Cardano Price Forecast: Bears aiming for a yearly low of $0.50 as on-chain data show increasing dormant wallet activity

- Cardano’s price hovers around $0.56 on Wednesday after falling 13% the previous week.

- Token Terminal data shows that ADA’s fee collection has been constantly falling in 2025.

- The technical outlook and on-chain metrics suggest a correction as dormant wallet activity increases.

Cardano (ADA) price hovers around $0.56 on Wednesday after falling 13% the previous week. Token Terminal data shows that ADA’s fee collection has constantly fallen in 2025, indicating lower blockchain usage and activity. The technical outlook and on-chain metrics suggest a correction as dormant wallet activity increases.

Cardano dormant wallet activity rises while netflow turns negative

Santiment’s Age Consumed index projects a bearish outlook for Cardano. The spikes in this index suggest dormant tokens (tokens stored in wallets for a long time) are in motion, and it can be used to spot short-term local tops or bottoms.

In the case of ADA, history shows that the spikes were followed by a fall in Cardano’s price as holders moved their tokens from wallets to exchanges, thereby increasing the selling pressure.

The most recent uptick on Monday was the highest spike since mid-January and also forecasted that ADA was ready for a downtrend.

%20%5B11-1744190059140.41.10%2C%2009%20Apr%2C%202025%5D.png&w=1536&q=95)

ADA Age Consumed chart. Source: Santiment

Coinglass’s ADA spot netflow data also gives a negative outlook. The data shows that ADA’s spot netflow has been constantly negative since mid-March, and as of this week, it recorded $21.08 million in outflows.

ADA Spot Inflow/outflow chart. Source: Coinglass

Additionally, Token Terminal data shows that Cardano’s fee generation has fallen considerably from $663,400 in January to $53,000 on April 9. This fee fall indicates lower blockchain usage and activity, which doesn’t bode well with Cardano’s price.

ADA fee generation chart. Source: Token Terminal

Cardano Technical Outlook: ADA bears aim for $0.50 mark

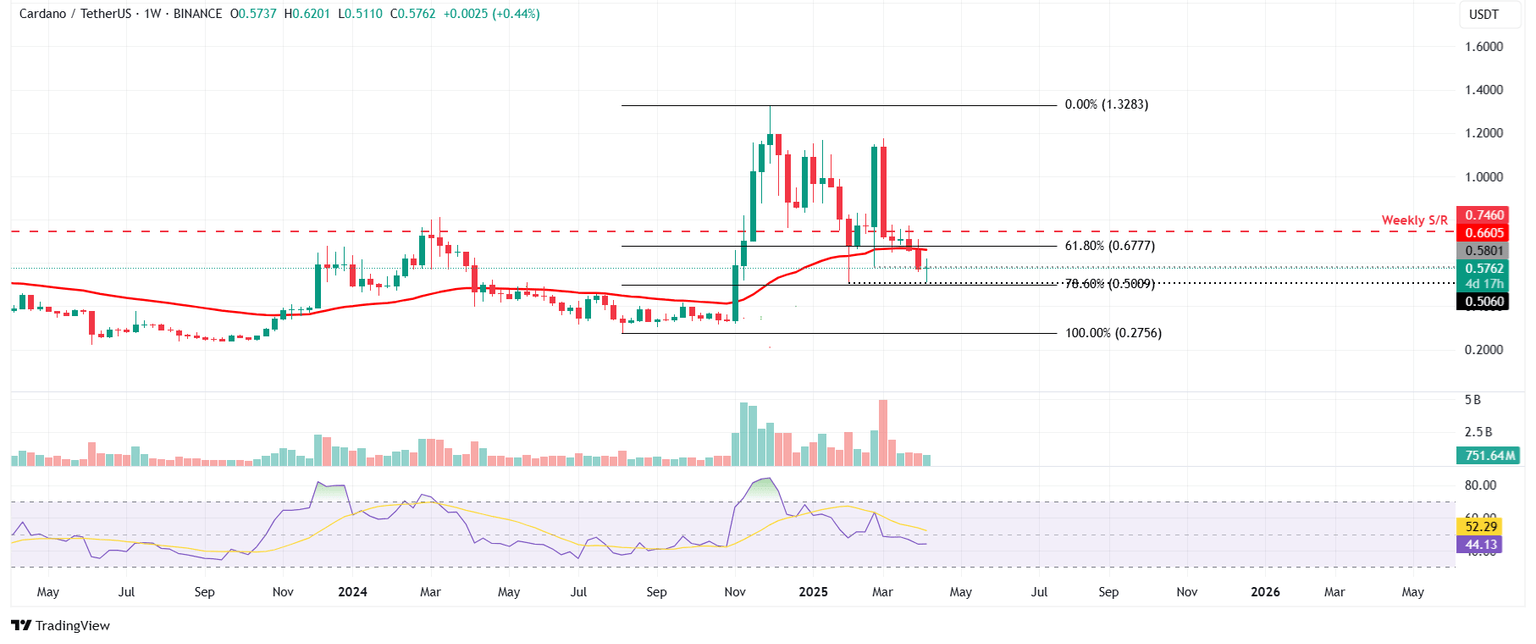

Cardano’s weekly chart shows that ADA extended the decline below the 61.8% Fibonacci retracement (drawn from its August 5 low of $0.27 to the December 3 high of $1.32) at $0.67 and lost 13.23% last week, retesting the February 28 low of $0.58 on Friday. As of this week, ADA bounced slightly after dipping and finding support around $0.51 on Monday. At the time of writing on Wednesday, ADA hovers around $0.56.

If ADA continues its downward momentum, it could extend the decline to test the year-to-date low of $0.50 set on February 3.

The Relative Strength Index (RSI) on the weekly chart reads 44 and points downward, indicating bearish momentum.

ADA/USDT weekly chart

However, if ADA recovers, it could extend the positive move to retest the 50-week Exponential Moving Average (EMA) at $0.66.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.