- The BTC/USD broke free from the narrow range to the downside.

- A steady flow of negative comments took a toll.

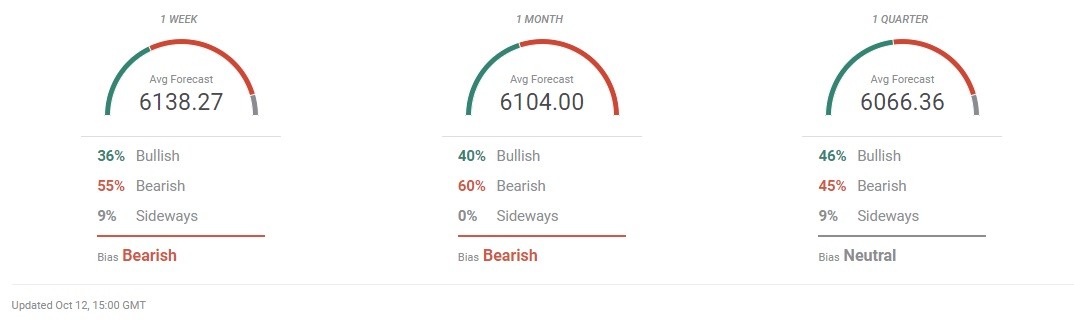

- The technical picture implies consolidation after a strong movement. The expert poll shows a bearish bias.

Bitcoin and other cryptocurrencies had a hard week as the market capitalization of all coins dropped below $200B for the first time since September 19. Negative noise has started to take its toll on market sentiments creating favorable conditions for bearish breakthrough out of the ranges.

Juniper Research prophets a dramatic collapse for the cryptocurrency market in its recent study on Bitcoin and altcoin trends. The experts believe that decreased transaction volumes point to imminent crash by the end of the year.

Meanwhile, Finder.com published the results of the recent survey conducted among cryptocurrency experts, who continued downgrading their year-endn forecasts. While the median forecast still points to 60% price increase from current levels, their predictions tend to decline as compared to previous levels.

Elsewhere, the International Monetary Fund (IMF) warned that the recent cryptocurrency boom created new risks and vulnerabilities in the global financial system, while numerous cybersecurity breaches posed new threats to cross-border payment systems and disrupted the flow of goods and services. Also, IMF was concerned about excessive risk-taking in cryptocurrency trading.

At the same time, another potential market mover is just around the corner. Traders and investors are waiting for SEC's ruling on crypto ETF, where a favorable decision might serve as a powerful catalyst for an upside movement.

See: Bitcoin ETF explained: 9 questions and answers about the critical crypto catalyst

Get 24/7 Crypto updates in our social media channels: Give us a follow at FXStreet Crypto Trading Telegram channel

BTC/USD Technical Analysis - A fly in bears' oatmeal

The technical picture for Bitcoin is full of uncertainties. On the one hand, the price broke free from the triangle pattern with a textbook-like sharp movement to the downside. Having smashed a couple of support levels, it stopped at $6,060, which is the lowest level since August 14. This bearish setup is supported by weak recovery impulse and subdued trading volumes that have returned to normal levels after a short-lived spike.

However, there is an ugly fly in this bears' oatmeal. The collapse was stopped by the critical uptrend support that dates back to June lows. The Relative Strength Index reversal from oversold territory amid inactive Momentum indicator one may suggest that suggests that the market is gripped with indecision on approach to a critical support level.

$6,100-$6,000 congestion area that includes an August flash-crash low and mid-September low, has been tested several times since the end of June, however each time, the market initiated a recovery, not ready to push the price below the round number of $6,000 down to 2018 lows at $5,800. Long-term Bitcoin bears can hardly celebrate a real victory until the price stays above this area.

Meanwhile, the upside is pretty crowded with strong technical levels that can damp the recovery potential and send the price muddling along in a narrow range until a new catalyst comes along.

$6,400 is a former support that now serves as a strong resistance that can stop the recovery and push Bitcoin back into the range. 23.6% Fibonacci retracement level (monthly) located on the approach to the above said resistance creates an additional hurdle for the bulls and supports the consolidation case for the week ahead.

The next resistance is produced by DMA50 at $6,600. Once it is cleared, the recovery may be extended towards $6,770-$6,800 congestion zone that includes DMA100 and resistance that capped the upside at the end of September.

The Forecast Poll of experts shows a bearish bias on Bitcoin; experts tend to low their forecasts on digital coin No. 1 amid unimpressive price dynamics.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Coinbase lists WIF perpetual futures contract as it unveils plans for Aevo, Ethena, and Etherfi

Dogwifhat perpetual futures began trading on Coinbase International Exchange and Coinbase Advanced on Thursday. However, the futures contract failed to trigger a rally for the popular meme coin.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Ethereum cancels rally expectations as Consensys sues SEC over ETH security status

Ethereum (ETH) appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the Securities & Exchange Commission (SEC) and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US Federal Bureau of Investigations (FBI) has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission (SEC) is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

-636749388780503402.png)