Bitcoin Weekly Forecast: Why $20,000 BTC is programmed

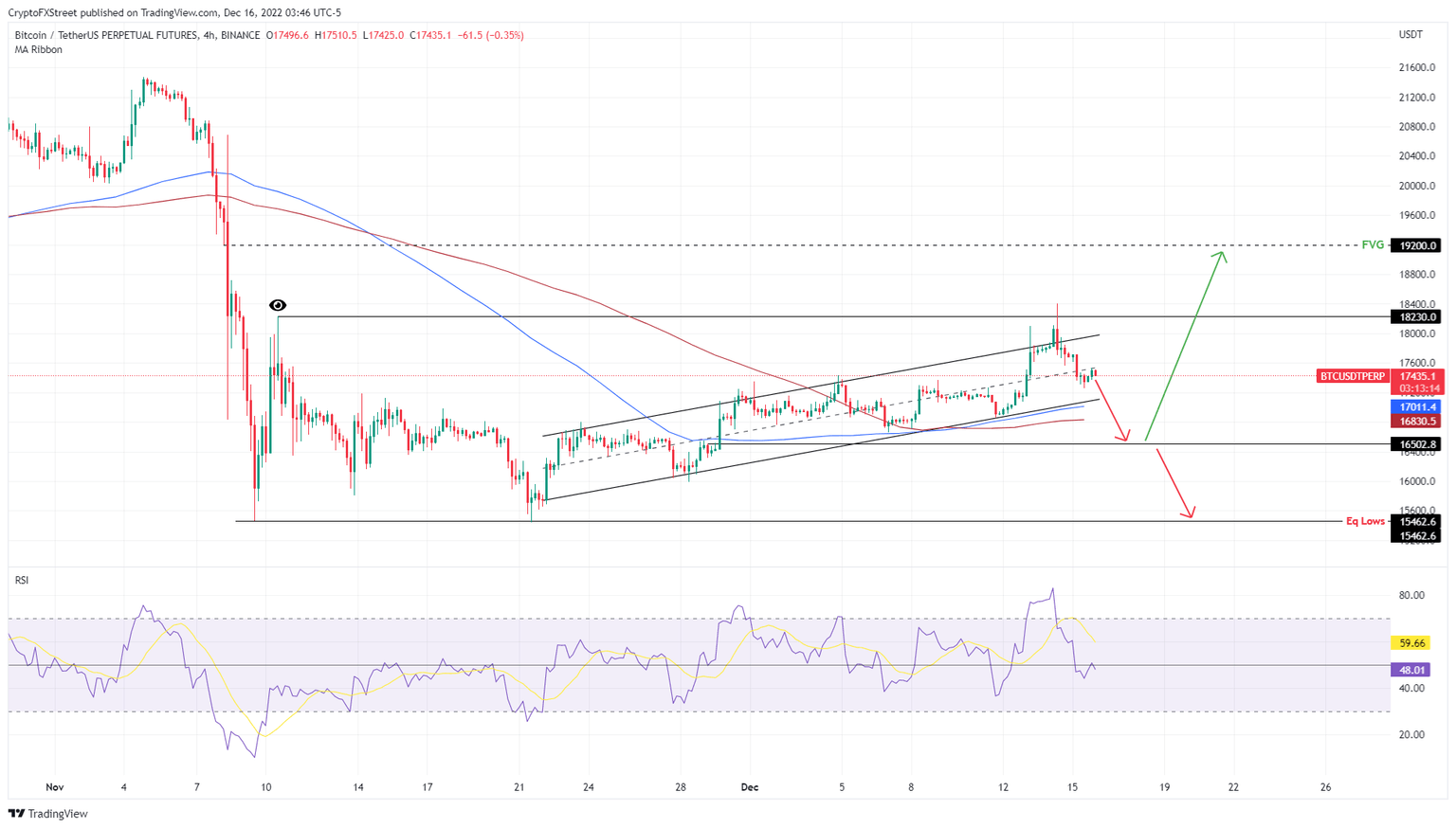

- Bitcoin price could pause its minor retracement due to the presence of strong support, extending from $16,800 to $17,000.

- FOMC Meeting this week helped the big crypto re-gain some footing.

- A bounce in the aforementioned region or after a retest of $16,500 is likely to result in a move to $19,200.

- A four-hour candlestick close below $16,500, followed by the inability to recover above it will invalidate the bullish thesis for BTC.

Bitcoin (BTC) price is traversing a channel that is sloping to the upside. Despite the consolidation, BTC is slowly climbing higher like clockwork. The recent Federal Open Market Committee (FOMC) Meeting on December 15 caused BTC to spike beyond the confines of the channel, but things are back to normal.

Bitcoin price to remain green

Bitcoin price has set up four higher highs and four lower lows over the last three weeks. Connecting these swing points using trend lines shows an ascending parallel channel formation. This development saw a spike that pushed BTC above the channel due to the volatility induced around the FOMC Meeting.

As the volatility died down, Bitcoin price cooled off, sliding back into the ascending parallel channel. As BTC pulls back to the lower limit of the channel, investors should expect buyers to step in due to the presence of the 20-day and 30-day Exponential Moving Averages (EMAs) at $17,011 to $16,830.

