Crypto Today: Traders book $500M losses as BTC, XRP, and PEPE, tumble on hawkish Fed fears

- The cryptocurrency sector shrank 6% in 24 hours as the aggregate market cap dropped to $3.2 trillion on Tuesday.

- Cryptocurrencies traders witnessed over $500 million in liquidations as markets reacted negatively to upbeat US jobs data.

- Bitcoin price plunged as low as $97,000, down 4% from the $102,750 rally recorded after US Fed VP Barr resigned on Monday.

- BTC, ETH and XRP market caps suffered losses in excess of 5%, with prominent memecoins DOGE, SHIB and PEPE taking double-digit haircuts.

Bitcoin Market Updates: BTC plunges to $97K

- Bitcoin’s winning start to 2025 came to an abrupt end on Tuesday and BTC prices plunged 6% from $102,750 before finding support at the $97,000 mark.

- Bitcoin ETFs recorded $987 million inflows on January 6, buoyed by US Fed VP Michael Barr's resignation on Monday.

Altcoin market updates: XRP, ADA, AVAX surrender 2025 gains as US jobs data hints at a hawkish Fed

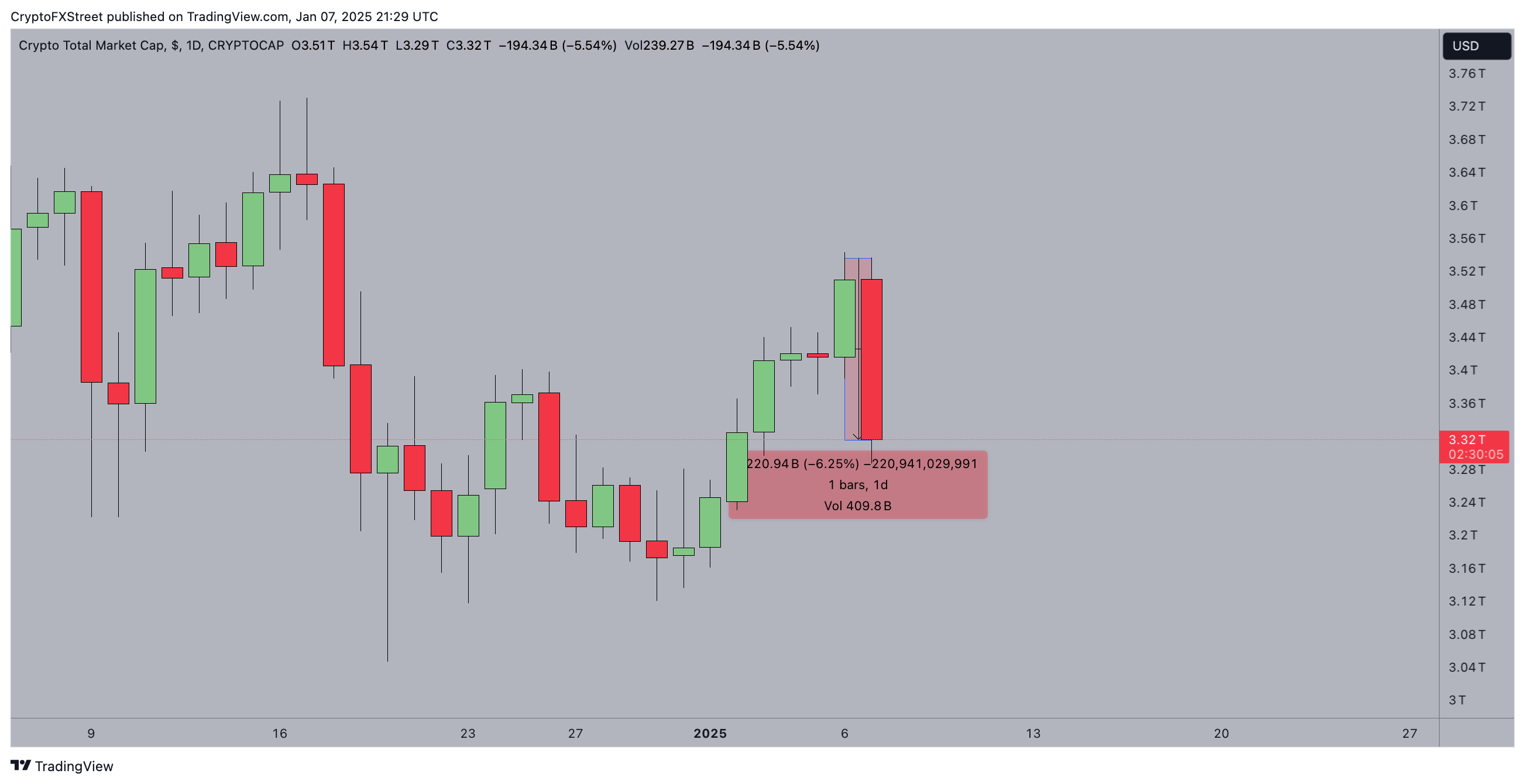

Mega cap altcoins suffered considerable losses during the abrupt market crash on Tuesday, as the global crypto market saw over $220 billion outflows over the last 24 hours.

