BTC Price Analysis: Bitcoin is courting $17,000, can traders tie the knot before New Year?

- Bitcoin price sees traders flirting with $17,000 on Wednesday.

- BTC fades a bit with some profit-taking, while overall, the rally has more legs to go.

- With equities in the green, more tailwinds should help BTC to plant a bullish flag above $17,000 soon.

Bitcoin (BTC) price is seeing bulls flirting with the psychological $17,000 level to the upside after the good trading day on Tuesday. Unfortunately, BTC bulls could not close above there, and a small fade unfolded, although no big selloff occurred. Expect this to be a small pause along the way as soon as Bitcoin bulls can pierce through the psychological level and reclaim the area above there, turning $17,000 into much-needed support.

BTC could be seen adding $600 in a matter of a day

Bitcoin price finally came back from the dead after another sell-off last week. Traders, though, are not being scared that easily anymore as most of them are getting accustomed to the very volatile year of trading, seeing their beloved cryptocurrencies often getting slaughtered by the stronger US Dollar. On Tuesday, BTC was able to break above $17,000 but unfortunately could not close above it as profit-taking occurred, which kept going during the ASIA PAC session on Wednesday.

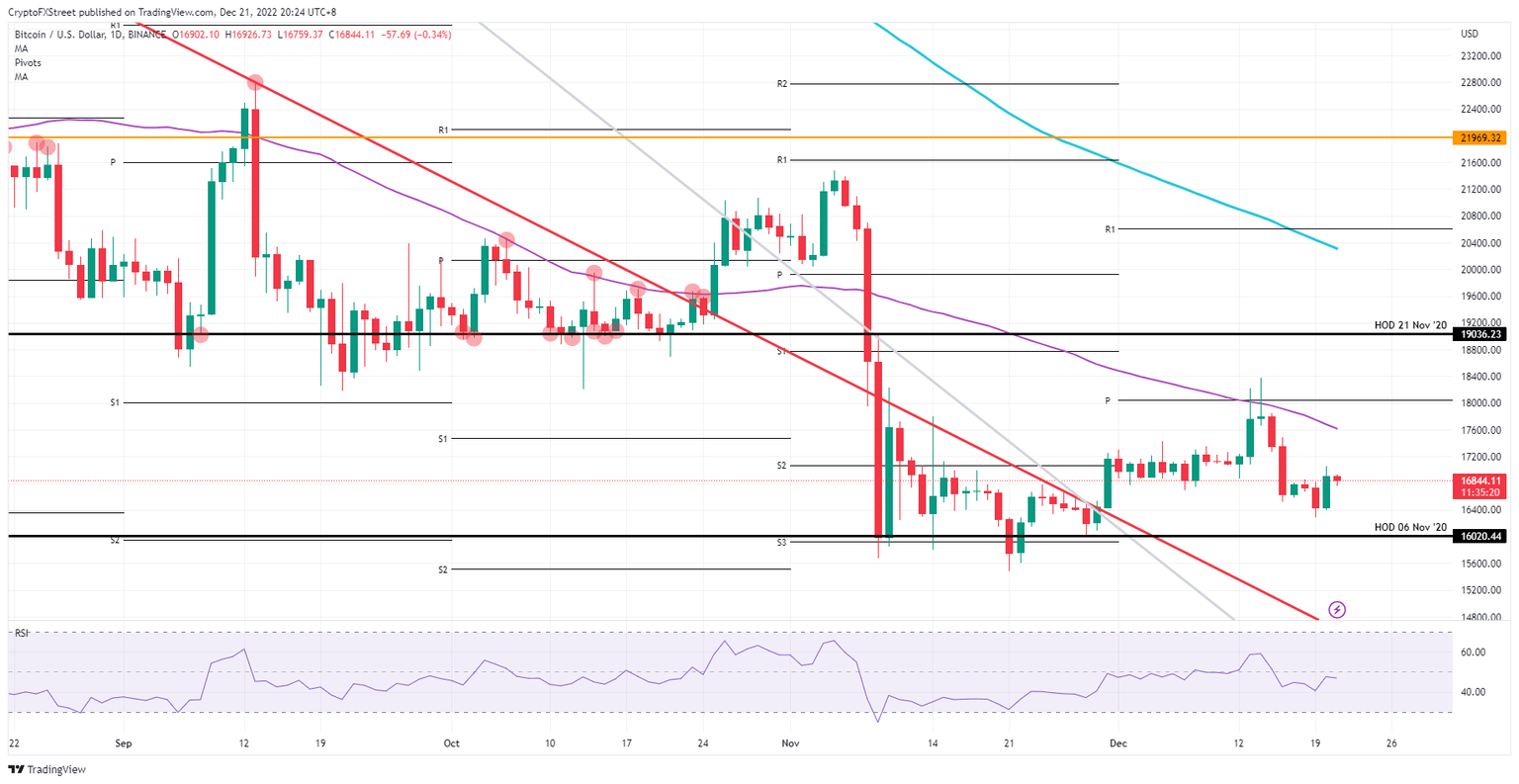

BTC is at the time of writing continuing this small profit-taking, fading below a 1% decline. If bulls can keep their act together, helped by the subdued Relative Strength Index (RSI), more upside looks granted. Certainly, as a calmer and low-volume moment of the year is set to kick in, a grind above $17,000 could provide enough support even to tick $17,600 by Friday if the US session can erase the current fade.

BTC/USD daily chart

A bit disturbing to see is that not one asset is making big moves that could trigger a domino effect. This could make traders nervous, further limiting their positions, which would not be enough to halt this fade. In that case, the Bitcoin downtrend would get more legs and start flirting with a break at $16,020.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.