Bitcoin Price Forecast: BTC stifled under strong resistance stacks – Confluence Detector

- BTC downside capped at $9,700, as per the daily confluence detector.

- The MACD shows that market momentum reversing from bullish to bearish.

BTC has bounced up from the $10,425 and has encountered resistance at the SMA 20 curve and gone down to $10,480. The 20-day Bollinger Band has stopped constricting, which shows that the price volatility is rising, hinting at an imminent breakout.

BTC/USD daily chapter

The MACD shows that market momentum is on the verge of turning from bullish to bearish. This may sound like a death knell to the bulls for now, as a further price drop is expected. How much is the decline going to be? For that, let’s check the confluence detector.

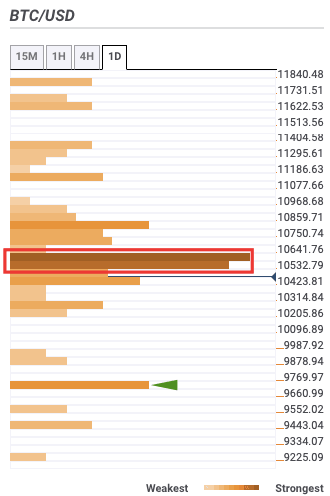

BTC daily confluence detector

BTC faces an immediate stack of resistance that’s pushing the price down. This stack goes from $10,500-$10,600, and it has the one-day Bollinger Band middle curve, one-day Previous High, Previous Month low, one-day Fibonacci 38.2% and 23.6% retracement levels and one-week Fibonacci 61.8% retracement level.

On the downside, the price can drop to $9,700 before it meets a moderate-to-strong support level. This level has the monthly Pivot Point resistance two and one-week Fibonacci 161.8% retracement level.

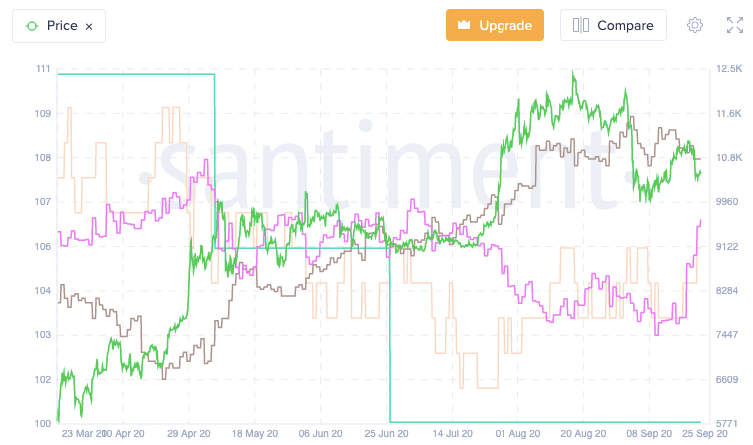

BTC holder distribution

Santiment's BTC holder distribution chart shows that there has been a sharp increase in the number of users holding 100-1000 coins and 10,000-100,000 coins. This has a favorable long-term implication on the price, even if the present outlook seems bearish.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637364323951502557.png&w=1536&q=95)