Dash price ready for a massive breakout towards $160, suggest technicals

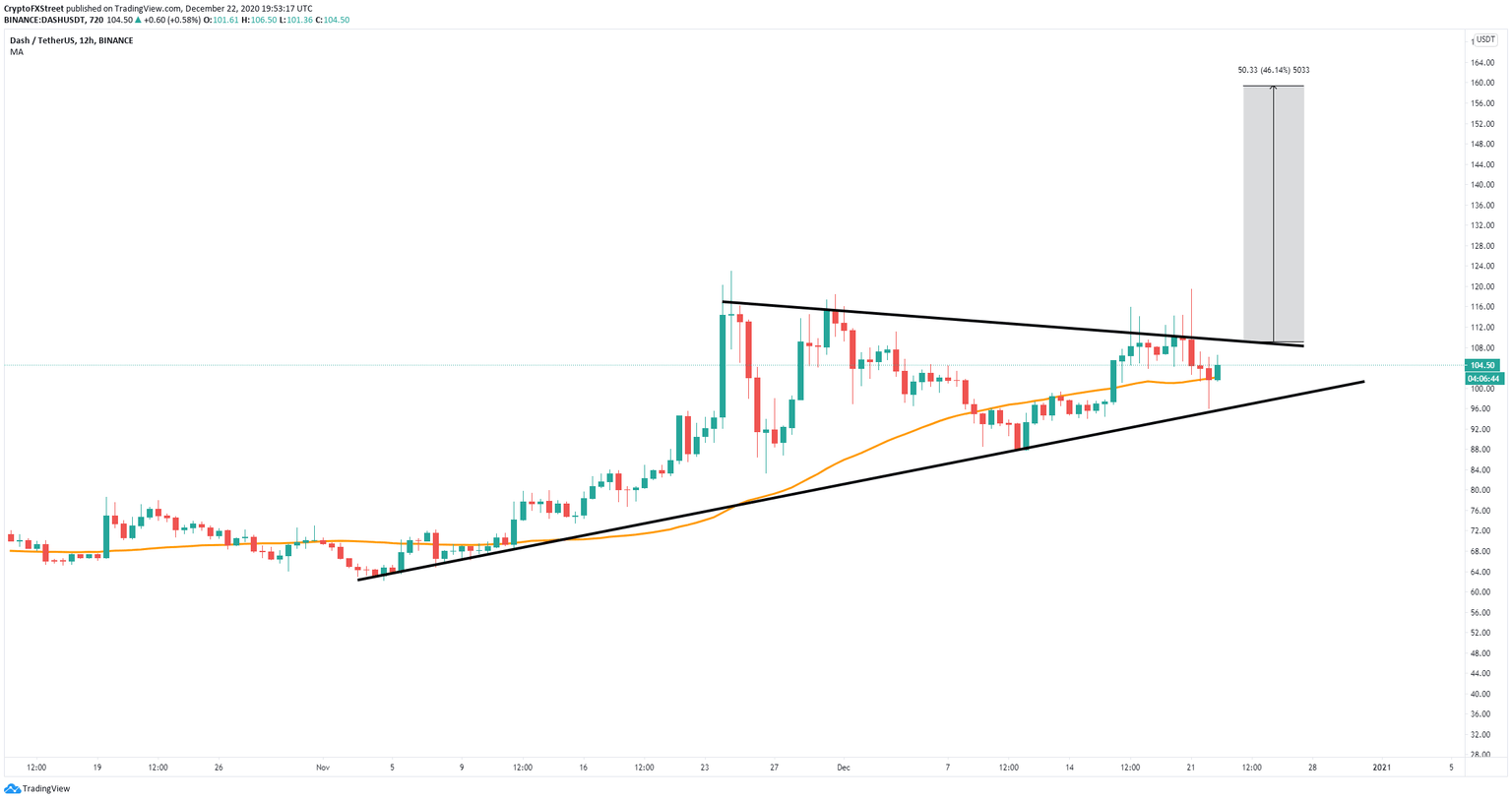

- Dash price remains contained inside a symmetrical triangle pattern on the 12-hour chart.

- A clear breakout above the pattern can easily drive Dash price towards a target of $160 in the long-term.

The digital asset has been trading relatively sideways for close to one month and awaits a clear breakout or breakdown within the next week. It seems that bulls have taken control again and are eying up a potential price target of $160.

Dash price needs to crack this critical resistance level to see a massive breakout

On the 12-hour chart, DASH has established a symmetrical triangle pattern and it’s trading right in the middle of it. Bulls have defended the lower trendline support at $95 and Dash price rebounded towards $106.

DASH/USD 12-hour chart

The digital asset has also climbed above the 50-SMA, turning it into a support level. The next resistance level is located at $109, which is the upper trendline of the pattern. A breakout above this point can push Dash price towards $160.

DASH IOMAP chart

On the other hand, failure to hold the 50-SMA at $102 will most likely drive DASH towards the lower trendline of the pattern again at $95. The In/Out of the Money Around Price (IOMAP) chart shows very little support around this area.

The IOMAP chart suggests that a breakdown below $95 might be likely as the most significant support area is located below $91. This adds credence to the bearish outlook given above.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637442637442663947.png&w=1536&q=95)