Cryptocurrencies Price Prediction: Ripple, Bitcoin & Ethereum – European Wrap 18 June

Ripple holders mull lawsuit outcome after SEC enforcement lead steps down

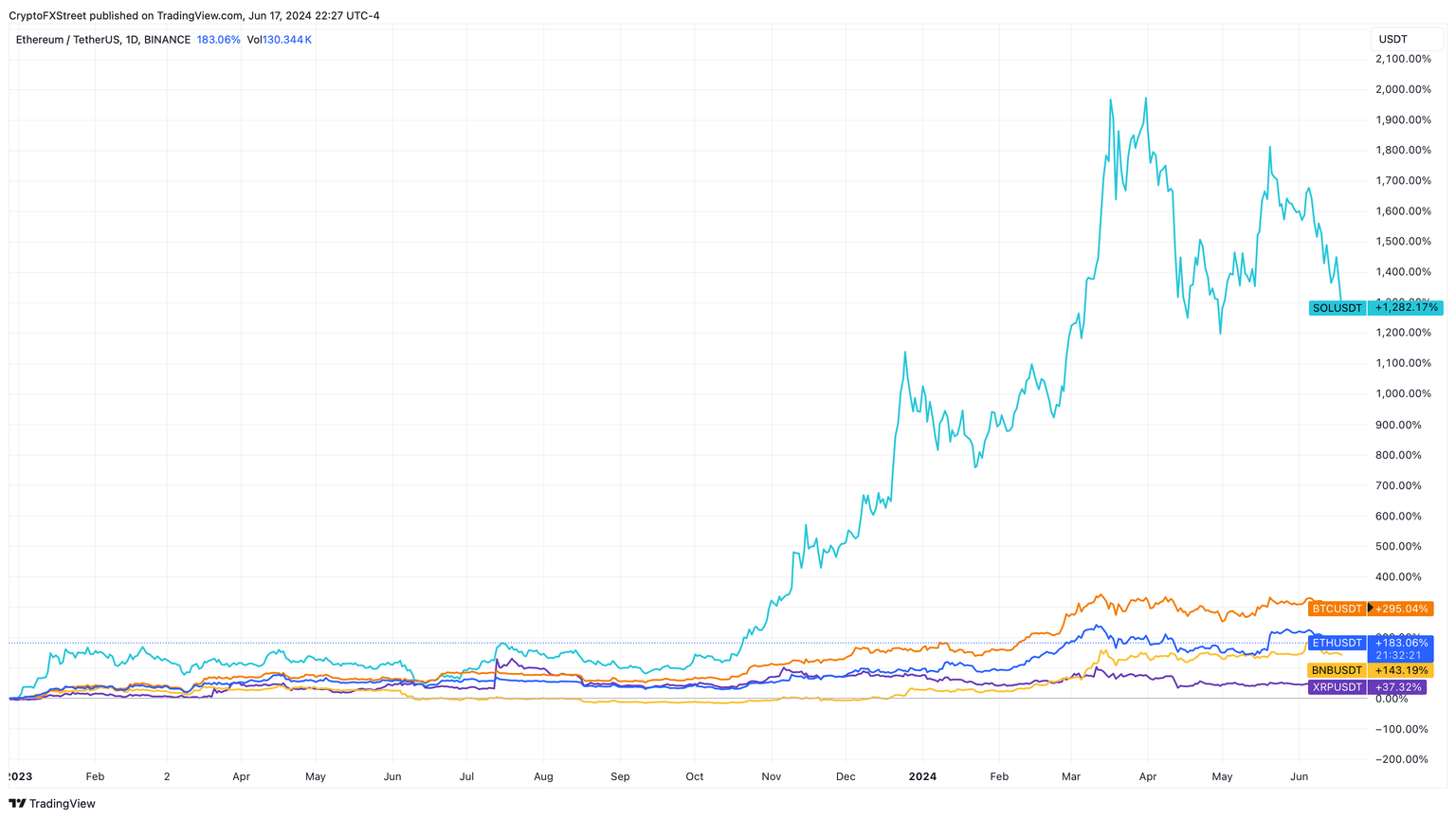

XRP trades in the red on Tuesday as Ripple (XRP) holders are awaiting developments in the US Securities and Exchange Commission’s (SEC) lawsuit against the firm with the case drawing to a close. The overall direction of the legal battle could be about to change as David Hirsh, the US regulator's enforcement lead for the crypto unit, stepped down from his position last week. This has raised concerns in the community regarding the future course of the SEC vs. Ripple lawsuit.

In its latest letter on June 15, The SEC addressed Ripple’s request for $10 million in fines, rejecting the possibility of such a penalty but opening the door to a $102 million settlement, well below the $2 billion initially demanded.

Is the Bitcoin price bottom here?

Bitcoin (BTC) price struggles around the $65,000 level on Tuesday. However, BTC seems supported by the 1-day to 1-week UTXO Age Bands, and other on-chain data indicates a significant easing of Fear Of Missing Out (FOMO) and a recent sell-side liquidity sweep, hinting at a possible bottoming out of BTC's price.

Data from CryptoQuant's UTXO Realized Price Age Distribution metric includes a set of realized prices along with age bands. Overlaying a set of different realized prices helps us overview each cohort’s holding behavior and can act as a support and resistance level indicator.

Spot Ethereum ETF anticipation wipes nearly $70 million worth of ETH

The cryptocurrency market has been on a downtrend for nearly two weeks but Monday’s events showcased how impatient Ethereum (ETH) investors are. In a downtrending market, traders are usually looking for signs of reversal to maximize profits. But sometimes, false signals might end up trapping many eager bulls, and Monday was one of those days.

While $19.81 million Bitcoin (BTC) longs were wiped on June 18, a whopping $39 million ETH longs faced the ax. Additionally, in the past 24 hours, total liquidation for Ethereum has hit nearly $69 million while that of Bitcoin hovers around $47 million. This widespread gap further adds to how impatient ETH holders are.

Author

FXStreet Team

FXStreet