Dogecoin Price Forecast: Why investors should zoom out and consider the monthly narrative

- Dogecoin price is down 32% on the month.

- DOGE is testing the 50-month moving average as support.

- A monthly close below $0.072 could set up a 50% decline for Dogecoin in the coming months.

Dogecoin price continues to display bearish technicals. Traders may want to zoom out to larger timeframes and consider DOGE’s bearish macro potential.

Dogecoin price points south

Dogecoin price is wreaking havoc on the risk-taking bulls who entered the market this year. As of December 21, the notorious meme coin is down 32%, bringing the lost market value to a 90% decline since all-time highs. Still, despite the whopping price decline, DOGE bears may just be getting started.

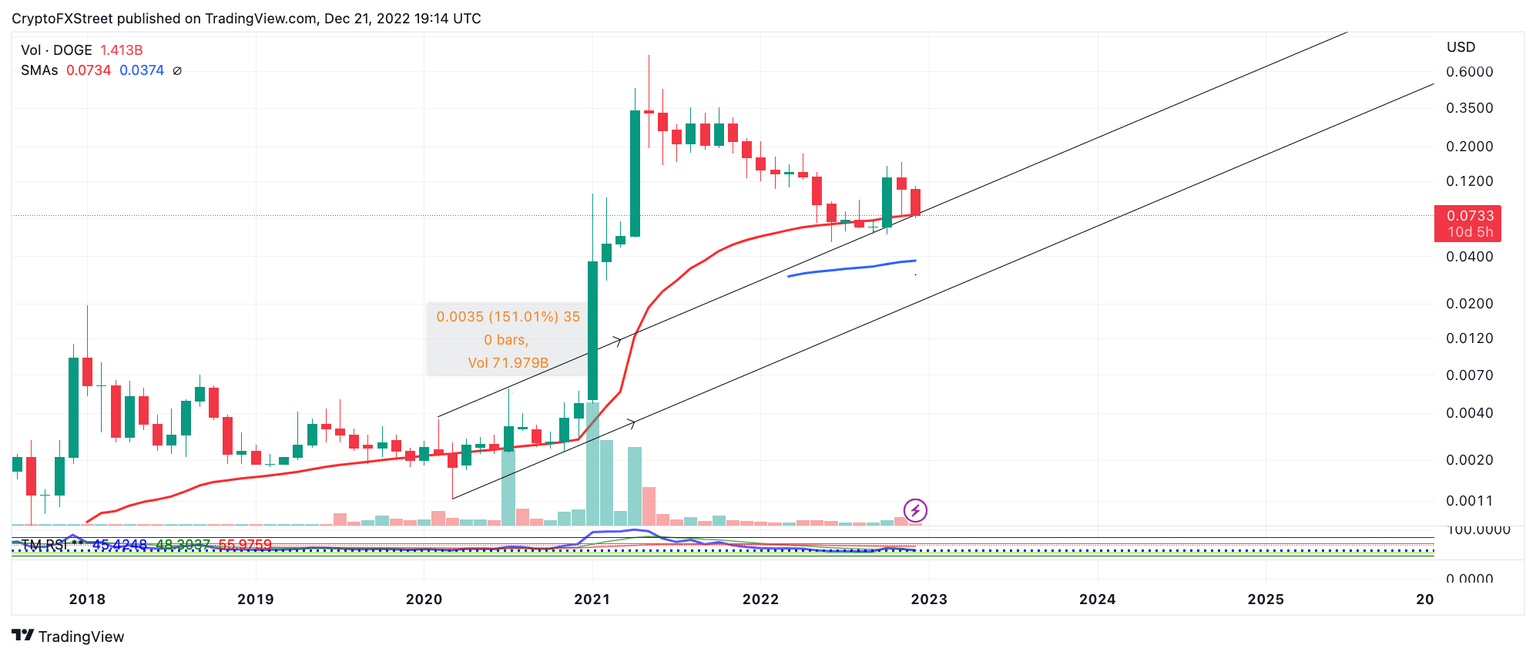

Dogecoin price currently auctions at $0.073. Congestion forms on smaller time frames above the 50-month moving average (MMA). A close below the indicator would be a tremendous display of strength from bears in the market. Auction Market Theory, which uses Pareto’s 80-20 rule, would suggest DOGE have an 80% chance of tagging the 100-month moving average if the 50-MMA fails to provide support.

The 100-month moving average is currently positioned at $0.037 and has yet to be retraced following Dogecoin’s infamous 10x bull run in 2021. DOGE would decline by 48% if the bears were successful.

DOGE/USDT 1-Month Chart

Still, there are ten days left in December, and Crypto investors know that a lot can change heading into the end of the month. Invalidation of the bearish thesis will require the monthly closing candle stick to settle above the 50-MMA, ideally with a bullish hammer or Doji candlestick.

DOGE will likely need to recoup between 50%-80% of lost market value on the month to establish the bullish requirements. In doing so, Dogecoin could remain range bound and potentially tag the midpoint of the current trading range at $0.09, resulting in a 35% increase from the current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.