Coinbase market value falls below meme coin Dogecoin, and Cardano

- The market capitalization of Coinbase currently sits at $7.9 billion, lower than Dogecoin’s $9.9 billion.

- COIN stock price has declined by more than 66% in the last four months, from $106 to $35.

- Cathie Wood’s Ark Investment Fund keeps buying the dip, holding now 5.8M Coinbase shares.

- Dogecoin price noted a 4.4% increase in value to kickstart a 15% rally.

Coinbase (COIN), the second biggest cryptocurrency exchange in the world, is also one of the only few publicly traded crypto companies. However, despite its transparency and registration with the authorities, the company has not seen particular growth in terms of value. In fact, its declining value has resulted in Coinbase now being worth less than the meme coin Dogecoin (DOGE).

Coinbase relentless downtrend over last few months

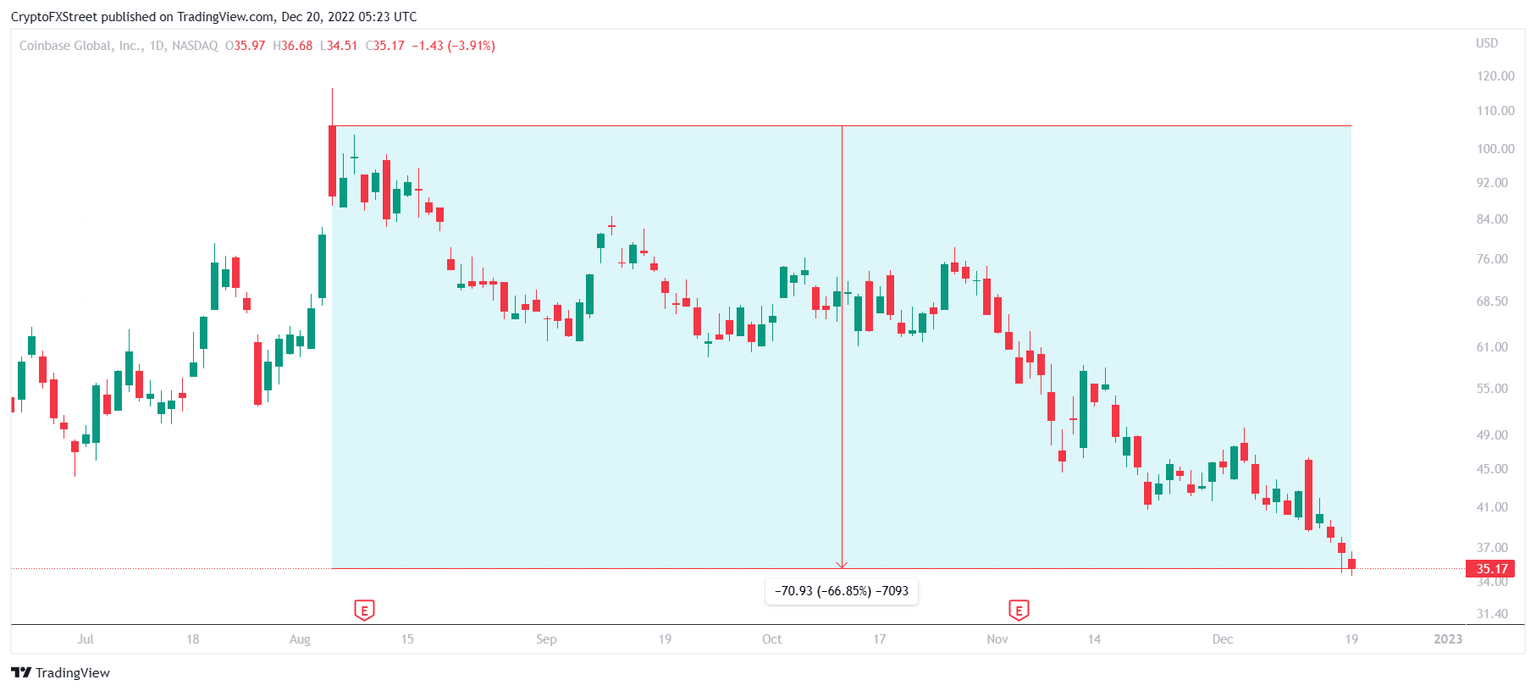

Coinbase has noted a consistent decline from the moment it hit its all-time high of $368 back in November 2021. Since then, COIN has lost almost 90% of its entire market value bringing the stock’s price to $35.15. Most of this drawdown, however, was observed over the last four months.

Between August and December, COIN stock fell by a staggering 66.85% in value, trading from $106.10 to $35.15. Consequently, the total market capitalization of Coinbase reduced to just $7.9 billion, which is far lower than Dogecoin’s $9.9 billion and even Cardano’s (ADA) $8.8 billion.