In general, the range between $16,800 to $17,000 is a strong support area and is a place where Bitcoin price is likely to bounce. Beyond this range, the $16,500 level is also a good foothold where sidelined buyers can accumulate BTC at a discount.

A bounce off any of the aforementioned support levels is likely to result in smart money targeting the next crucial level at $19,200. In total, this run-up would amount to a 16% upswing for bulls.

BTC/USDT 1-day chart

On-chain metrics point to a bullish BTC

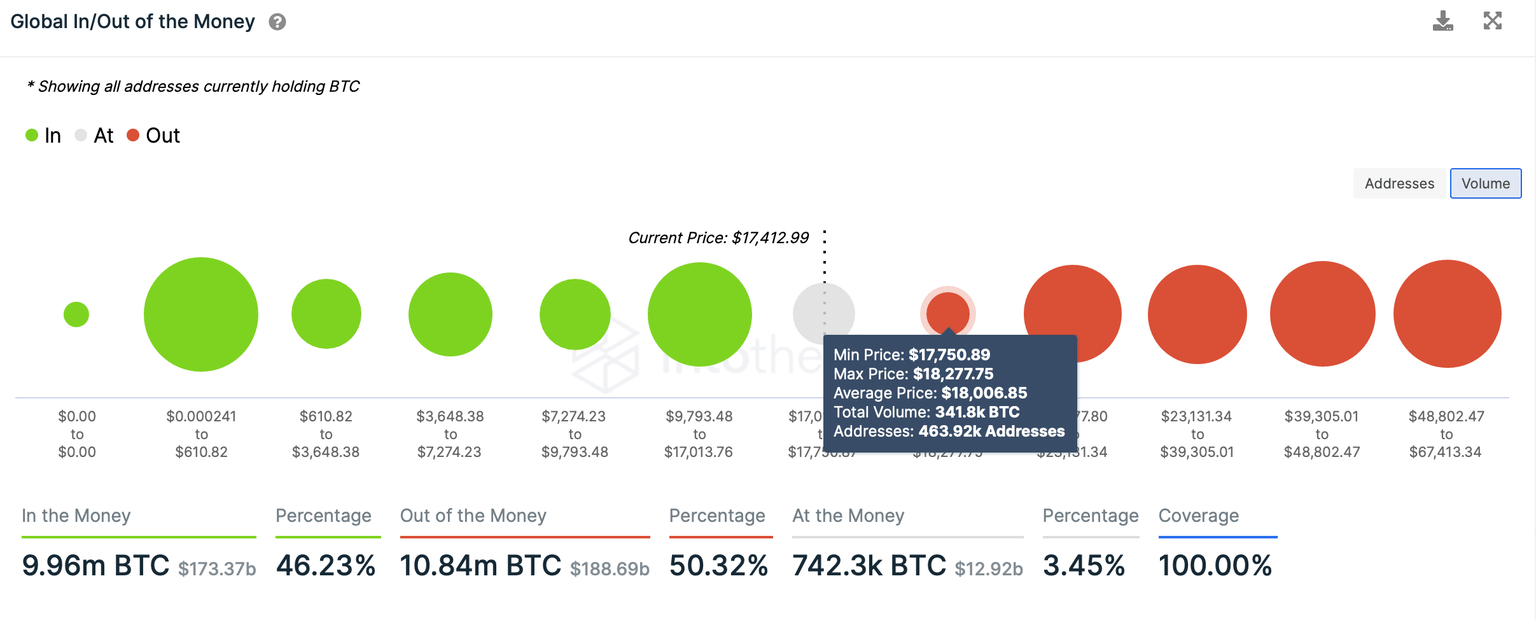

While the bullish outlook might not make sense for Bitcoin price, looking at the transaction data adds more credence to this thesis. IntoTheBlock’s Global In/Out of the Money (GIOM) model shows that the immediate hurdle at $18,000 is relatively weak and the one beyond that at $20,267 is the target.

Here, roughly 4.78 million addresses that purchased 2.34 million BTC at an average price of $20,267 are “Out of the Money.” Some of these investors are likely to sell their holdings at breakeven, putting an end to the uptrend.

Traders can be conservative and start booking profits around $19,200 or higher in anticipation of this trend reversal at $20,267.

BTC GIOM

Furthermore, whales holding between 100 and 1,000 BTC seem to have ramped up their accumulation after the crash in November's first week. These wallets spiked from 3.85 million to 3.9 million, indicating that 50,000 BTC were scooped up by these smart money investors.

The last time this happened was in March when Bitcoin price rose 23% after these set of wallets accumulated 30,000 BTC. If history repeats, Bitcoin price is due for another explosive move.

%2520%5B11.34.07%2C%252016%2520Dec%2C%25202022%5D-638067774208709124.png&w=1536&q=95)

BTC supply distribution

For long-term outlook on BTC read: Bitcoin Price Prediction: BTC yet to face its toughest hurdle at $19,100

While the bullish outlook makes sense from a technical and on-chain perspective, investors need to be careful around the $16,500 support level. A four-hour candlestick close below the said barrier followed by the inability to recover above it will invalidate the bullish thesis for Bitcoin price.

This development could lead to Bitcoin price sweeping the sell-stop liquidity resting below the $15,460 equal lows.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.