Dogecoin Price Prediction: DOGE traders deposit $1.2B as France’s Macron tackles Elon Musk

- Dogecoin price consolidates below $0.40 on Tuesday, down 3% from last week’s peak.

- France President Emmanuel Macron raised meddling allegations against Elon Musk ahead of German Parliamentary elections.

- Musk’s historical influence within the memecoin community has triggered a cautious outlook among DOGE spot traders.

- In the derivatives markets, traders opened $1.2 billion in new positions in the last 24 hours, driving DOGE open interest above the $4 billion mark.

Dogecoin price consolidates below $0.40 on Tuesday, amid tailwinds from France's President Emmanuel Macron raised election meddling allegations involving Elon Musk on Monday. DOGE traders have opened over $1.2 billion worth of new positions within 24 hours of the news. Is the DOGE price on the verge of abreakout to $1 or a reversal toward $0.30?

Dogecoin price stalls at $0.40 amid crypto rally as France President files complaints against Elon Musk

Dogecoin's price consolidates below $0.40 on Tuesday, following Emmanuel Macron's accusations against Elon Musk.

The French President accused Musk of using his X platform to influence upcoming German elections.

Musk’s historical influence on DOGE has made traders cautious, as his public statements often drive significant price volatility.

The chart above shows how the DOGE price has consolidated within the $0.35 - $0.40 narrow channel over the last three days, signaling hesitation among traders.

Due toMusk’s historical influence, this news event is expected to trigger knee-jerk reactions among DOGE traders in the coming sessions.

DOGE traders deposit $1.2B in anticipation of a volatile market reaction

While Macron’s allegations against Musk have drawn media attention, speculative traders are making strategic moves to profit from the expected market volatility.

Markets data shows that DOGE traders opened an unusual volume of fresh positions within 24 hours of the news.

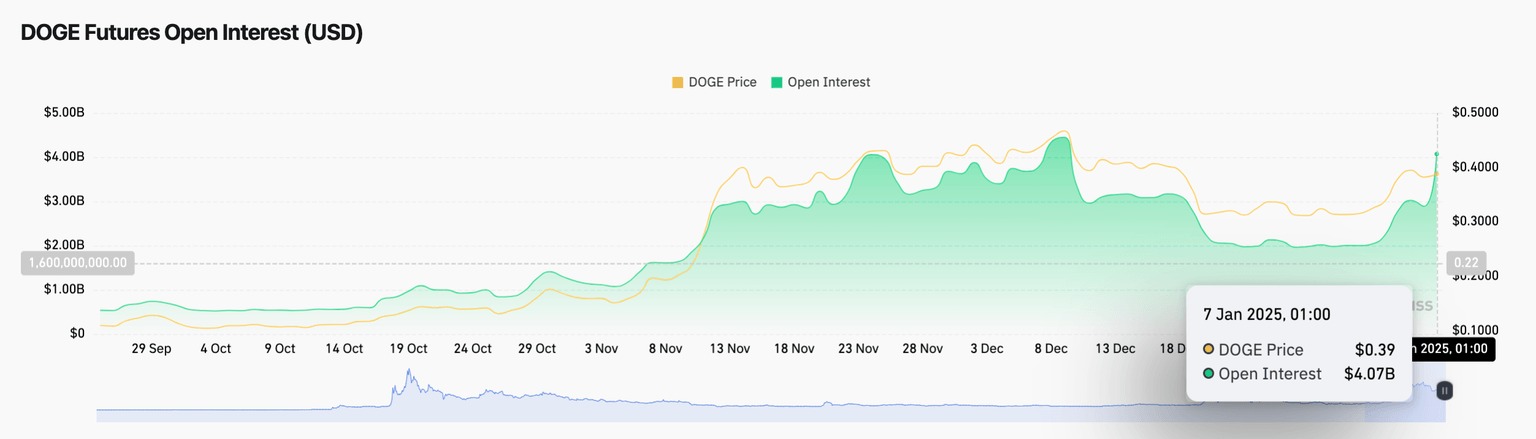

Confirming this narrative, Coinglass’ Open Interest chart above tracks daily changes in total active futures contracts positions listed for a specific crypto asset.

Dogecoin open interest grew from $2.89 billion on Sunday to $4.07 at the time of writing on Tuesday.

This shows that DOGE traders have opened $1.18 billion worth of new positions within 24 hours of Macron's accusation against Elon Musk.

This unusual surge in open interest during a price consolidation phase is often interpreted as an early signal of an imminent breakout phase.

First, increased market liquidity and investor interest puts DOGE in a prime position for another leg-up.

More so, if Elon Musk effectively counters Macron’s accusations and shifts the narrative, his influence could intensify bullish sentiment among DOGE traders.

Additionally, the broader crypto market rally may provide a tailwind for DOGE.

With BTC rallying above $100,000, this could bolster market-wide optimism pushing it past its $0.40 resistance level.

DOGE price forecast: Speculative traders betting on a $0.50 breakout

Dogecoin price rose 28% in the first five days of 2025 but has since failed to stage a decisive breakout above $0.40.

DOGE traders piled $1.18 billion inflows within the aftermath of Macron’s allegations against Musk, signalling widespread optimism for an imminent breakout toward $0.50

Technical indicators on the DOGEUSD daily chart also affirm this bullish Dogecoin price forecast.

Dogecoin price continues to trade within the upper range of the Keltner Channel, indicating ample growth potential.

The Bull Bear Power indicator trending in positive values also affirming that buyers are gaining control.

If these conditions persist, a sustained DOGE price close above $0.41 could pave the way for a breakout toward $0.50.

The recent surge pushed DOGE to test $0.40, a key resistance level. If traders maintain buying pressure, the next resistance levels are $0.45 and $0.50.

Conversely, failure to hold $0.40 could result in a pullback to the $0.36 support level, near the Keltner midline.

A break below this level may trigger further declines toward $0.33, the lower channel boundary.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.