Dogecoin Price Prediction: DOGE could hit $0.1 soon if this happens

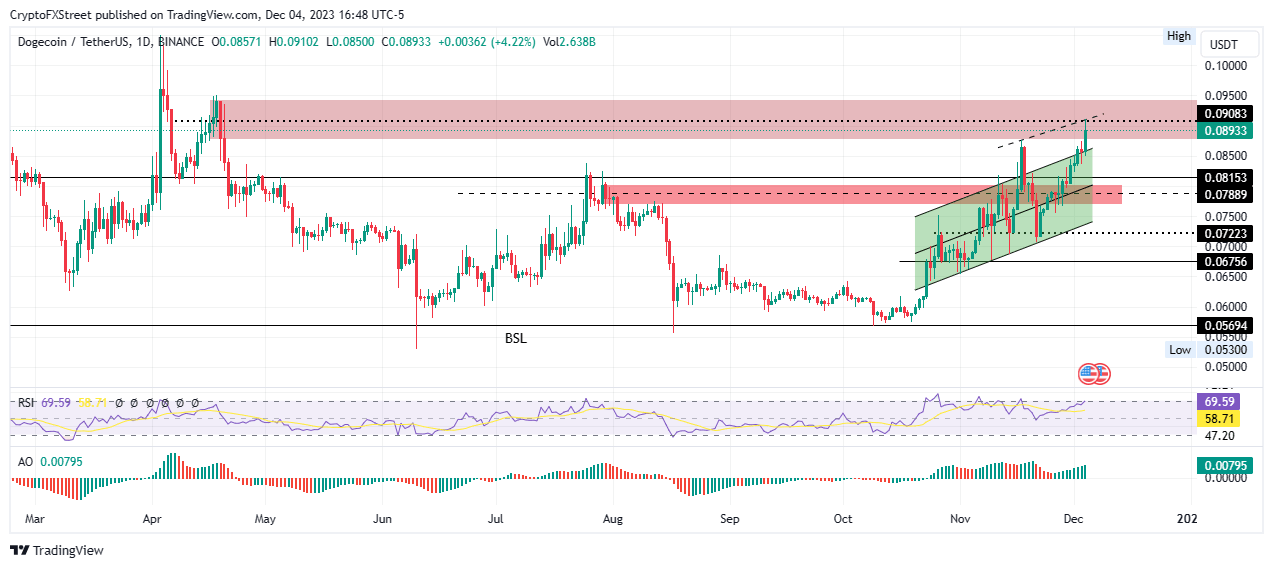

- Dogecoin price broke out above an ascending parallel channel amid strong bullishness.

- DOGE could make a 15% climb to the $0.1 level amid rising momentum and strong presence by the bulls.

- The $0.09083 roadblock is critical for the meme coin’s upside potential marking a make or break transition.

- A decisive candlestick close below the $0.07889 midline would invalidate the current bullish outlook.

Dogecoin (DOGE) price is trading with a bullish bias, not only showing a broader market bullishness but also a newly found flow of capital into the meme coin market, with CoinMarketCap data showing meme coins are rallying on the seven-day timeframe.

Also Read: Dogecoin breaks key $0.088 barrier ahead of tenth birthday, 87% DOGE holders at profit

Dogecoin price leads meme coin rally

Dogecoin (DOGE) price is up 15% in the last 24 hours to trade for $0.08933 as of 9:50 PM GMT. Alongside it, Shiba Inu (SHIB) is up 10% while Pepe coin (PEPE) and Floki Inu (FLOKI) are up 30% and 15% respectively.

As capital flows into meme coins, Dogecoin price broke out above the upper boundary of an ascending parallel channel to test the midline of a supply barrier extending from $0.08754 to $0.09432 at $0.09083.

For the largest meme coin by market capitalization to realize its upside potential and reach of the $0.10000, Dogecoin price must overcome this roadblock and flip it to a support level. A decisive break and close above this level would clear the skies for a continuation north, bringing the forecasted target into focus.

Increased buying pressure above current levels could see Dogecoin price flip the supply zone to a bullish breaker, closing above the $0.09500 level before a run up to the $0.01000 psychological level. Such a move would constitute a 10% climb above current levels.

DOGE/USDT 1-day chart

On-chain metrics to support Dogecoin price bullish outlook

On-chain data from IntoTheBlock’s Global In/Out of the Money (GIOM) metric supports the bullish thesis, showing Dogecoin price enjoys more robust support downward than overhead pressure. As indicated, any efforts to push the price south would be countered by buying pressure from 335,940 addresses that had previously purchased approximately 18.08 billion DOGE tokens at an average price of $0.085196.

The data also indicates that at current rates, 86.29% of DOGE holders are sitting on unrealized profit (in the money) while 10.53 holders sit on unrealized losses (out of the money). Meanwhile, around 3.18% are breaking even (At the money).

With more holders in the profit, the effective selling pressure on Dogecoin price will remain lower than the overall selling pressure as investors look to ride the broader market rally.

DOGE GIOM

Furthermore, Santiment data shows notable spikes in the number of active addresses on 24-hour as well as 30-day timeframes. This shows the number of unique addresses involved in DOGE transactions and therefore crowd interaction is rising. This element could bode well for Dogecoin price.

DOGE Santiment: Active addresses

Conversely, if selling pressure increases to overpower buyer momentum, Dogecoin price could fall back into the fold of the ascending channel under $0.08500, or worse extend the fall to lose the support due its midline at $0.07889.

A break and close below the midline of this supply zone extending from $0.07687 to $0.08039 would confirm the continuation of the slump, with Dogecoin price likely to spiral to $0.07223, or in the dire case, extend a leg down to find support at $0.06756. Such a move would constitute a 25% fall below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B00.41.24%2C%252005%2520Dec%2C%25202023%5D-638373260645746492.png&w=1536&q=95)