Dogecoin price might recover losses if volume picks up

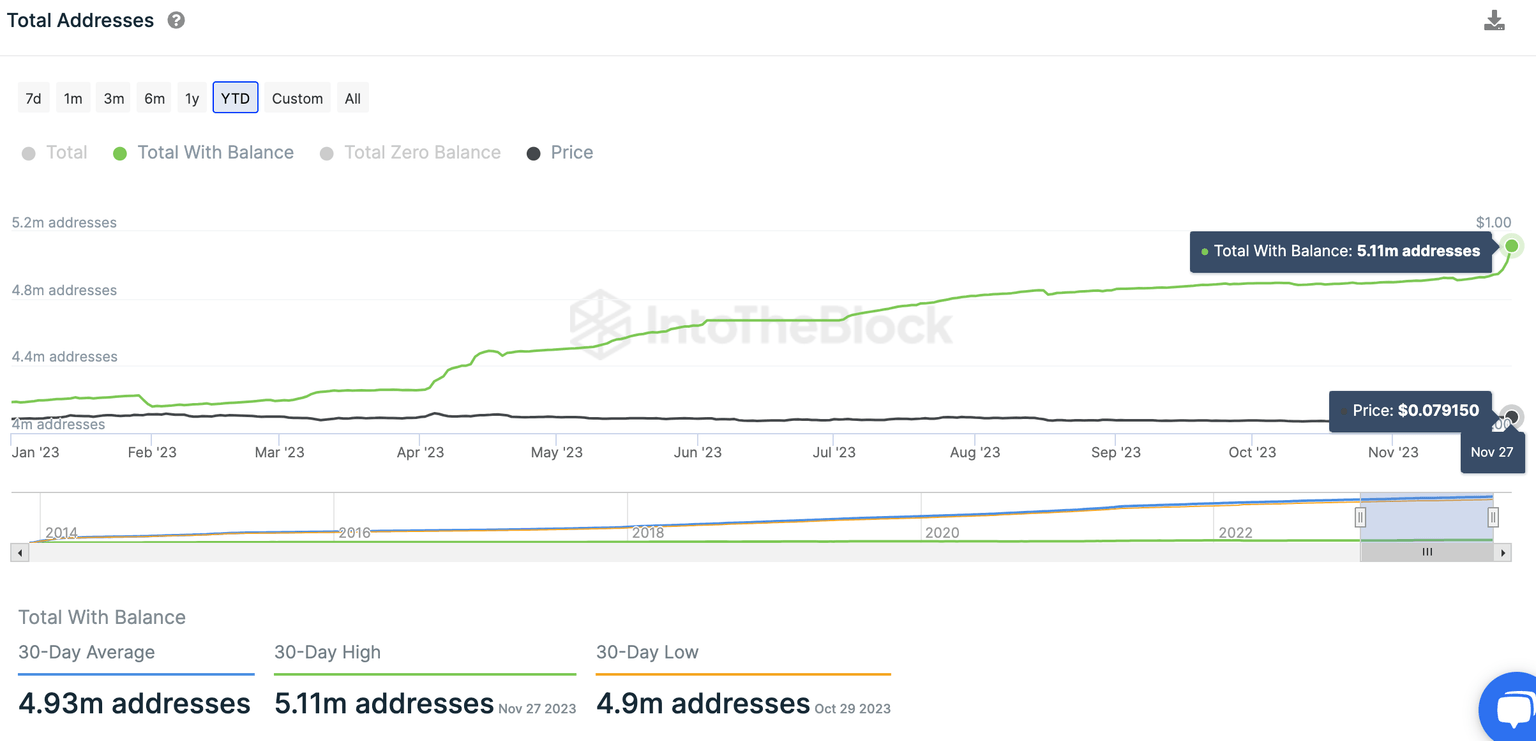

- Dogecoin wallet addresses with a non-zero balance climbed to 5.11 million.

- DOGE active addresses, and volume increased alongside price gains, supporting a bullish outlook.

- DOGE price is likely to begin its recovery with the rising transaction volume and activity in Dogecoin.

Dogecoin has noted a massive rise in wallet addresses with a non-zero balance. This increase is typical of rising demand among market participants for DOGE. On-chain metrics paint a bullish outlook for Dogecoin.

Also read: Bitcoin price sees flat performance as correlation with equities is on the rise

Dogecoin sees massive spike in new wallet addresses

The recent price rally in DOGE, that sent the Shiba-Inu-themed meme coin to its local peak of $0.087 on November 17, was accompanied by a massive increase in non-zero balance wallet addresses. According to data from crypto intelligence tracker IntoTheBlock, Dogecoin’s non-zero balance wallets climbed to 5.11 million.

This marks an important milestone, as DOGE wallets with a balance hit a record high.

DOGE total addresses with balance

The spike in wallet addresses supports a bullish thesis for DOGE recovery. However, ideally this should be accompanied by a spike in volume to add credence to the signal. Whilst actual Volume for the meme coin lags behind, Santiment data sheds light on a rise in Active Addresses.

As seen in the chart below, Volume is lagging behind, despite the meme coin’s recovery. Nevertheless, there is a considerable increase in the 24 hour Active Addresses in DOGE. This rise in Active Addresses could foreshadow an increase in DOGE volume, which could still fuel a recovery in the meme coin.

DOGE Active Addresses and price

DOGE Volume and price

At the time of writing, DOGE price is $0.077 on Binance. The largest meme coin by market capitalization, rallied 12% in the last thirty days, and remained unchanged in the past week. DOGE yielded nearly 2% losses on the day for holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B16.03.01%2C%252028%2520Nov%2C%25202023%5D-638367667322557158.png&w=1536&q=95)

%2520%5B16.03.08%2C%252028%2520Nov%2C%25202023%5D-638367667720060199.png&w=1536&q=95)