Dogecoin price is on a downtrend toward $0.20

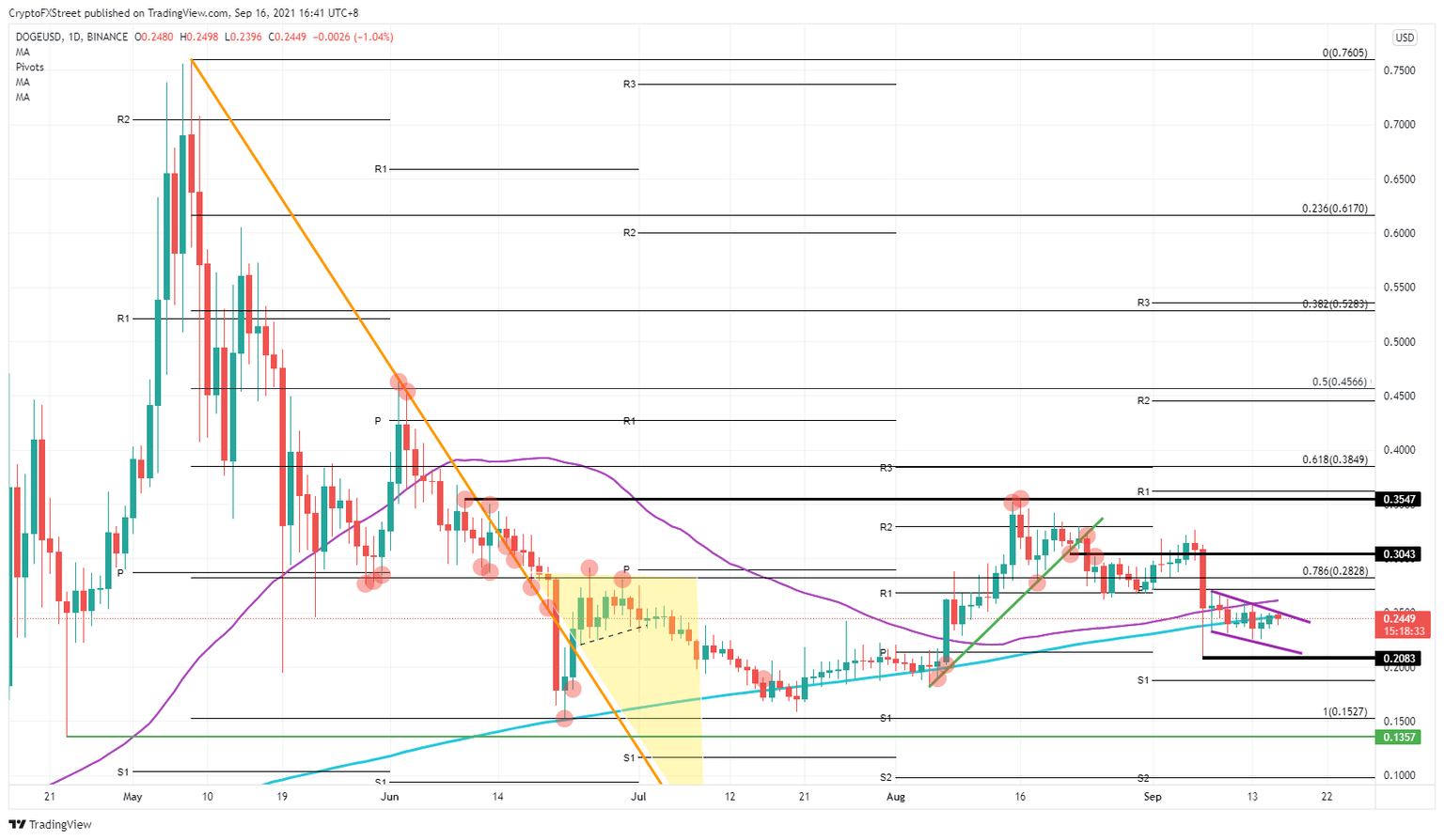

- Dogecoin price action is caught in a descending trend channel.

- Supportive moving averages have turned into resistance.

- A retest of the September 7 low is the profit target for bears in DOGE.

Dogecoin (DOGE) price action has been respecting a descending trend channel for nine consecutive days now. Sellers are looking to book profit around $0.20, which falls in line with the low from September 7.

Dogecoin price is trending lower and can lose 16% of its value

Dogecoin price has been moving in the downward trend channel since September 7. In the beginning of the DOGE trend formation, price action could still have flipped to the upside with the help of the 55-day and the 200-day Simple Moving Averages (SMA). In the meantime, price action has been trending lower, and both the 200-day and the 55-day SMA have turned into resistance now. DOGE bears now have two very supportive elements in their corner to push prices lower.

Buyers in Dogecoin are, however, trying to ramp the price up, with multiple tests of the upper trend line of the descending trend channel. Sellers are standing firm and defending their short view with great success. As the interest for DOGE bulls starts to fade, expect sellers to take over price action further and run the price down toward $0.20. That level was the low from September 7 and will be the targeted level for DOGE bears to book profit on their short positions, if not all their profit.

DOGE/USD daily chart

Expect buyers to come in at that $0.20 mark to start building up some long positions in the handover from sellers booking profit. If that level does not hold, at $0.19 the monthly S1 support level is waiting to do its duty. In a broader price range, DOGE bulls could go for a fade trade to get long.

Suppose sellers are stubborn and do not let any opportunity for the buyers to get in. In this case, expect a push through S1 toward $0.15. That level coincides with the low from June 22.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.