Dogecoin price must break $0.21 for DOGE to enter new bull rally

- Dogecoin price has broken through some important supportive factors.

- Buyers will need to wait for a solid entry opportunity.

- Expect price action to be capped at $0.26 and instead look for a retest of $0.21 before price action in DOGE starts to recover.

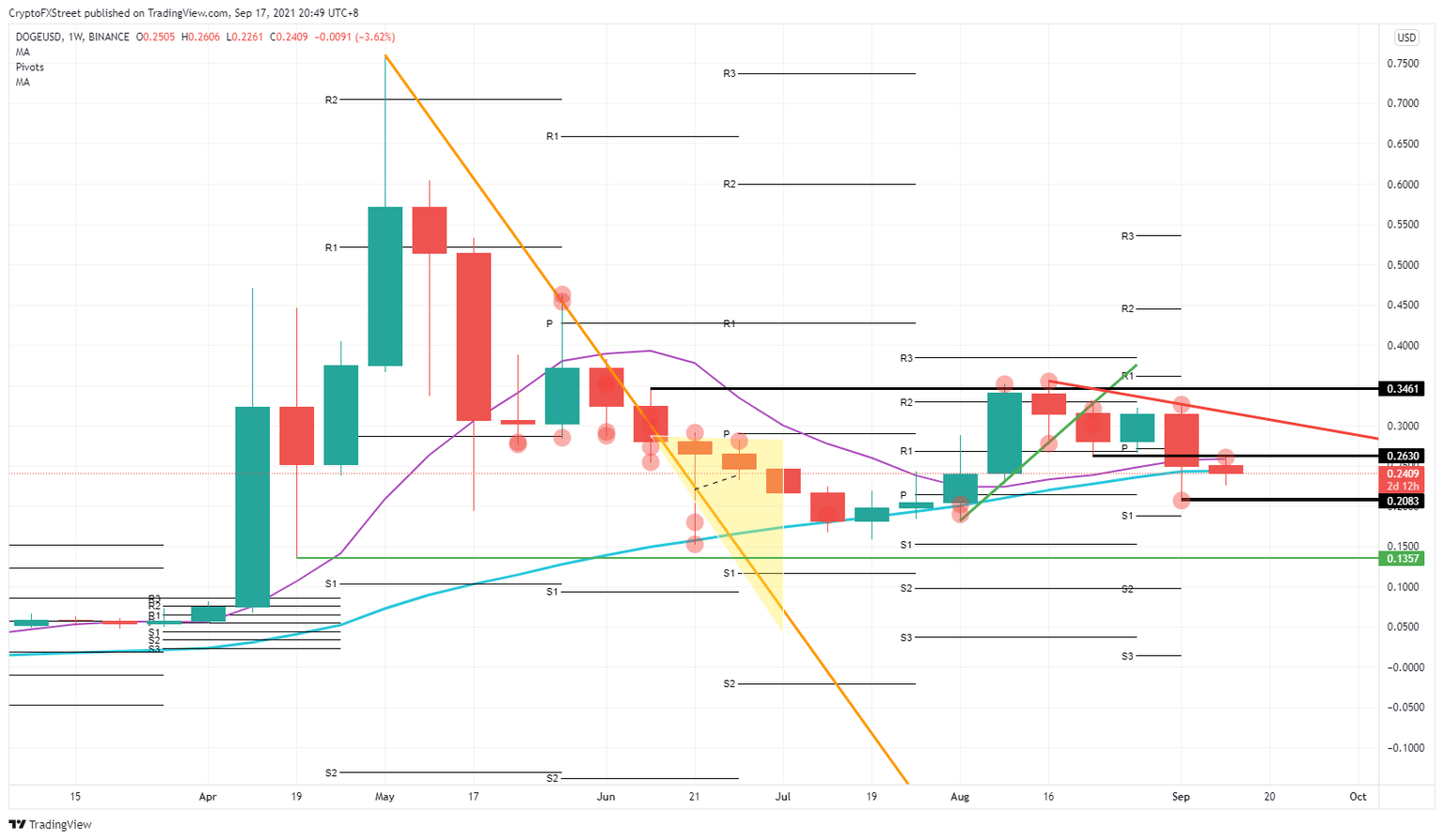

Dogecoin (DOGE) has not been in a sweet spot for buyers and investors since mid-August. After a failed attempt from buyers to close above $0.35, price action in DOGE has been trading downwards in favor of the sellers. Sellers are eyeing another push to the downside with the second test of $0.21.

Dogecoin price faces on critical resistance barrier

Dogecoin price is getting more and more technical indicators in the bearish corner, building a case for another push to the downside. Last week a failed attack from buyers on the red descending trend line caused buyers to get flushed out of their longs, with sellers pushing DOGE price action 30% lower. Bears ran the stops from buyers who placed their stops below the 55-day and 200-day Simple Moving Average (SMA). That made price action dip quickly towards $0.21.

In the meantime, buyers attempt to stabilize price action in DOGE, but a bull trap is starting to form. Bulls do not look able to push price action above $0.26, and the 55-day SMA just below is adding a cap on the price action, thus limiting any upside potential.

DOGE/USD weekly chart

Expect price action in DOGE to fade and start trading down towards $0.21. In terms of strength, that level looks quite bleak. The monthly S1 support at $0.19 might help a little bit. But the ultimate price target for sellers will be $0.14. That level was the low from mid-April, and except for a dip in June, price action has not been around these low levels in the past few months.

Should buyers avoid the bull trap and break above $0.26, the volume will be added to the charge higher. Yet, the red ascending trend line at the topside will limit any further profits unless a favorable tailwind can act as a catalyst for a boost in conviction and sentiment next week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.