Dogecoin price pre-Christmas spark in danger, snuffed out by DOGE whale selling spree

- Dogecoin price posts 8.5% rebound in five days, as investors beam with hope for year-end rally.

- DOGE whale addresses could keep the price down if they continue with the selling spree.

- Dogecoin price must cross above a confluence resistance at $0.0855 to confirm plausible year-end rally.

Dogecoin price is battling a sudden increase in overhead pressure after posting a five-day bullish stint to trade at $0.0771 at the time of writing. The leading meme coin came under pressure earlier this week as investors reacted to billionaire Elon Musk's intention to leave Twitter as CEO.

Following Musk's $44 billion Twitter acquisition deal, Dogecoin price exploded to $0.1596, prompting investors to believe that the meme coin would benefit a lot if he held onto the top position at the microblogging company. Elon Musk said he would step down to run developer and server teams as soon as he finds his replacement.

Dogecoin price flashes red signals ahead of 2023

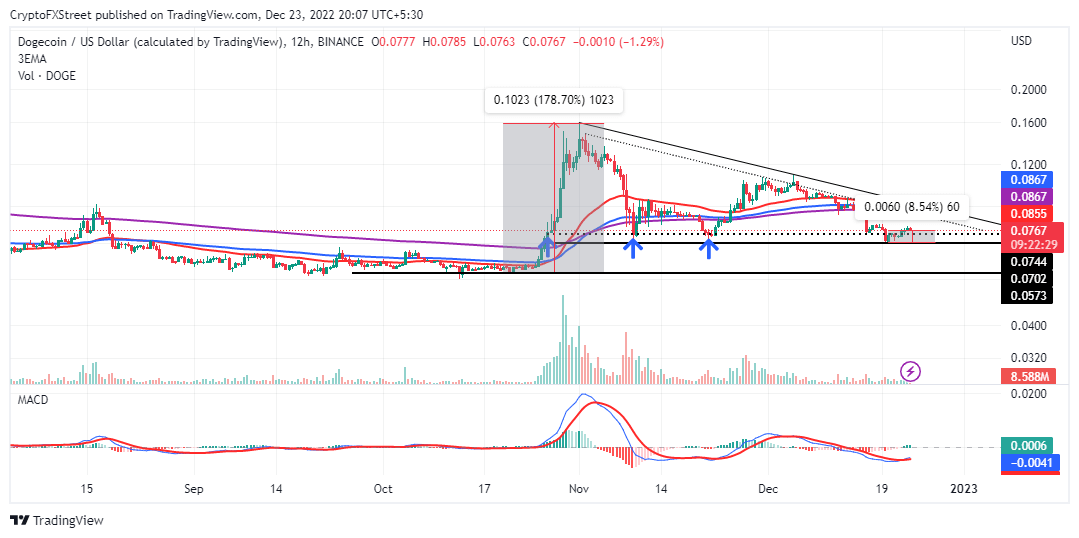

Dogecoin price may have upheld a longer-term uptrend if it had cracked resistance at $0.0855, in confluence with the 50-day Exponential Moving Average (EMA) (in red), the 100-day EMA (in blue) and the dotted falling trend line – illustrated on the 12-hour time frame chart below.

Still, breaking above the upper falling trend line (the continuous line) would have bolstered DOGE past $0.1000, from where it could rise to tag $0.1600. Dogecoin is exchanging hands at $0.0771 amid a spike in selling pressure and a growing risk of retesting support at $0.0702 and $0.0573, respectively.

DOGE/USD 12-hour chart

Bulls are probably waiting for a lower-priced DOGE before pushing the price up again. Remember, despite the resistance at $0.0855, Dogecoin price's outlook seems quite bullish. The Moving Average Convergence Divergence (MACD) indicator recently sent a buy signal as the blue line crossed above the signal line (in red), implying that a recovery was in the offing.

What could be preventing Dogecoin price from year-end rally?

Large-volume investors are known to impact crypto prices either positively or negatively. When they buy more tokens, prices generally go up – the opposite is true.

Therefore, declines will likely follow when addresses holding between 100,000 and 1,000,000 coins sell 2.08% of DOGE's total supply. This explains Dogecoin's price 28% loss in just three weeks.

Dogecoin Supply Distribution

From the chart above, we see that addresses in this investment tier currently hold 17.80% of the meme coin's total supply, down from 19.88% on December 1 and 21.01% on November 1.

Dogecoin price movement to the upside could stay limited as long as this selling spree continues. Similarly, the meme coin would incline to explore the rabbit hole until it finds a bottom amid the crypto winter.

Related articles:

Stablecoin volume explodes, hits $7.4 trillion, defies crypto winter and FTX contagion

Bitcoin prepares for spike in volatility after holding steady through US stock market bloodbath

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B17.37.20%2C%252023%2520Dec%2C%25202022%5D-638074075317649464.png&w=1536&q=95)