DASH Price Analysis: DASH aims for a 75% breakout to $250

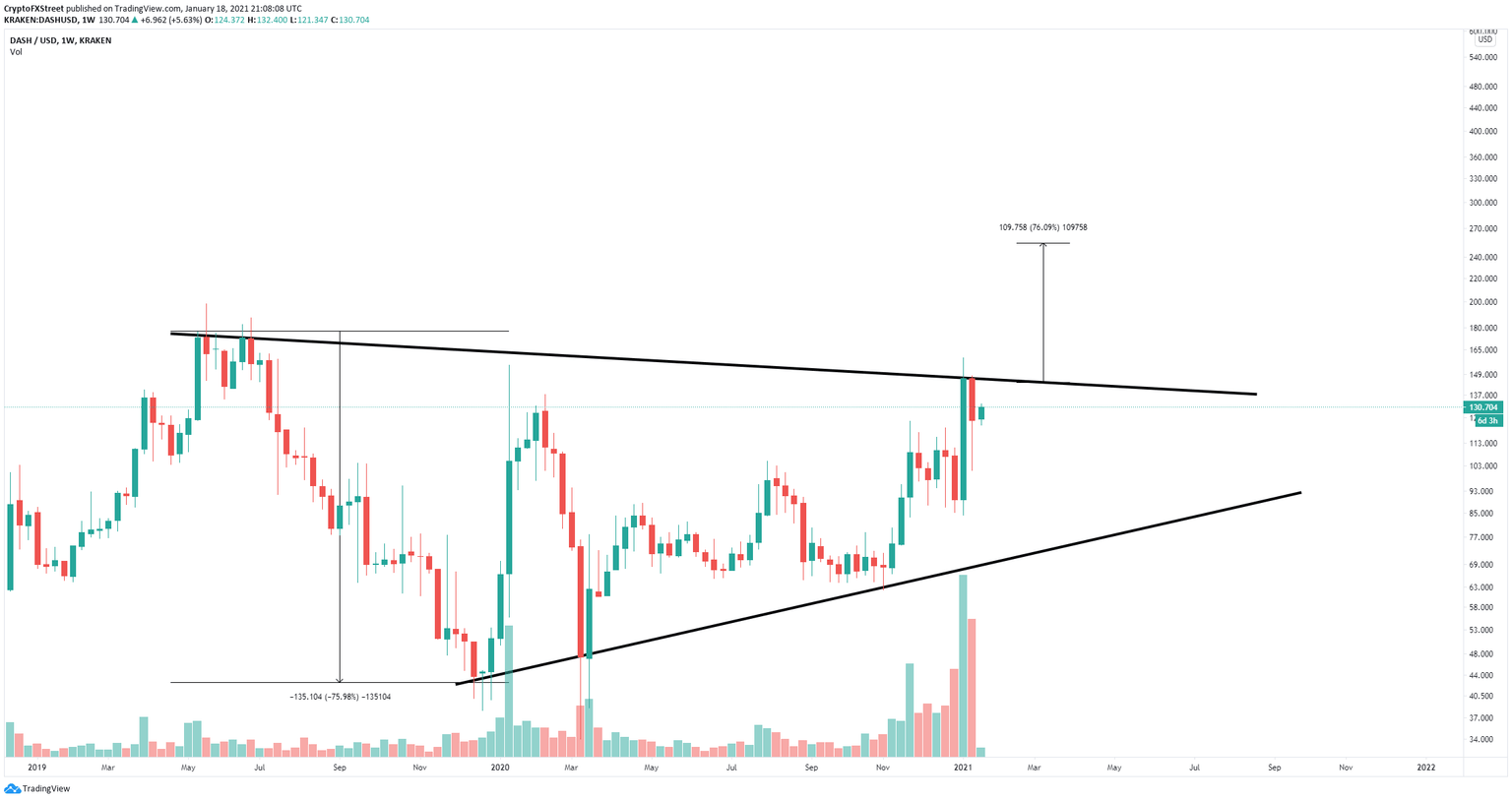

- Dash price is currently bounded inside a long-term symmetrical triangle on the weekly chart.

- The recent bullish momentum could be enough to push DASH into a massive breakout.

Dash is up by 100% since November 2020 and bulls aim to continue pushing the digital asset to new highs. There is only one critical resistance level before a significant 75% breakout on the weekly chart.

Dash price needs to climb above $140 to rise higher

On the weekly chart, Dash price has established a symmetrical triangle pattern and could see a breakout in the near future. The digital asset is currently trading at $130 while the trendline resistance is located at $140.

A breakout above $140 could quickly push Dash price towards $250, a 75% increase which is determined using the height of the pattern.

DASH social volume

Additionally, the social volume of DASH has been declining notably since the peak at $154 on January 10. This decline also indicates that a potential breakout or breakdown is nearby.

However, a rejection from the top trendline at $140 could be devastating for Dash as bears can quickly push the digital asset down to the lower boundary of the triangle pattern at $70.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B22.09.56%2C%252018%2520Jan%2C%25202021%5D-637466011338822003.png&w=1536&q=95)