total volume of COMP traded in the past day, which touched a high of $216 million. While the amount might seem small despite the altcoin being the top performer, it amounts to nearly half of the entire $550 million market capitalization of Compound.

Compound volume and market capitalization

This is rather rare for a small-cap cryptocurrency, as even among large-cap coins, the 24-hour volume tends to be far lower than 50% of the token’s market capitalization. In fact, the Compound price rally boosted the demand to the point where its daily volume was nearly at par with top coins such as Stellar, Tron and Bitcoin Cash.

The recent surge in price is serving well for COMP holders, and thus, their presence is increasing despite a decline in network growth. The active addresses over the past five days increased by 92%, from 292 to 562.

Compound active addresses

Network growth, however, noted a steep drop. This indicator measures the rate at which new addresses are formed on the network, which highlights the strength of the cryptocurrency’s adoption.

Compound network growth

This adoption has slowed down since July 17 after red candlesticks took over the chart for a while, but are expected to be short-term in effect. Per the Relative Strength Index (RSI), recovery is likely as the indicator bounced off the neutral line at 50.0 instead of slipping below it, which would demonstrate waning bullishness.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.35.02%2C%252027%2520Jul%2C%25202023%5D-638260145015346833.png&w=1536&q=95)

%2520%5B05.05.19%2C%252027%2520Jul%2C%25202023%5D-638260145413224555.png&w=1536&q=95)

%2520%5B05.00.27%2C%252027%2520Jul%2C%25202023%5D-638260145590035379.png&w=1536&q=95)