Cardano price ready to conquer new highs, while ADA debuts on the Coin Cloud platform

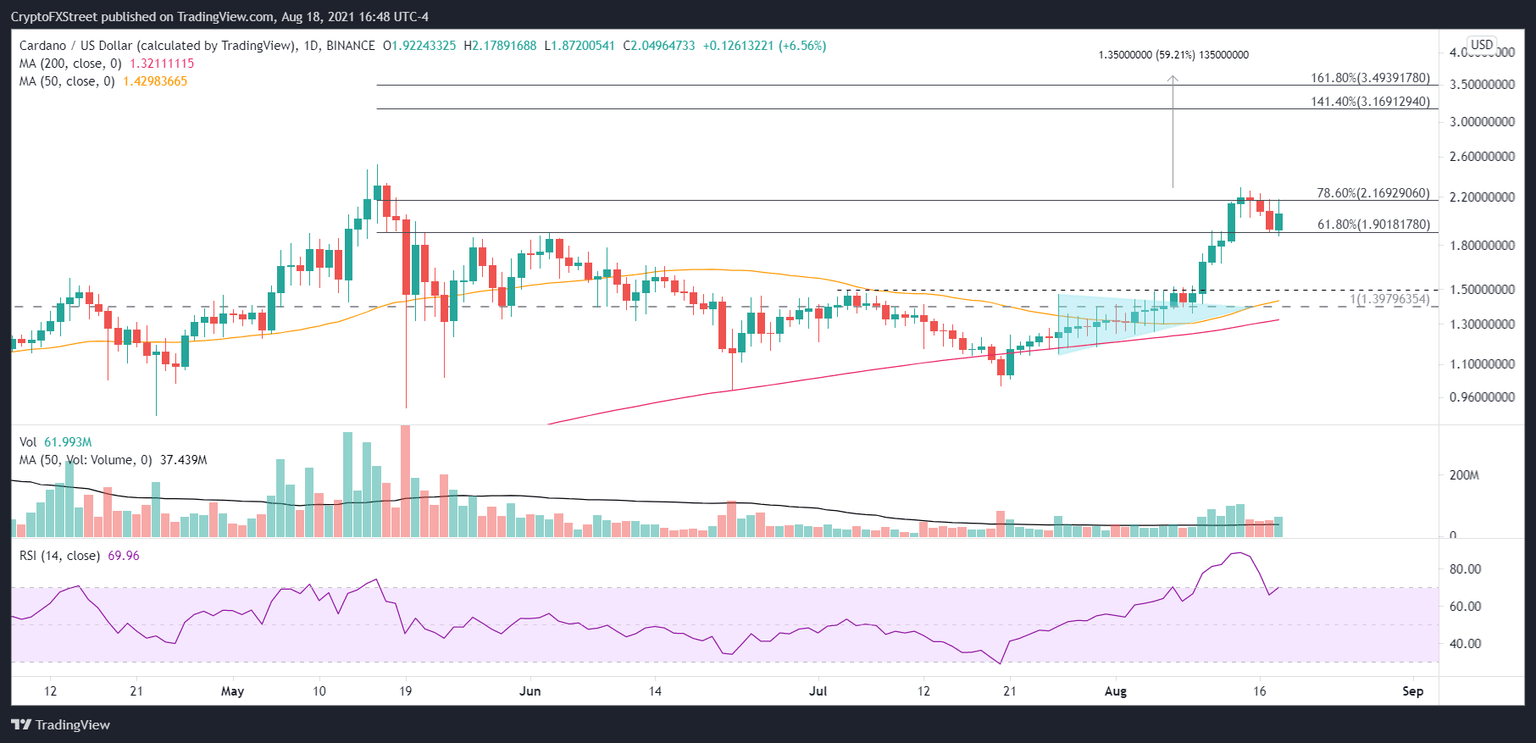

- Cardano price may close with a bullish outside day after identifying support at the 61.8% Fibonacci retracement at $1.90.

- ADA daily Relative Strength Index (RSI) records the third-highest reading since 2017 at 88.76.

- Coin Cloud adds ADA to their digital currency machine platform, joining more than 30 other digital currencies.

Cardano price rallied over 50% last week, carrying ADA to within 10% of the all-time high of $2.51. Since February, it was the best weekly performance and repositioned the cryptocurrency as a new target for speculators moving forward.

Coin Cloud bolsters platform with the fourth-largest cryptocurrency

Coin Cloud, the biggest two-way digital currency machine (DCM) operator in the United States and Brazil, announced that it is adding Cardano (ADA), SushiSwap (SUSHI), Celsius (CEL) and 1inch (1INCH) to their DCM platform. The digital currencies will be available at more than 3,000 locations across the United States and Brazil.

ADA joins a pool of over 30 top digital currencies, including Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Litecoin (LTC), as well as various stablecoins and DeFi tokens. The inclusion of ADA means that Coin Cloud will be offering one of the most popular cryptocurrencies and creating new options for their clients, according to Chris McAlary, DEO of Coin Cloud.

Cardano and the other coins we've added have strong communities and are a perfect fit for our clients as we continue to give them new options within the crypto-space to get involved and expand their portfolio of coins.

The Coin Cloud two-way DCMs, with an easy-to-use interface, allow individuals to buy and sell virtual currencies across six different categories with cash or credit card and utilize the free Coin Cloud mobile wallet to store, buy and sell from anywhere in the world.

Cardano price not waiting for Bitcoin as altcoin season erupts

Cardano price has struggled with the 2018 high of $1.40 for most of 2021, including failed breakout attempts in February, March and April. ADA did overcome the resistance in May, but it was short-lived as the digital token fell back below the level in June. Last week’s breakthrough has changed the price structure and offers a new opportunity.

Over the last three days, Cardano price has been consolidating the ramp higher, releasing the price compression that is a factor after registering the third-highest reading on the daily RSI. So far, the correction has secured support at the confluence of the 61.8% retracement of the May-July correction at $1.90, with a series of highs in late May and early June. The rebound today has the potential to close ADA with a bullish outside day on the bar charts, affirming the credibility of the support around $1.90 and the strength of the underlying bid for ADA.

A daily close above the August 14 high of $2.28 should release Cardano price for a quick test of the all-time high of $2.51 before being spirited into new highs. The primary targets for the breakout include the 141.4% extension of the May-July correction at $3.17 and the 161.8% extension of the same correction at $3.49. The 161.8% extension is close to the 261.8% extension of the 2018-2020 secular decline at $3.63, returning 59% to ADA investors from the August 14 high.

ADA/USD daily chart

Suppose Cardano price is not successful in holding the $1.90 area. In that case, ADA could suffer a notable retracement of the recent rally due to a lack of credible support levels until the July 4 high of $1.49.

Cardano price has benefitted from the re-emergence of altcoins and fundamental developments related to the Alonzo upgrade. The momentum now has ADA within striking distance of the all-time high and a new period of relative strength versus the broader cryptocurrency market.

Here, FXStreet's analysts evaluate where ADA could be heading next as it seems primed for new all-time highs.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.