Bitcoin traders should watch these metrics after the market dump on Black Monday

- Bitcoin's new bull cycle high could take weeks after similarities between recent decline and post-halving correction of the 2015-2017 cycle.

- Bitcoin may have already topped for the current cycle, considering its exponential decay in the past four cycles.

- Bitcoin on-chain indicators are flagging bearish signs, but potential Fed rate cut could help maintain the bull market play.

Bitcoin (BTC) is up nearly 4% on Tuesday after recovering quickly from Black Monday's crash. As the market attempts a recovery, a few key metrics and indicators explored in this article could prove crucial in the coming weeks.

Key Bitcoin metrics to watch out for as BTC attempts recovery

Popular trader Peter Brandt noted that the Bitcoin dip to $49,050 on Monday has seen the current halving cycle following a similar move to the post-halving correction of the 2015-2017 cycle. He also noted that a new bull cycle high for Bitcoin could take several weeks, considering the weeks it took Bitcoin to reach new highs after its post-halving correction in the past two cycles.

Bitcoin Halvings Price Behaviour

However, Brandt also cautioned investors by reposting an article he wrote on April 26, indicating that Bitcoin may have topped in the current cycle. He highlighted that Bitcoin is experiencing exponential decay, losing "80% of the exponential energy of each successful bull market cycle." This is visible in the magnitude of Bitcoin's performance in its past four cycles.

Bitcoin Exponential Decay

This suggests that Bitcoin would experience an exponential growth of around 4.5x, which is 80% of the low-to-high gain multiple it saw in the 2018-2021 cycle.

"Taking a low for the current cycle of $15,473 projects a high for this cycle of $72,723 — guess what — a price that has already been reached," wrote Brandt. However, he noted that if Bitcoin had already topped in the current cycle, a retreat to around the mid-30K levels could be "the most bullish thing" that could happen to Bitcoin in the long term.

A repost of an @htltimor analysis from Brandt also shared a similar sentiment:

Word of warning: technically this looks like we had the cycle top already and not only that: we also had the bigger cycle top. Meaning a lot of the elasticity had gone out of the PA. You can see that from the decreasing RSI at each high. pic.twitter.com/k5PkXefuK2

— HTL-NL (@htltimor) August 6, 2024

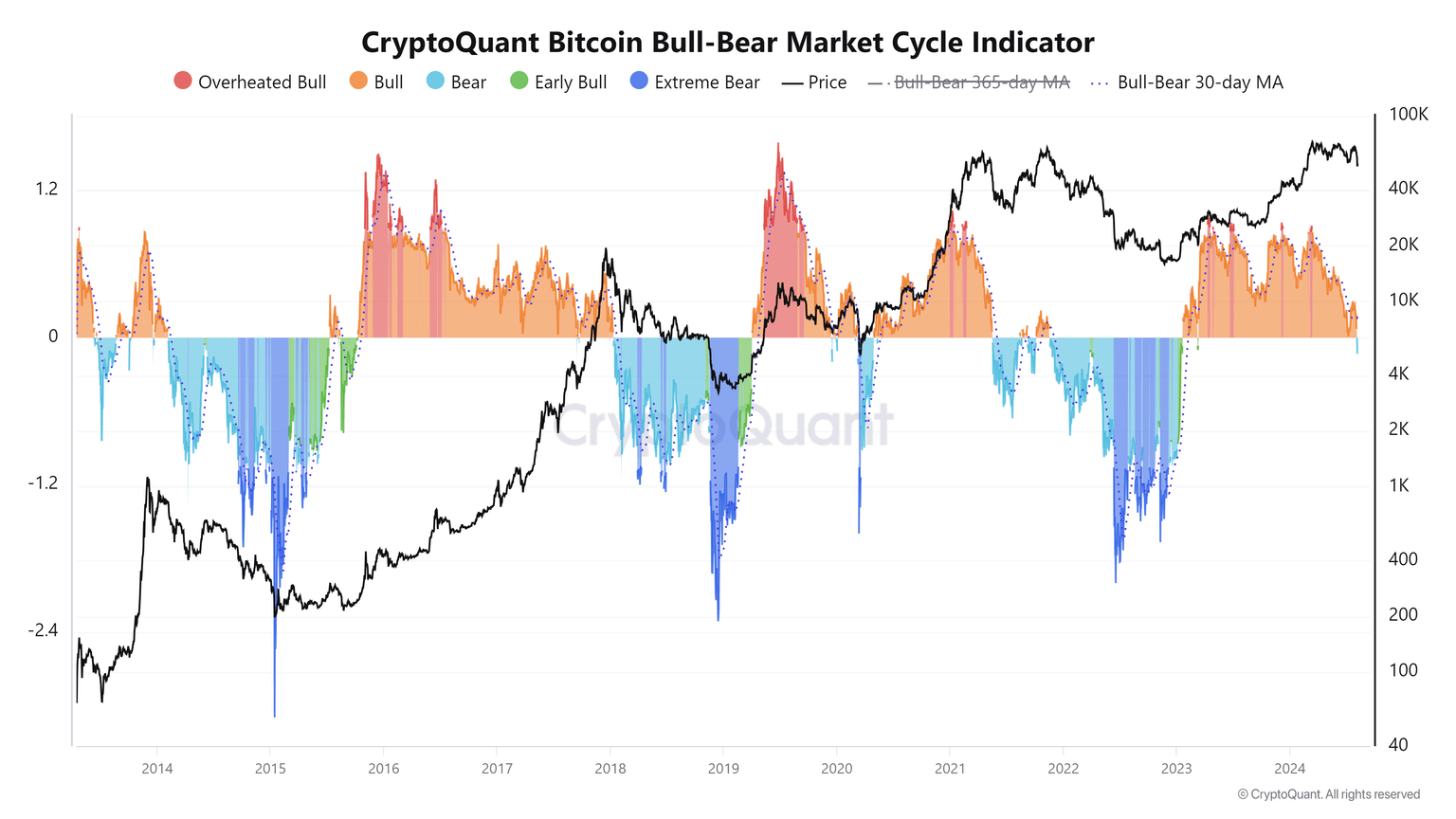

Bearish signs are now flashing in Bitcoin as the Bull-Bear Market Cycle indicator has crossed into the bear area for the first time since January 2023, according to CryptoQuant's data. Previously, the indicator had crossed to the bear area during the COVID market sell-off in March 2020, the Chinese mining ban in May 2021 and the FTX crash in November 2022.

