Dash Price Prediction: DASH hits another colossal milestone as $600 beckons

- Dash spikes above $300 after triggering a technical pattern breakout.

- Extending the uptrend to $600 will depend on the bulls’ ability to break above the hurdle at $340.

- A correction may come into the picture, especially now that the RSI is in the overbought region.

The Dash rally is catching momentum after achieving its technical breakout target. At the time of writing, the token is seeking support above $300. A comprehensive look at the weekly chart shows that the rally is halfway to $600.

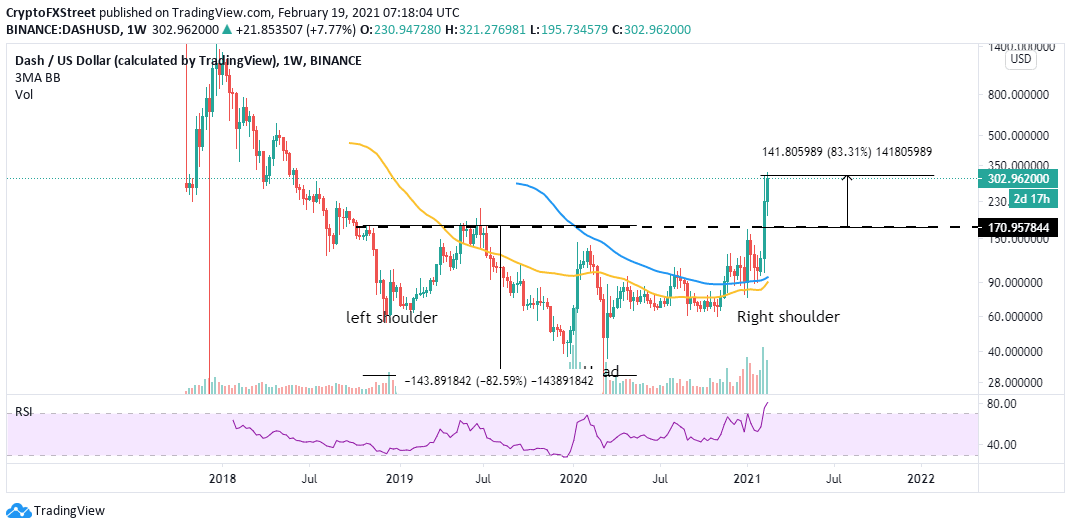

The inverse H&S pattern sets Dash on the launchpad

The inverse head-and-shoulders is a bullish pattern in technical analysis. A break above the horizontal line results in a drastic upswing resembling Dash from $170 to marginally above $300. If the next crucial hurdle at $340 is broken, DASH may rally toward $600.

Meanwhile, the Relative Strength Index continues to move higher within the overbought region. Moreover, a golden cross pattern is likely to come into the picture on the weekly chart with the 50 Simple Moving Average (SMA) crossing above the longer-term 100 SMA.

DASH/USD weekly chart

The IOMAP model by IntoTheBlock reveals that little resistance is ahead of Dash. In other words, gains are likely to increase with bulls increasing their grip. However, some attention must be channelled to the region between $325 and $335. Here, nearly 4,800 addresses purchased roughly 52,700 DASH. This a subtle resistance that may not do much to hinder the rally to higher levels.

On the downside, Dash sits on areas with immense support, mostly between $270 and $280. Here, 14,800 addresses previously bought nearly 361,000 DASH. Slicing through this zone may not be easy, thus adding weight to the bullish outlook.

Dash IOMAP model

Looking at the other side of the fence

Dash may fail to hold the rally if the resistance at $340 remains unshaken. The RSI is not in the overbought region, which means that investors have to proceed with caution. A correction from the current levels will test support at $300. If push comes to shove, declines will continue to $280.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren