Bitcoin Price Forecast: BTC gets support from two angles and heads back to $17,000

- Bitcoin price sees tailwinds coming in from equities and a weaker US Dollar.

- BTC could see the bearish sentiment being countered and even overtaken by bulls.

- Expect to see $17,000 later this week in a mild grind higher.

Bitcoin (BTC) price was trading mostly sideways over the weekend as bulls were able to refrain bears from touching base again at $16,000. With the unofficial last week of trading starting, BTC sees tailwinds coming in from several angles as bulls are putting a floor underneath the price action. Expect to see a mild grind higher if this sentiment continues to wither throughout the week for the big cryptocurrency.

Bitcoin sees some buying interest arising

Bitcoin price is getting underpinned after a very muted weekend where bears and bulls were quite balanced. As the dust settled over the weekend after the most eventful week of 2022 in terms of central bankers, bulls are getting the chance to thrive in a much calmer market. After a really busy week, most central bankers will already be shopping for Christmas, so the real market-moving elements should decrease this week.

Bitcoin sees some support and tailwinds coming in from equities in the green on Monday, while the US Dollar is substantially weakening, flirting with the highs of past Friday in the EUR/USD price action. These two elements are triggering some buying in risk assets across the board. If this sentiment continues, expect BTC to grind higher toward $17,000 in the coming days.

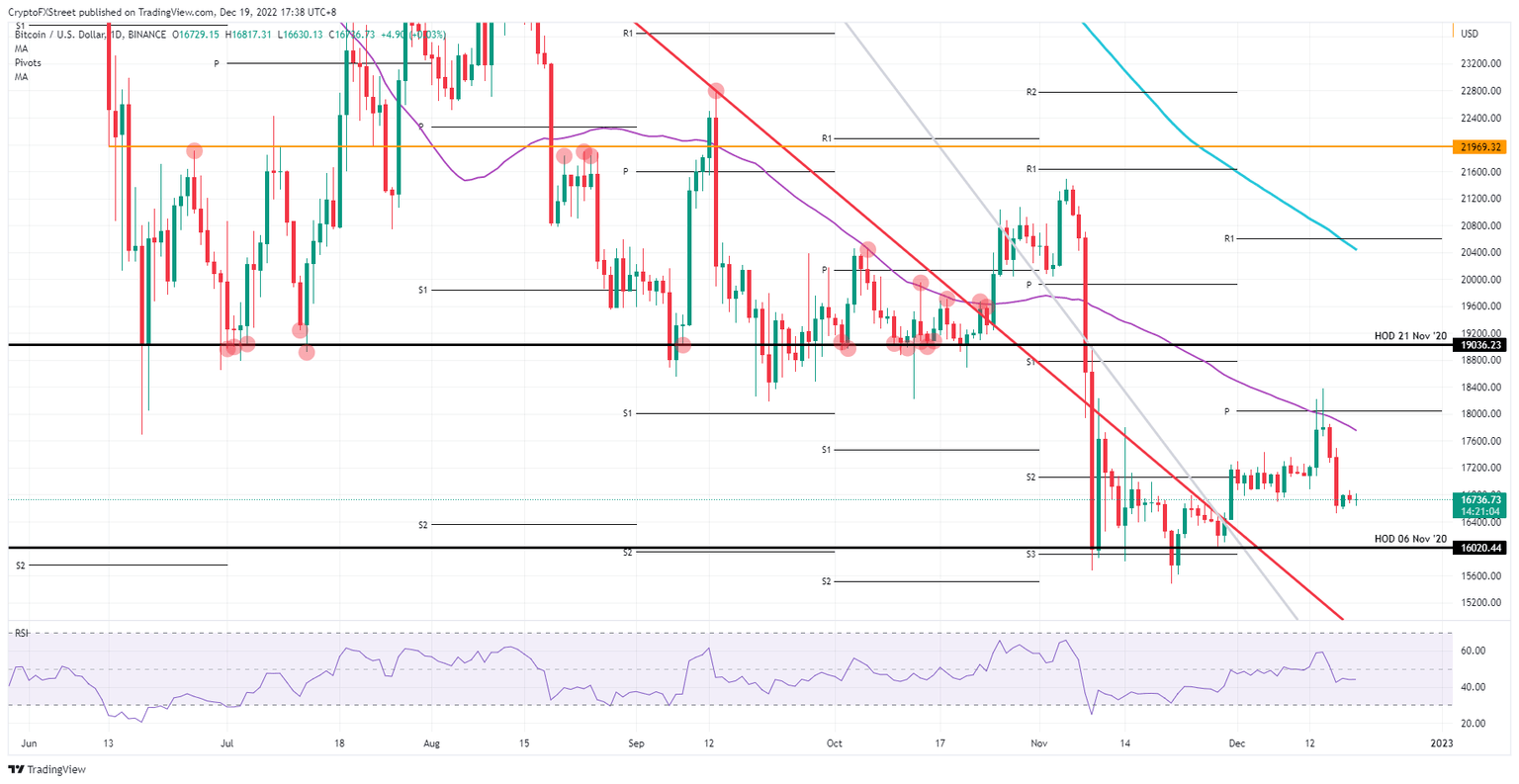

BTC/USD daily chart

Risk to the downside comes with these two supportive tailwinds that could easily flip into headwinds should a selloff occur. If the stock markets start to sell off, that will go hand-in-hand with a stronger US Dollar, making it a double whammy of bearish pressures BTC is facing. A dip towards $16,400 would materialise, with a big risk of follow-through towards $16,020 as a magnet pulling price action down.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.