DASH Price Prediction: DASH targets $120 amid inverse head-and-shoulders breakout

- DASH/USD’s path of least resistance appears north.

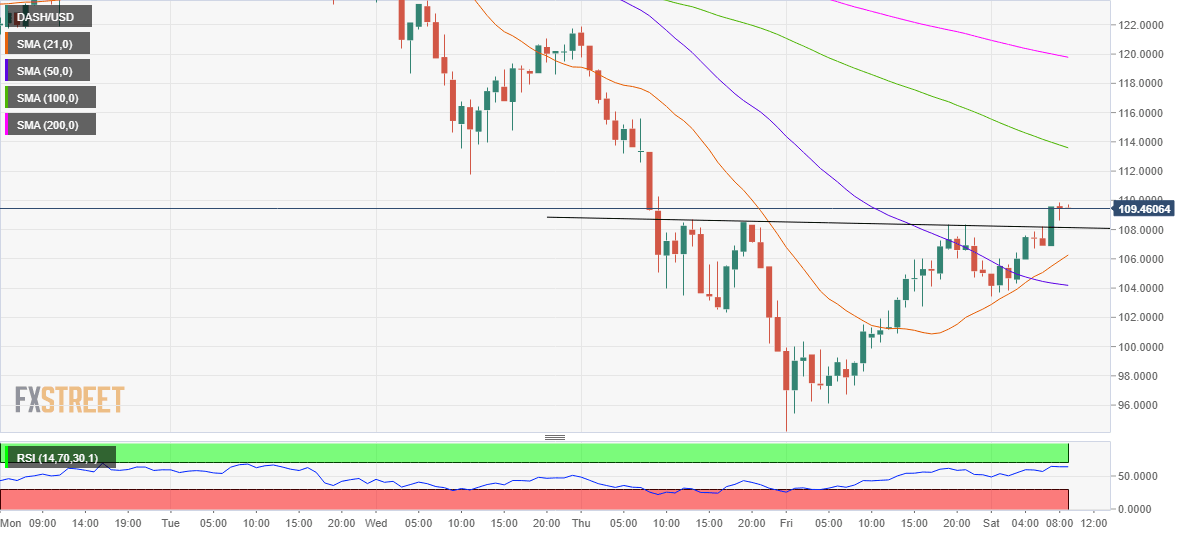

- Inverse head-and-shoulders breakout confirmed on the 1H chart.

- Bullish crossover and RSI back the case for additional upside.

Dash (DASH/USD) bulls take a breather just under the $110 level after the renewed uptick.

Dash, one of the top 50 widely traded crypto assets, adds 12% over the past 24 hours, although is poised to end this rollercoaster week in the red zone.

In the second half of the week, the DASH bulls regained control, looking to extend the recovery mode into Saturday.

DASH: Bulls back in command amid favorable technicals

DASH/USD: Hourly chart

From a near-term technical perspective, the altcoin broke through the trendline resistance at $108.15, validating an inverse head-and-shoulders breakout on the hourly chart.

The bullish crossover, with the 21-hourly moving average (HMA) having cut above the 50-HMA, has also strengthened the case for further upside.

Therefore, the DASH bulls now aim for the pattern target measured at $122. Ahead of that the bearish 100-HMA at $113.77 could test the bulls’ commitment.

A sustained move above the latter, the critical downward-sloping 200-HMA at $120 would be tested. The Relative Strength Index (RSI) holds at higher levels, now at 63.84, pointing to more gains in the offing.

On the flip side, the inverse head-and-shoulders neckline resistance now support at $108.15 could offer an initial cushion.

The bullish 21-HMA at $105.87 is likely to offer strong support, protecting the bulls against any downside pressures.

The sellers could also aim for the 50-HMA cap at $104.19 if the abovementioned support gives way.

All in all, the path of least resistance appears to the upside in the near-term.

DASH/USD: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.