Dogecoin breaks key $0.088 barrier ahead of tenth birthday, 87% DOGE holders at profit

- Dogecoin price has crossed key resistance at $0.088076, with early 87% DOGE wallets sitting on unrealized profits.

- DOGE tokens worth $11.94 billion were moved by whales in transactions greater than $100,000 last week.

- Dogecoin on-chain metrics support a bullish outlook.

As Dogecoin (DOGE) approaches its tenth anniversary on Wednesday, the Shiba-Inu-themed meme cryptocurrency has surpassed a crucial resistance level at $0.088076, reaching the highest level since mid-April. The recent upswing in the memecoin’s value has driven many Dogecoin holders towards profitability, and whale transactions – or moves made by large-wallet investors totalling more than $100,000 – also climbed during the last week, further supporting DOGE price gains.

Also read: Three gaming crypto tokens to have in your watchlist as GTA 6 trailer looms: AXS, MANA and ENJ

When was DOGE born?

Dogecoin is inspired by the Shiba Inu dog Kabosu, born on November 2, 2005. The DOGE token was launched on December 6, 2013, so the meme coin has completed ten years of existence. Within the first thirty days of Dogecoin’s launch, the official website dogecoin.com observed nearly one million visitors.

In the week leading up to DOGE’s tenth birthday, on-chain metrics have turned bullish, signaling that a continuation of the recent price uptrend is possible.

Dogecoin on-chain metrics support bullish outlook

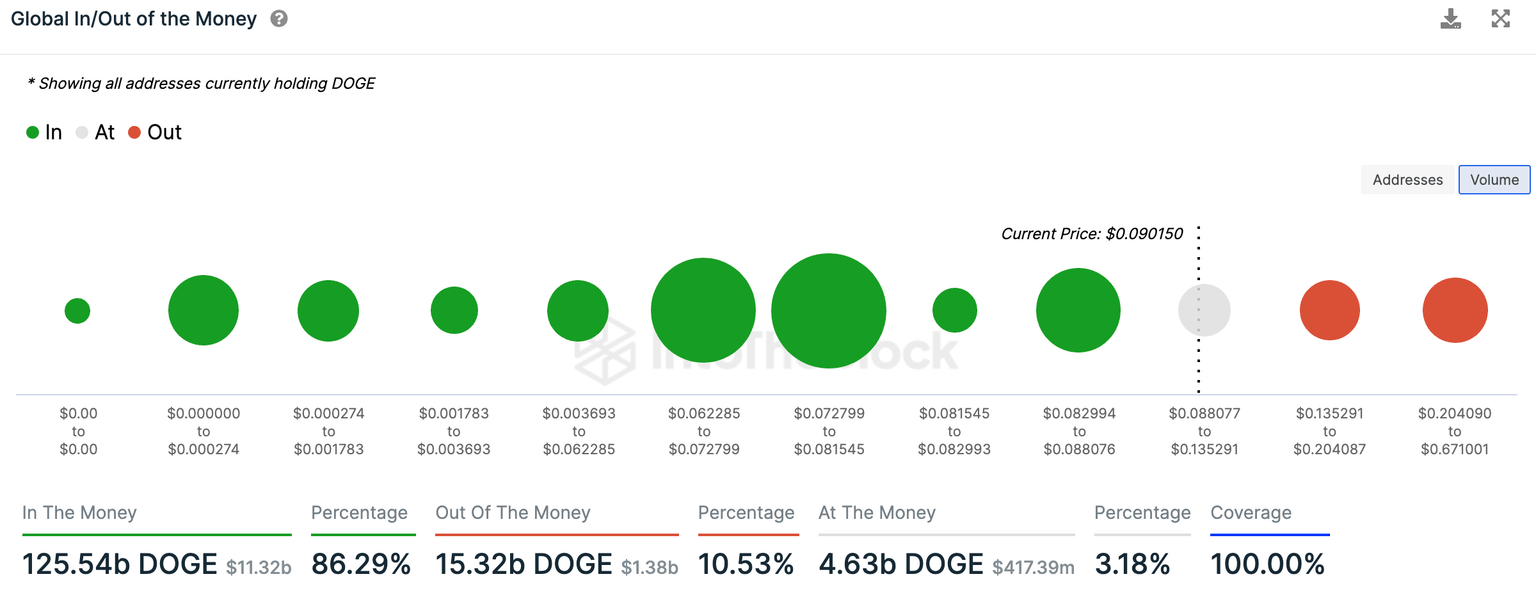

Based on on-chain metrics from IntoTheBlock, 86.29% DOGE wallet addresses – which hold 125.54 billion Dogecoin tokens – are currently profitable. DOGE price crossed a major hurdle, the range between $0.082994 and $0.088076, to hit $0.090150 early on Monday.

The next resistance is between the range $0.088077 to $0.135291.

Global In/Out of the Money map. Source: IntoTheBlock

In the past week, whale transactions valued at $100,000 and higher, hit the $11.94 billion mark, based on IntoTheBlock data. Large volume transactions during an uptrend support a bullish thesis for DOGE price.

The Network Value to Transactions Ratio (NVT) is a metric that divides market capitalization by transacted volume in the specified window. This metric is used to identify whether a trend is sustainable or likely to change.

Since November 15, the NVT ratio is nearly stable, meaning that there is a balance between market capitalization growth and transaction volume. This consistency in the NVT ratio suggests that the current uptrend is likely to persist.

Network Value to Transaction (NVT) ratio. Source: IntoTheBlock

Whale accumulation adds another layer of support to DOGE’s bullish thesis. DOGE wallets holding 10 million to 100 million coins and 100 million to 1 billion coins have accumulated 230 million tokens and 1.04 billion tokens to their portfolios, respectively, in the last month.

DOGE whale wallet accumulation. Source: Santiment

At the time of writing, DOGE trades at $0.089520 on Binance, yielding nearly 4% daily gains for holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B15.09.49%2C%252004%2520Dec%2C%25202023%5D-638372854881683994.png&w=1536&q=95)