Cardano price smashes all-time highs, ADA aims for another 20% climb

- Cardano price is ready to bust through the next obstacle to hit higher levels.

- The sentiment around ADA remains bullish ahead of the Alonzo hard fork next month.

- Cardano is headed for a 20% upswing targeting $3.36 to continue its tremendous run.

Cardano price (ADA) has yet again recorded another all-time high at $2.84, as it continues to challenge previous records. ADA is headed for a 20% surge as the cryptocurrency proceeds by showing massive strength.

Cardano price eyes $3.36 next

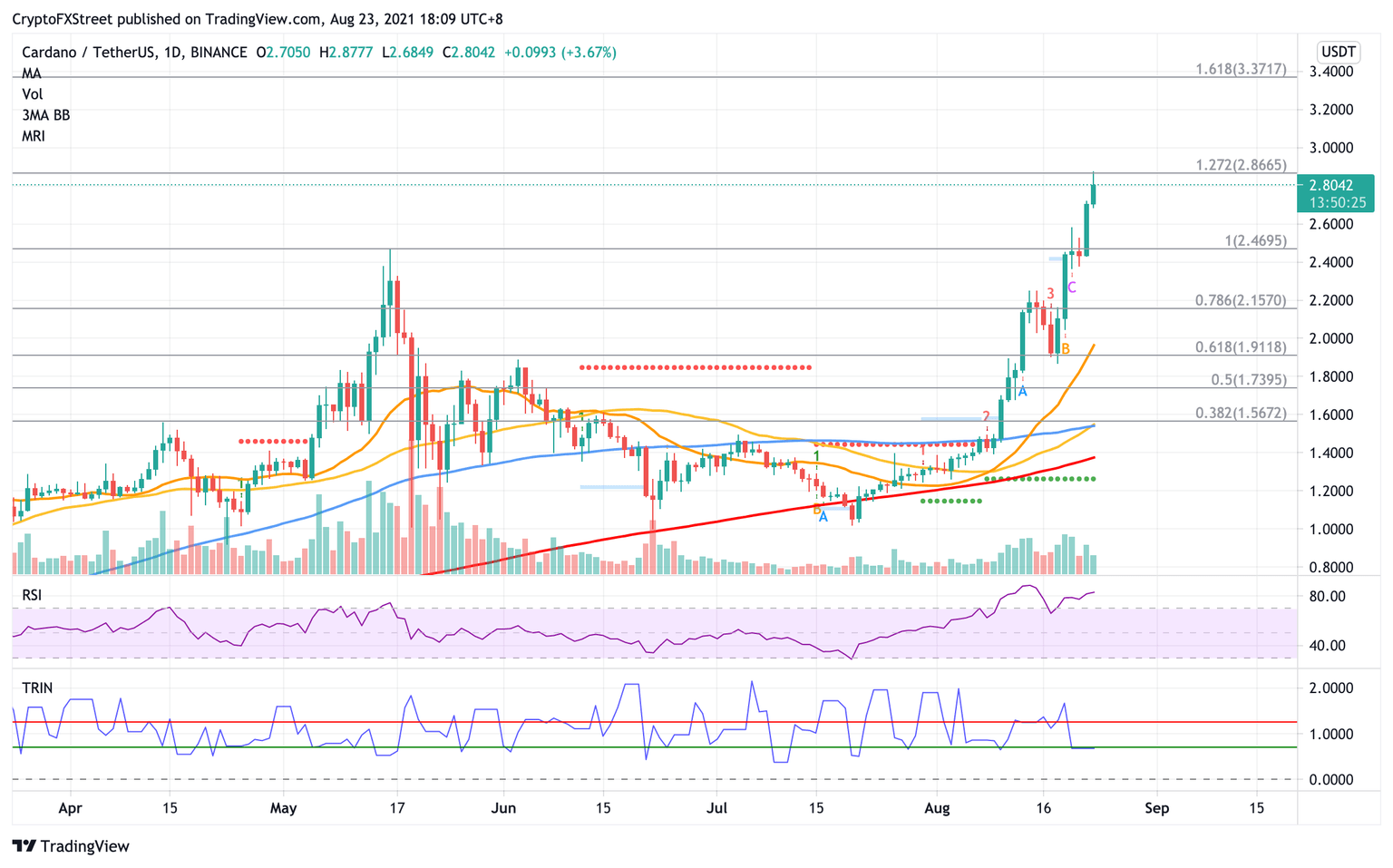

Cardano price rallied to a new record high on August 23, claiming $2.84, showing no signs of slowing down. ADA is close to tagging the 127.2% Fibonacci extension level at $2.86, the next level to tackle before aiming higher.

Should Cardano price be able to slice above the aforementioned resistance level, ADA would be aiming for a 20% run toward the 161.8% Fibonacci extension level at $3.37.

While nearly 100% of ADA investors are now in profit, Cardano price seems to be rising in tandem with the increasingly positive sentiment in anticipation of the smart contracts launch in September.

The Alonzo hard fork will introduce a smart contract functionality that will allow the network to become a leading contender in the industry of programmable blockchains to expand the solutions it can offer its users.

The new functionality would even allow the incorporation of applications such as decentralized finance platforms. Cardano would be in a better position to challenge Ethereum, the leading blockchain in regards to smart contract functionality.

On the daily chart, the Relative Strength Index (RSI) is showing that Cardano price is slightly overbought. However, the bullish narrative unravels as the RSI is indicating a lower level of being overbought with a reading of 83.22 at the current levels compared to the August 14 high at 89.21.

ADA/USDT daily chart

Adding credence to the optimistic outlook is the Arms Index (TRIN), which is used to gauge overall market sentiment. The indicator is providing a bullish signal since its value is less than 1.0, currently at 0.67, suggesting that there is greater purchasing volume than selling volume.

Although the bulls are taking control of the market, ADA could still be susceptible to a correction, witnessed by many bull runs. Cardano price would discover meaningful support at the May 16 high at $2.46, before slumping below toward the August 14 high at $2.25.

Should a spike in selling pressure materialize, Cardano price could tag the 78.6% Fibonacci extension level at $2.15. Given the current market conditions, lower levels are not expected for ADA.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.