COIN 1-day chart

This drawdown in price has proved to be of value to Cathie Wood’s Ark Investment Management, which to date has acquired over 5.8 million COIN shares. The most recent purchase came on December 15 when the investment firm bought another $3.2 million worth of COIN.

This was followed by the company’s purchase from November when it bought over 420K shares, following Coinbase CEO Brian Armstrong’s confirmation of zero exposure to FTX.

The decision by Ark Investment did not make sense to most of the community, as Brian Armstrong himself said that the crypto exchange is expecting its revenue to decline by 50% this year.

Earlier this month, the executive had stated,

“Last year in 2021, we did about $7 billion of revenue and about $4 billion of positive EBITDA, and this year with everything coming down, it’s looking, you know, about roughly half that or less.”

Dogecoin price goes up

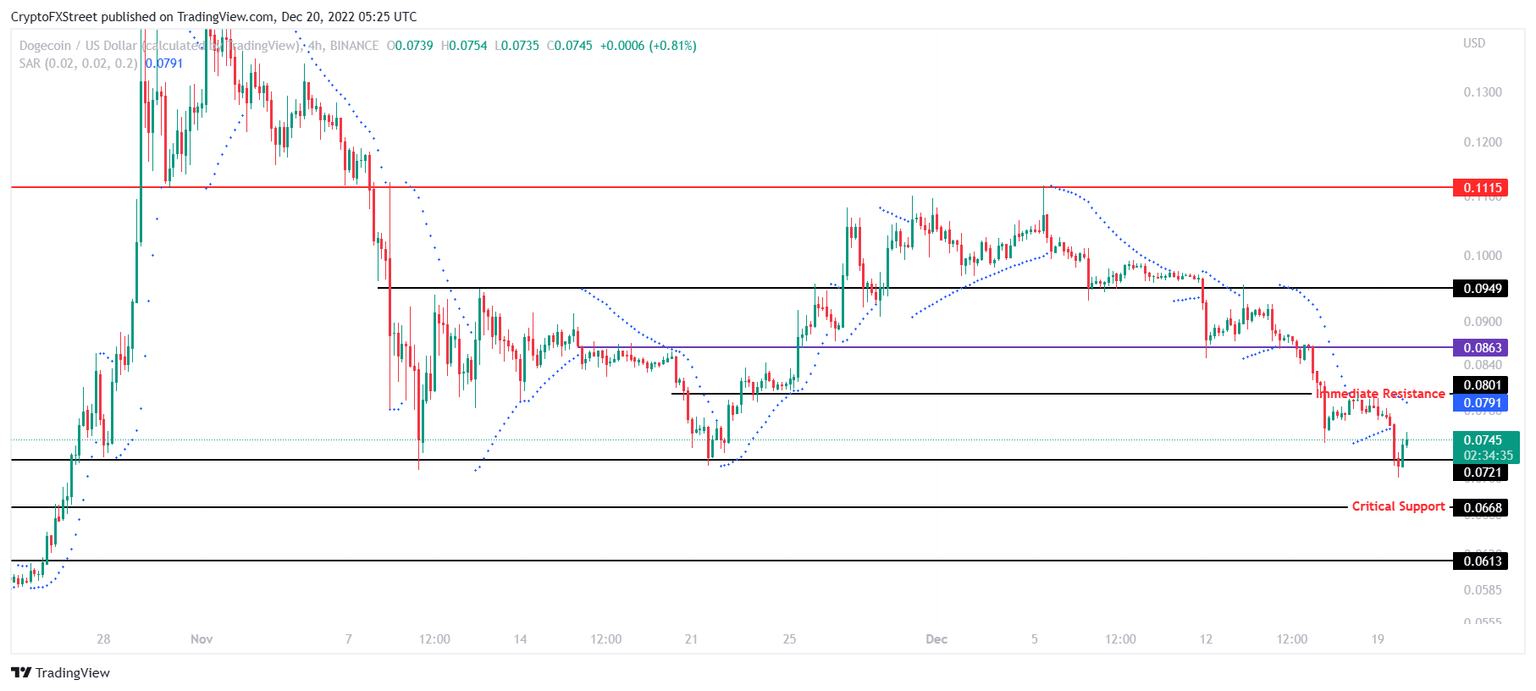

Dogecoin price observed a jump as the cryptocurrency’s total value came up to be more than the Coinbases one. Trading at $0.074, DOGE rose by 4.4%, bouncing off the immediate support at $0.072.

The meme coin is looking to tag its immediate resistance at $0.080. Flipping this level into a support floor is crucial for Dogecoin price to initiate a run up to $0.086. Breaching this level would mark a 15% rally for DOGE and set the cryptocurrency up for further recovery.

DOGE/USD 4-hour chart

However, if Dogecoin price takes a downturn and slips below the $0.072 mark, it would end up tagging the critical support at $0.066. A daily candlestick close below this price would invalidate the bullish thesis and result in DOGE falling to $0.061.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.