CRO price flaunts buy signal as Crypto.com taps Transak for Visa, Google Pay Services

- Crypto.com price nears the tail end of an extended retracement from $0.1250.

- Crypto.com expands CRO's adoption following a strategic partnership with Transak for Visa and Google Pay payments.

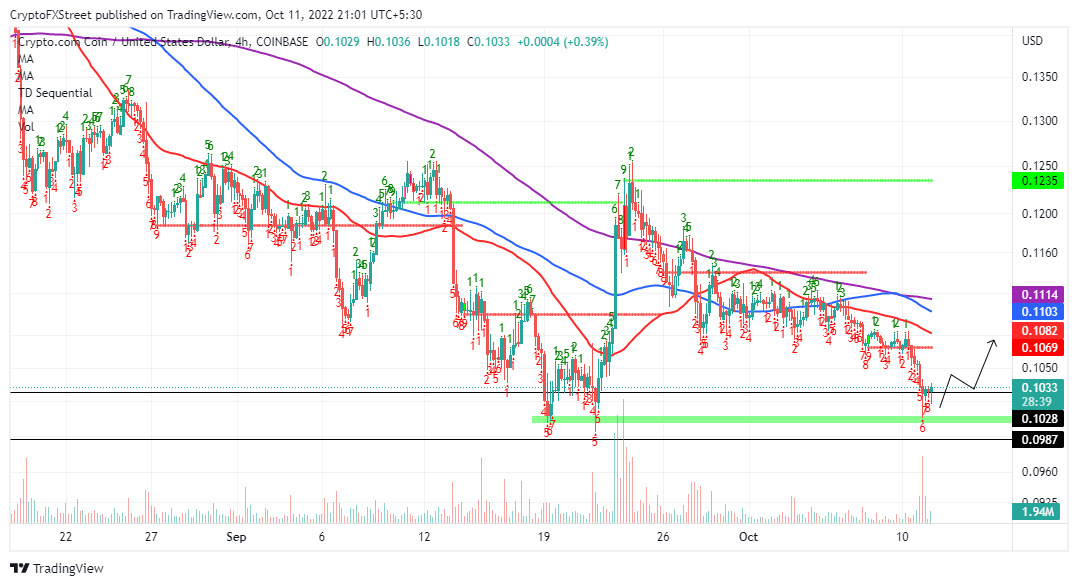

- CRO price recovery is in the offing based on a buy signal from the TD Sequential indicator.

Crypto.com price appears to be exhausting its downtrend in the wake of rejection from its September highs around $0.1250. The native exchange token will likely brush shoulders with its June lows before contemplating a bullish turnaround. Sidelined investors considering holding CRO might find the token relatively discounted, thus prompting a significant northbound move.

Crypto.com announces strategic partnership with Transak

Transak, a platform designed to support Web3 applications, has partnered with Crypto.com to provide the latter's users with payment services such as Visa and Google Pay. On Tuesday, Crypto.com announced the development via Twitter, outlining that bank transfers outside the United States are supported.

What's next for CRO price?

Crypto.com price is considering a bullish move, but first, it could slide to test June lows at $0.0987. Investors may consider this area a suitable entry position, especially with Santiment's MVRV (market value realized value) on-chain metric falling to -5.11%.

An MVRV reading below the mean line (0%) suggests that Crypto.com price is undervalued. Investors tend to buy as this metric dips further into the negative and sell as it lifts above the mean line. Therefore, a bullish trend reversal may occur from fundamental and technical perspectives.

Crypto.com MVRV chart

Underpinning Crypto.com price optimistic outlook is a buy signal presented by the TD Sequential indicator. The formation of a red nine candlestick reveals the bear market run is losing momentum – a situation bulls could seize to take control and determine CRO price's next direction.

CRO/USD four-hour chart

However, traders are advised to activate their buy orders when CRO price changes the direction north of its support at $0.1250. The low of the sixth and seventh candles in the count should close below the low of the eighth and ninth bars to validate the bullish rebound.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B17.55.26%2C%2011%20Oct%2C%202022%5D-638011004877217113.png&w=1536&q=95)