Global Crypto Market Capitalization, January 7, 2025 | Source: TradingView

Global Crypto Market Capitalization, January 7, 2025 | Source: TradingView

The likes of Avalanche, Chainlink, and Ripple (XRP) experienced considerable losses, as the massive market liquidation caught over-leveraged bulls unawares.

- Avalanche (AVAX) price declined 11% as bears forced a correction from the seven-day time frame peak of $45 to $33.

- Chainlink also slid 10.4% as LINK price came within whiskers of losing the $20 support.

- Ripple (XRP) price also witnessed a sizable 7% loss on the day, as long-term investors were spotted booking profits.

Chart of the day: Traders book $500 million losses amid Crypto crash

The cryptocurrency market experienced a sharp decline over the last 24 hours, with the total market capitalization shrinking by 6% to $3.2 trillion.

Futures traders faced liquidations exceeding $500 million, as market sentiment turned bearish following stronger-than-expected JOLTs job openings data in the United States.

This data reinforced expectations of a hawkish Federal Reserve policy.

According to the liquidation heatmap, Ethereum (ETH) and Bitcoin (BTC) led the losses, with $8.16 million and $4.93 million liquidated, respectively.

Altcoins like Dogecoin (DOGE) and Solana (SOL) also saw significant liquidation volumes of $3.86 million and $3.72 million. In total, 146,478 traders were liquidated, with the largest single liquidation order, worth $11.94 million, recorded on Binance in the ETH/USDT pair.

The downturn followed comments from Fed Chair Jerome Powell, who hinted at fewer rate cuts for Q1 2025 during the December 17 FOMC meeting.

The hotter-than-expected JOLTs data amplified concerns of prolonged monetary tightening, further dampening investor confidence.

As Trump’s January 20 inauguration approaches, Cabinet announcements and potential market-positive speculation may provide some relief.

It remains to be seen whether the crypto market will recover from its initial bearish reaction or continue its downward trajectory

Crypto news updates:

- Coinbase Granted Rare Legal Appeal in Ongoing SEC Case

Coinbase has secured an important legal breakthrough in its battle with the U.S. Securities and Exchange Commission (SEC).

Judge Katherine Polk Failla of the Southern District of New York has granted the cryptocurrency exchange a rare interlocutory appeal, allowing it to challenge the SEC’s claims in the Second Circuit Court of Appeals.

The SEC alleges that Coinbase operates as an unregistered exchange, broker-dealer, and offers unregistered securities through its staking program.

The ruling also pauses ongoing district court proceedings while the appeal is reviewed.

- CFTC Chair Rostin Behnam Resigns, Calls for Stronger Crypto Oversight

Rostin Behnam, Chair of the U.S. Commodity Futures Trading Commission (CFTC), has announced his resignation effective January 20.

His four-year tenure was defined by aggressive enforcement actions in the digital asset space and calls for stricter regulatory oversight of crypto markets.

Behnam emphasized the need for disciplined regulation to address the growing regulatory gaps in the sector.

During his leadership, the CFTC took significant actions, including securing a $4.3 billion settlement with Binance for operating an unlicensed derivatives platform in the U.S.

- Canadian PM Front-Runner Pierre Poilievre Advocates for Crypto and DeFi

Pierre Poilievre, leader of Canada’s Conservative Party and a front-runner for the position of Prime Minister, following Justin Trudeau’s resignation, has emerged as a strong proponent of cryptocurrency and decentralized finance (DeFi).

Poilievre opposes central bank digital currencies (CBDCs) and supports treating crypto assets like commodities for tax purposes.

His platform includes favorable regulations for blockchain companies and promoting cryptocurrency as a hedge against economic instability.

Poilievre has demonstrated a personal interest in digital assets, having invested in the Purpose Bitcoin ETF in 2022.

He has actively opposed CBDC implementation, backing Bill C-400 to regulate them while advocating for Canadians’ right to use Bitcoin and other digital currencies.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.