Bitcoin Bull-Bear Market Cycle Indicator

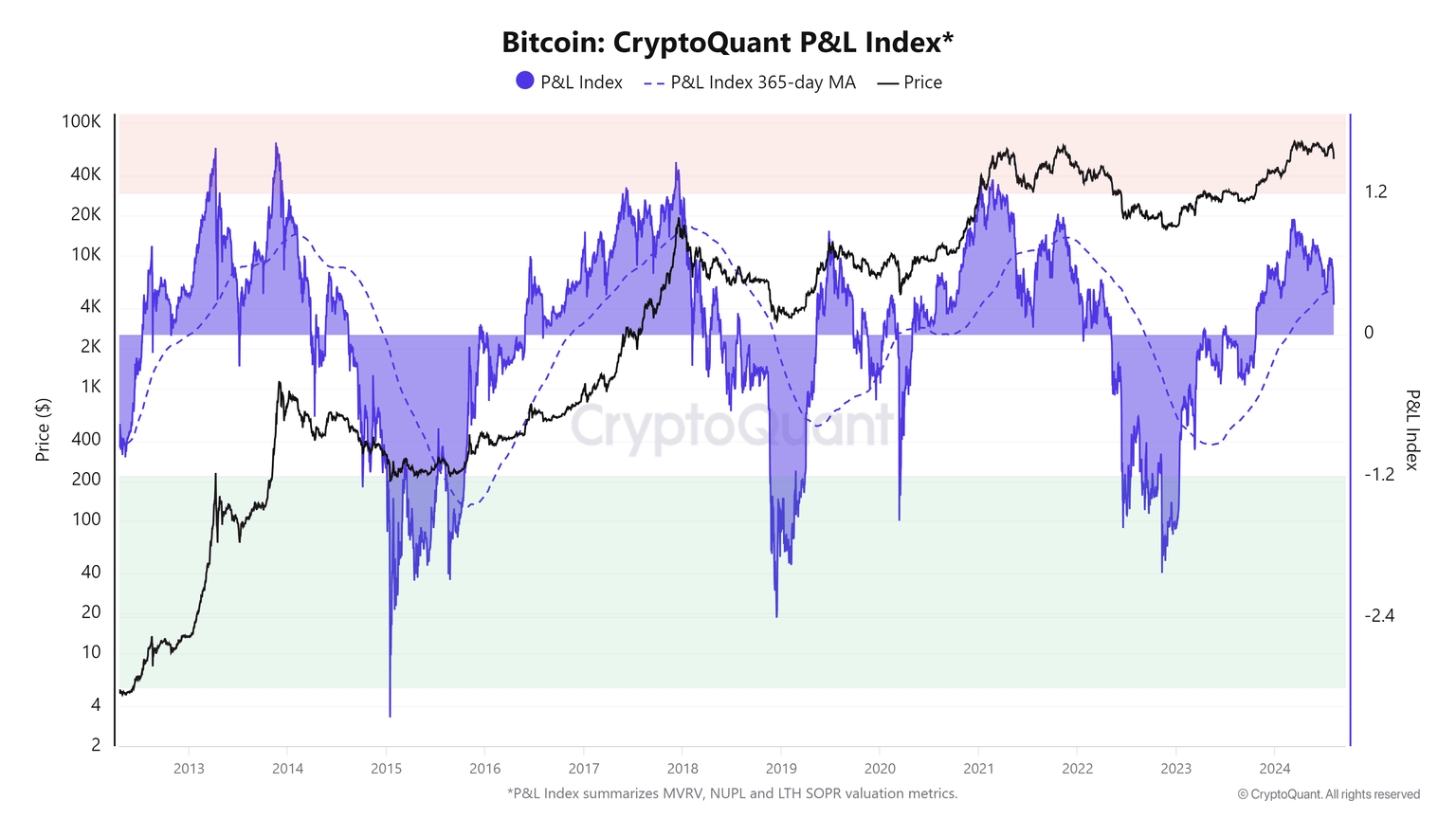

The bearish signs are reinforced by the Profit & Loss (P&L) Index and its 365-day moving average, which is declining rapidly. Bitcoin is said to be in a bear market when the index moves below the moving average and vice versa when it goes above the moving average. Currently, the P&L index has breached the moving average, indicating signs of a bear market. "If bearish trends persist for over two weeks, market recovery could be challenging," noted CryptoQuant CEO Ki Young Ju.

Bitcoin Profit & Loss (P&L) Index

Meanwhile, whales holding between 1,000 and 10,000 BTC increased their holdings during Monday's market crash, according to IntoTheBlock's data. This buying may have been from long-term holders (>155 days), as they noted their highest buying activity so far in 2024 after the market dipped, according to Glassnode data.

Coupled with this, the Federal Reserve could cut rates in September after the poor Non-farm Payroll (NFP) data triggered fears of a recession. A rate cut is a net positive for Bitcoin as it encourages investment in stocks and commodities rather than government bonds. Hence, such a move could help Bitcoin rally and maintain the bull market play.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi