Dogecoin, Shiba Inu could extend gains as selling pressure declines, investors accumulate DOGE and SHIB

- Dogecoin, and Shiba Inu retail investors accumulate the meme tokens while whales distribute their holdings.

- Less than 50% of the wallets holding DOGE and SHIB are currently profitable, selling pressure on meme coins could reduce.

- DOGE, and SHIB extend gains by nearly 2% on Wednesday.

Dogecoin (DOGE), and Shiba Inu (SHIB) extend their gains on Wednesday as the selling pressure on the meme coins reduced. Data from the on-chain intelligence tracker IntoTheBlock shows that less than 50% of wallet addresses holding these meme coins are currently profitable.

This metric indicates that the selling pressure on DOGE and SHIB has reduced. The meme coin category has noted a surge in market capitalization as the market recovers from the recent correction.

Meme coins added 4.5% to their market cap in the last 24 hours, reaching $45.83 billion.

Dogecoin, Shiba Inu on-chain metrics support gains

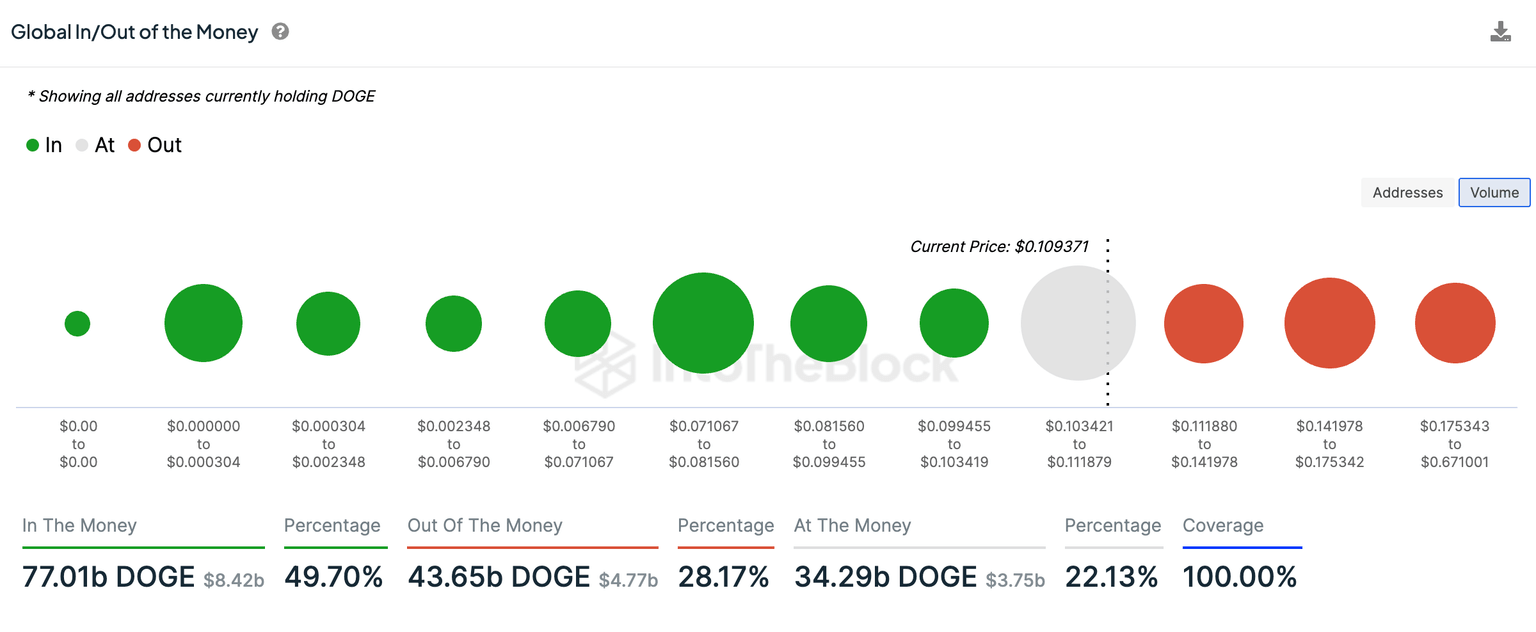

Dog-themed meme coins Dogecoin and Shiba Inu extend their gains on Wednesday, recovering from the broad crypto market correction. Data from crypto intelligence tracker IntoTheBlock shows that 49.70% of wallet addresses holding DOGE are profitable at $0.1093, and 32.26% of investors with SHIB in their wallets are profitable at $0.000017.

The percentage of investors profitable at the current price levels is under 50%, so the percentage of traders underwater (sitting on unrealized losses) is higher, signaling selling pressure on the meme coins will be relatively low as traders sitting on unrealized losses are typically less likely to sell their asset holdings to reach the breakeven price.

DOGE profitable/ underwater wallets percentage

SHIB profitable/ underwater wallets percentage

Santiment data shows that Dogecoin and Shiba Inu whales have distributed their holdings, while DOGE/ SHIB investors and retail traders accumulated the assets through the “dip” between July 1 and 10.

While whales shedding their asset holdings may be considered bearish, accumulation by small wallet investors has aided against a mass sell-off in the two meme coins.

Dogecoin supply distribution

Shiba Inu supply distribution

IntoTheBlock data shows that sentiment among Dogecoin and Shiba Inu traders is neutral on Wednesday. DOGE and SHIB’s correlation with Bitcoin is 0.94 and 0.88, respectively. As Bitcoin sustains above key support at $57,000 and extends its rally, the meme coins will likely follow suit.

On Wednesday, Dogecoin extends gains by 2.12% and Shiba Inu rallies 2.08% on Binance. At the time of writing, DOGE trades at $0.1098 and SHIB at $0.000016.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B11.22.34%2C%252010%2520Jul%2C%25202024%5D-638561919673838934.png&w=1536&q=95)

%2520%5B11.23.01%2C%252010%2520Jul%2C%25202024%5D-638561919879255190.png&w=1536&q=95)